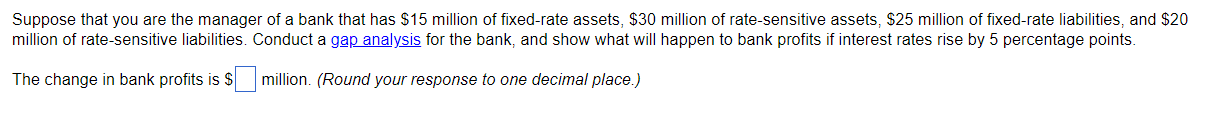

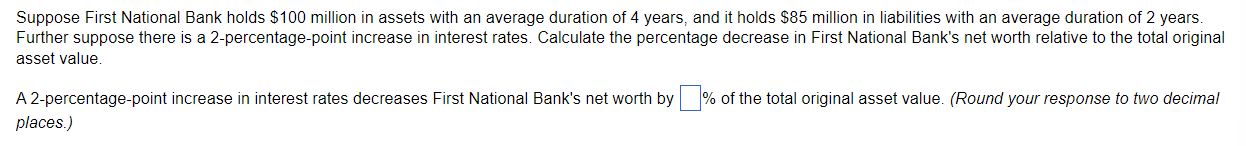

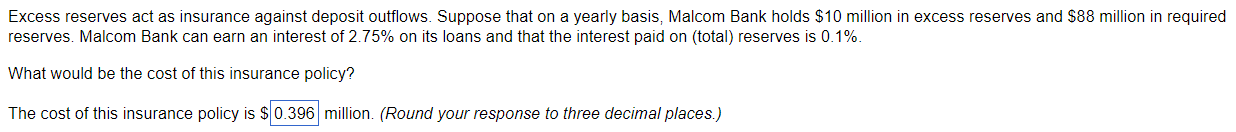

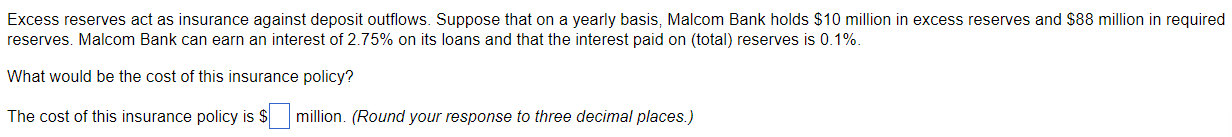

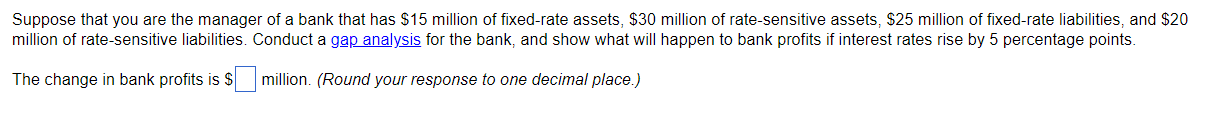

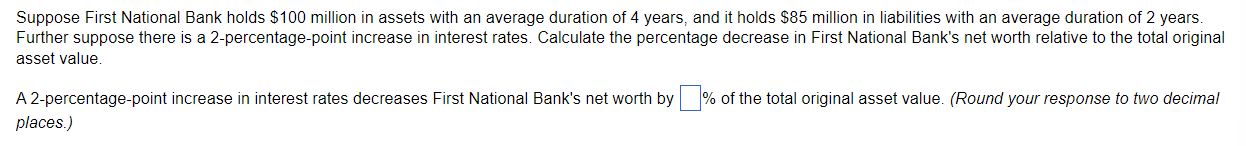

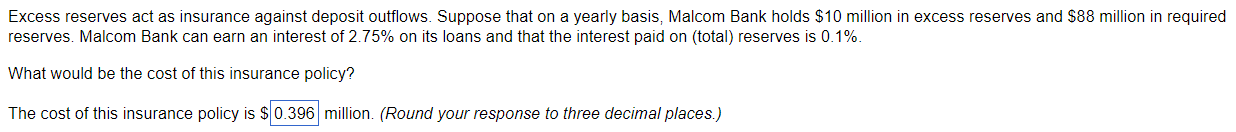

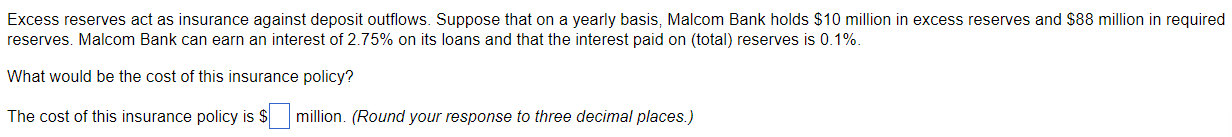

Suppose that you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. The change in bank profits is $ million. (Round your response to one decimal place.) Suppose First National Bank holds $100 million in assets with an average duration of 4 years, and it holds $85 million in liabilities with an average duration of 2 years. Further suppose there is a 2-percentage-point increase in interest rates. Calculate the percentage decrease in First National Bank's net worth relative to the total original asset value A 2-percentage-point increase in interest rates decreases First National Bank's net worth by % of the total original asset value. (Round your response to two decimal places.) Excess reserves act as insurance against deposit outflows. Suppose that on a yearly basis, Malcom Bank holds $10 million in excess reserves and $88 million in required reserves. Malcom Bank can earn an interest of 2.75% on its loans and that the interest paid on (total) reserves is 0.1% What would be the cost of this insurance policy? The cost of this insurance policy is $0.396 million. (Round your response to three decimal places.) Excess reserves act as insurance against deposit outflows. Suppose that on a yearly basis, Malcom Bank holds $10 million in excess reserves and $88 million in required reserves. Malcom Bank can earn an interest of 2.75% on its loans and that the interest paid on (total) reserves is 0.1% What would be the cost of this insurance policy? The cost of this insurance policy is $ million. (Round your response to three decimal places.) Suppose that you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. The change in bank profits is $ million. (Round your response to one decimal place.) Suppose First National Bank holds $100 million in assets with an average duration of 4 years, and it holds $85 million in liabilities with an average duration of 2 years. Further suppose there is a 2-percentage-point increase in interest rates. Calculate the percentage decrease in First National Bank's net worth relative to the total original asset value A 2-percentage-point increase in interest rates decreases First National Bank's net worth by % of the total original asset value. (Round your response to two decimal places.) Excess reserves act as insurance against deposit outflows. Suppose that on a yearly basis, Malcom Bank holds $10 million in excess reserves and $88 million in required reserves. Malcom Bank can earn an interest of 2.75% on its loans and that the interest paid on (total) reserves is 0.1% What would be the cost of this insurance policy? The cost of this insurance policy is $0.396 million. (Round your response to three decimal places.) Excess reserves act as insurance against deposit outflows. Suppose that on a yearly basis, Malcom Bank holds $10 million in excess reserves and $88 million in required reserves. Malcom Bank can earn an interest of 2.75% on its loans and that the interest paid on (total) reserves is 0.1% What would be the cost of this insurance policy? The cost of this insurance policy is $ million. (Round your response to three decimal places.)