Question

Suppose that you are holding a stock portfolio that has a current market value of $1,000,000 and its beta is 1.25. You expect the general

Suppose that you are holding a stock portfolio that has a current market value of $1,000,000 and its beta is 1.25. You expect the general market will go up in the next few months and you try to gain from the bull market by increasing the beta of your portfolio to 2.0 three months from now. You will use the e-mini S&P 500 that expires four months from today to raise the beta of your portfolio. The current spot price of the S&P 500 index is 4200. The annual riskfree interest rate is 5% (cc) and the estimated annual dividend yield of the S&P 500 3 index portfolio is 1%.

(a) Specify clearly how many e-mini S&P 500 index futures you will buy or sell to raise the beta of your portfolio to 2.0 (the number of contracts has to be round to the closest integer).

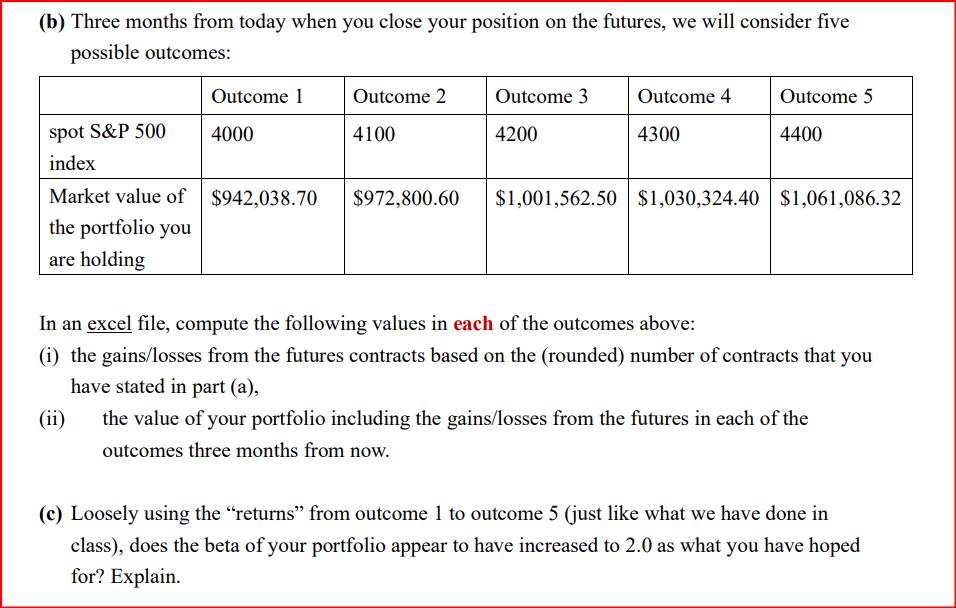

(b) Three months from today when you close your position on the futures, we will consider five possible outcomes: spot S&P 500 index Market value of the portfolio you are holding Outcome 1 4000 $942,038.70 Outcome 2 4100 Outcome 3 4200 Outcome 4 4300 Outcome 5 4400 $972,800.60 $1,001,562.50 $1,030,324.40 $1,061,086.32 In an excel file, compute the following values in each of the outcomes above: (i) the gains/losses from the futures contracts based on the (rounded) number of contracts that you have stated in part (a), (ii) the value of your portfolio including the gains/losses from the futures in each of the outcomes three months from now. (c) Loosely using the "returns" from outcome 1 to outcome 5 (just like what we have done in class), does the beta of your portfolio appear to have increased to 2.0 as what you have hoped for? Explain.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To raise the beta of your portfolio to 20 you need to calculate the number of emini SP 500 index futures contracts you should buy or sell The formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started