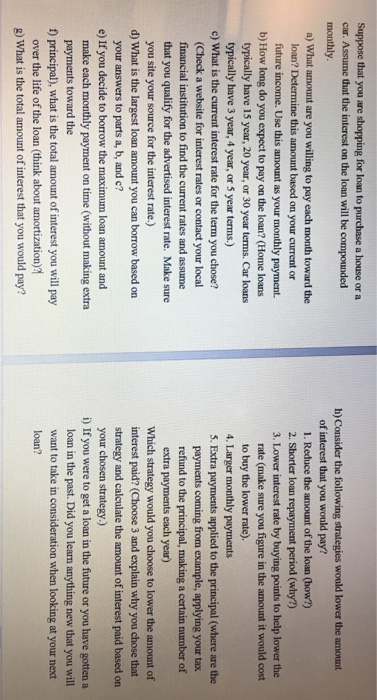

Suppose that you are shopping for loan to purchase a house or a car. Assume that the interest on the loan will be compounded monthly. What amount are you willing to pay each month toward the loan? Determine this amount based on your current or future income. Use this amount as your monthly payment. How long do you expect to pay on the loan? (Home loans typically have 15 year, 20 year, or 30 year terms. Car loans typically have 3 year, 4 year, or 5 year terms.) What is the current interest rate for the term you chose? (Check a website for interest rates or contact your local financial institution to find the current rates and assume that you qualify for the advertised interest rate, make sure you site your source for the interest rate.) What is the largest loan amount you can borrow based on your answers to parts a, b, and c? If you decide to borrow the maximum loan amount and make each monthly payment on time (without making extra payments toward the principal), what is the total amount of interest you will pay over the life of the loan (think about amortization)? What is the total amount of interest that you would pay? Consider the following strategies would lower the amount of interest that you would pay? Reduce the amount of the loan (how?) Shorter loan repayment period (why?) Lower interest rate by buying points to help lower the rate (make sure you figure in the amount it would cost to buy the lower rate), Larger monthly payments Extra payments applied to the principal (where are the payments coming from example, applying your tax refund to the principal, making a certain number of extra payments each year) Which strategy would you choose to lower the amount of interest paid? (Choose 3 and explain why you chose that strategy and calculate the amount of interest paid based on your chosen strategy.) If you were to get a loan in the future or you have gotten a loan in the past. Did you learn anything new that you will want to take in consideration when looking at your next loan? Suppose that you are shopping for loan to purchase a house or a car. Assume that the interest on the loan will be compounded monthly. What amount are you willing to pay each month toward the loan? Determine this amount based on your current or future income. Use this amount as your monthly payment. How long do you expect to pay on the loan? (Home loans typically have 15 year, 20 year, or 30 year terms. Car loans typically have 3 year, 4 year, or 5 year terms.) What is the current interest rate for the term you chose? (Check a website for interest rates or contact your local financial institution to find the current rates and assume that you qualify for the advertised interest rate, make sure you site your source for the interest rate.) What is the largest loan amount you can borrow based on your answers to parts a, b, and c? If you decide to borrow the maximum loan amount and make each monthly payment on time (without making extra payments toward the principal), what is the total amount of interest you will pay over the life of the loan (think about amortization)? What is the total amount of interest that you would pay? Consider the following strategies would lower the amount of interest that you would pay? Reduce the amount of the loan (how?) Shorter loan repayment period (why?) Lower interest rate by buying points to help lower the rate (make sure you figure in the amount it would cost to buy the lower rate), Larger monthly payments Extra payments applied to the principal (where are the payments coming from example, applying your tax refund to the principal, making a certain number of extra payments each year) Which strategy would you choose to lower the amount of interest paid? (Choose 3 and explain why you chose that strategy and calculate the amount of interest paid based on your chosen strategy.) If you were to get a loan in the future or you have gotten a loan in the past. Did you learn anything new that you will want to take in consideration when looking at your next loan