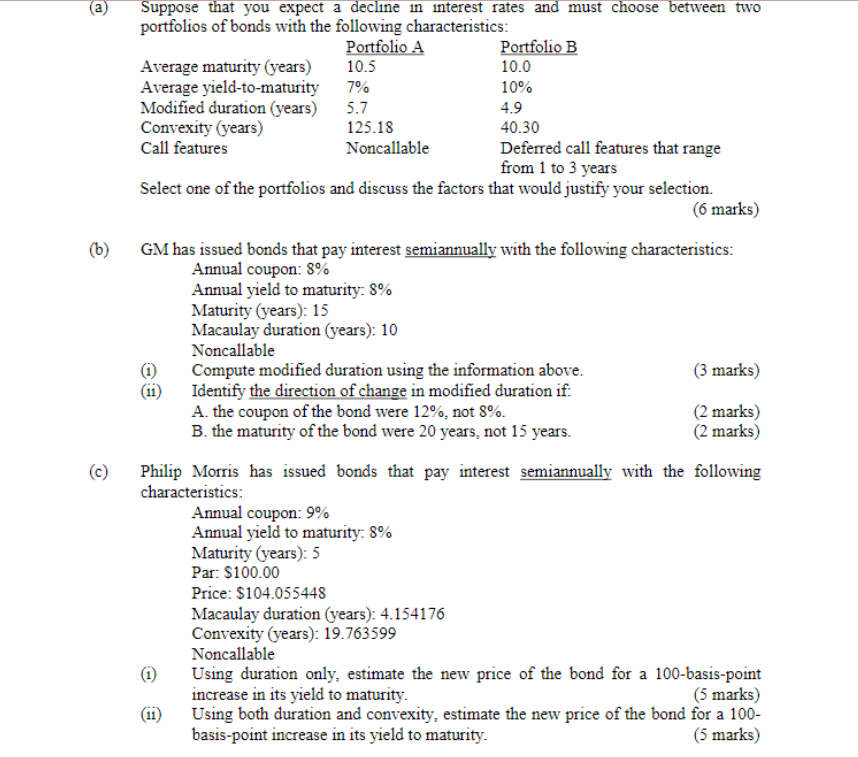

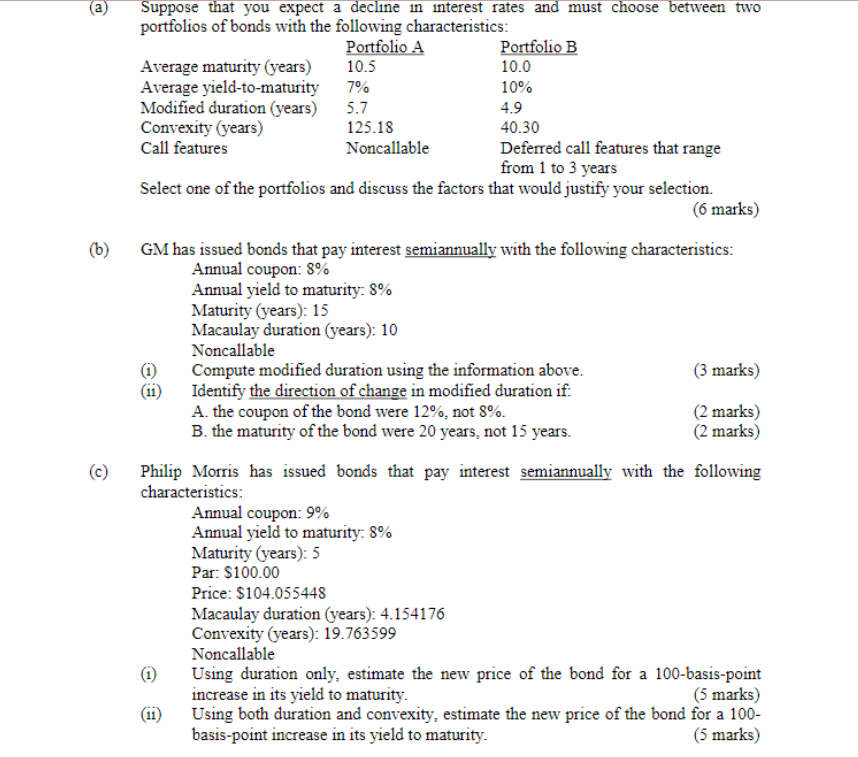

Suppose that you expect a decline in interest rates and must choose between two portfolios of bonds with the following characteristics: Portfolio A Portfolio B Average maturity (years) 10.5 10.0 Average yield-to-maturity 7% 10% Modified duration (years) 4.9 5.7 125.18 Convexity (years) 40.30 Call features Noncallable Deferred call features that range from 1 to 3 years Select one of the portfolios and discuss the factors that would justify your selection. (6 marks) (b) GM has issued bonds that pay interest semiannually with the following characteristics: Annual coupon: 8% Annual yield to maturity: 8% Maturity (years): 15 Macaulay duration (years): 10 Noncallable (3 marks) Compute modified duration using the information above. Identify the direction of change in modified duration if: A. the coupon of the bond were 12%, not 8%. (2 marks) B. the maturity of the bond were 20 years, not 15 years. (2 marks) (c) Philip Morris has issued bonds that pay interest semiannually with the following characteristics: Annual coupon: 9% Annual yield to maturity: 8% Maturity (years): 5 Par: $100.00 Price: $104.055448 Macaulay duration (years): 4.154176 Convexity (years): 19.763599 Noncallable (1) Using duration only, estimate the new price of the bond for a 100-basis-point increase in its yield to maturity. (5 marks) (11) Using both duration and convexity, estimate the new price of the bond for a 100- basis-point increase in its yield to maturity. (5 marks) Suppose that you expect a decline in interest rates and must choose between two portfolios of bonds with the following characteristics: Portfolio A Portfolio B Average maturity (years) 10.5 10.0 Average yield-to-maturity 7% 10% Modified duration (years) 4.9 5.7 125.18 Convexity (years) 40.30 Call features Noncallable Deferred call features that range from 1 to 3 years Select one of the portfolios and discuss the factors that would justify your selection. (6 marks) (b) GM has issued bonds that pay interest semiannually with the following characteristics: Annual coupon: 8% Annual yield to maturity: 8% Maturity (years): 15 Macaulay duration (years): 10 Noncallable (3 marks) Compute modified duration using the information above. Identify the direction of change in modified duration if: A. the coupon of the bond were 12%, not 8%. (2 marks) B. the maturity of the bond were 20 years, not 15 years. (2 marks) (c) Philip Morris has issued bonds that pay interest semiannually with the following characteristics: Annual coupon: 9% Annual yield to maturity: 8% Maturity (years): 5 Par: $100.00 Price: $104.055448 Macaulay duration (years): 4.154176 Convexity (years): 19.763599 Noncallable (1) Using duration only, estimate the new price of the bond for a 100-basis-point increase in its yield to maturity. (5 marks) (11) Using both duration and convexity, estimate the new price of the bond for a 100- basis-point increase in its yield to maturity