Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are managing a pension fund that has liabilities of $200mm per year for the next 10 years and $100mm per year

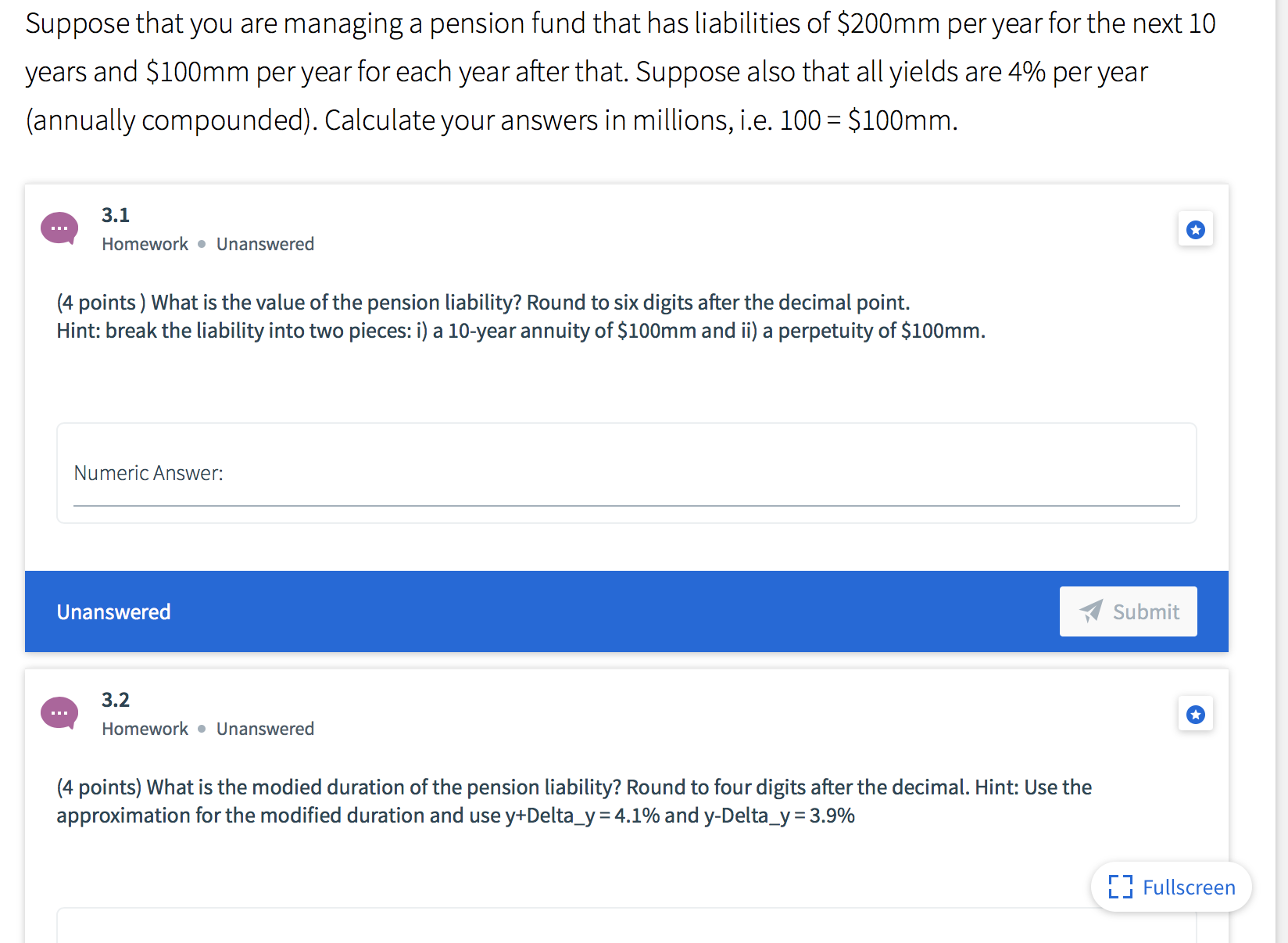

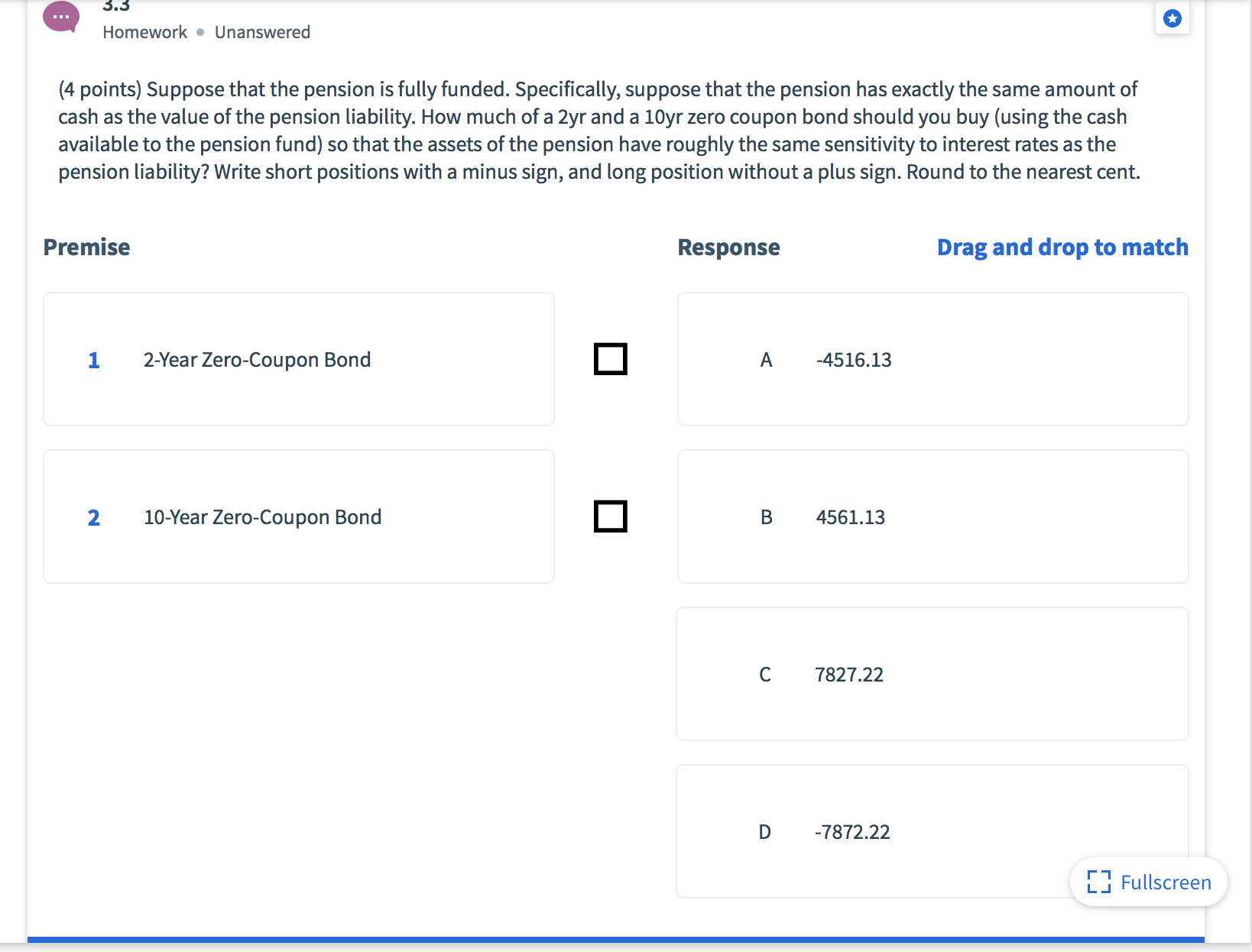

Suppose that you are managing a pension fund that has liabilities of $200mm per year for the next 10 years and $100mm per year for each year after that. Suppose also that all yields are 4% per year (annually compounded). Calculate your answers in millions, i.e. 100 = $100mm. 3.1 Homework Unanswered (4 points) What is the value of the pension liability? Round to six digits after the decimal point. Hint: break the liability into two pieces: i) a 10-year annuity of $100mm and ii) a perpetuity of $100mm. Numeric Answer: Unanswered 3.2 Homework Unanswered (4 points) What is the modied duration of the pension liability? Round to four digits after the decimal. Hint: Use the approximation for the modified duration and use y+Delta_y= 4.1% and y-Delta_y = 3.9% Submit LJ [ Fullscreen 3.3 Homework Unanswered (4 points) Suppose that the pension is fully funded. Specifically, suppose that the pension has exactly the same amount of cash as the value of the pension liability. How much of a 2yr and a 10yr zero coupon bond should you buy (using the cash available to the pension fund) so that the assets of the pension have roughly the same sensitivity to interest rates as the pension liability? Write short positions with a minus sign, and long position without a plus sign. Round to the nearest cent. Premise 1 2-Year Zero-Coupon Bond Response A -4516.13 2 10-Year Zero-Coupon Bond B 4561.13 C 7827.22 Drag and drop to match D -7872.22 [Fullscreen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started