Question

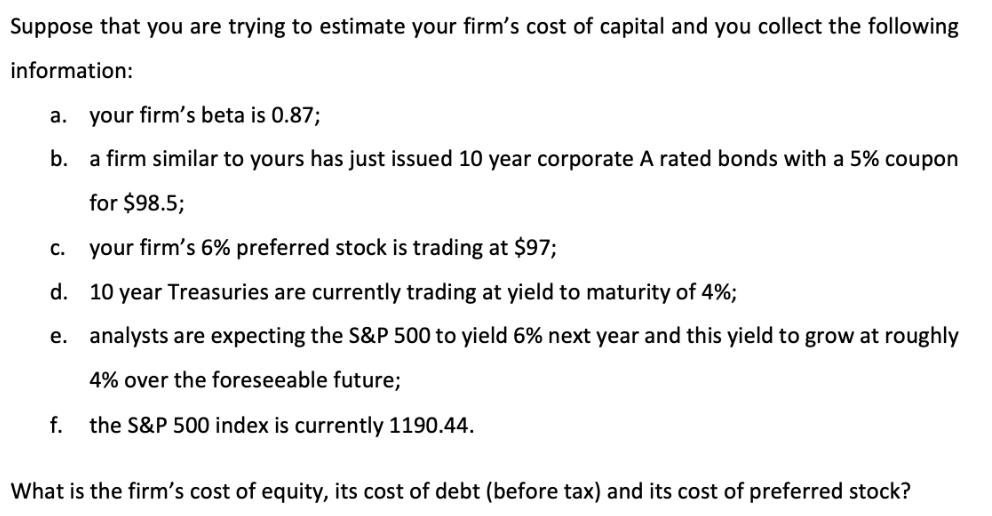

Suppose that you are trying to estimate your firm's cost of capital and you collect the following information: your firm's beta is 0.87; b.

Suppose that you are trying to estimate your firm's cost of capital and you collect the following information: your firm's beta is 0.87; b. a firm similar to yours has just issued 10 year corporate A rated bonds with a 5% coupon for $98.5; a. your firm's 6% preferred stock is trading at $97; d. 10 year Treasuries are currently trading at yield to maturity of 4%; e. analysts are expecting the S&P 500 to yield 6% next year and this yield to grow at roughly 4% over the foreseeable future; the S&P 500 index is currently 1190.44. C. f. What is the firm's cost of equity, its cost of debt (before tax) and its cost of preferred stock?

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App