Answered step by step

Verified Expert Solution

Question

1 Approved Answer

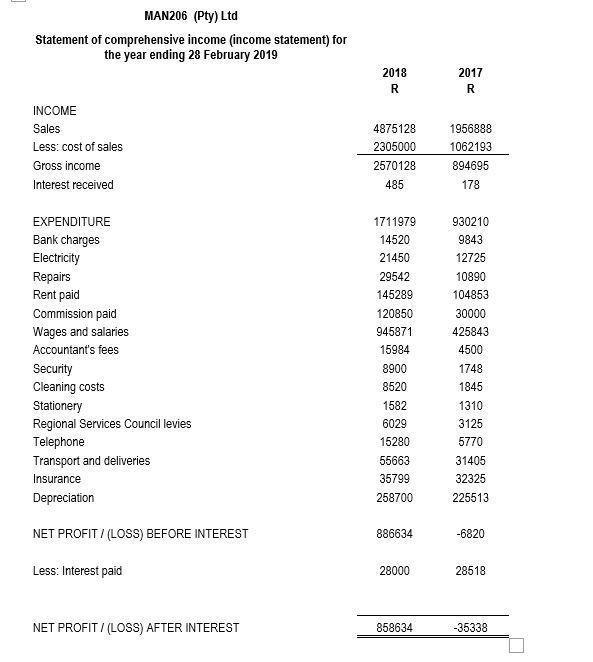

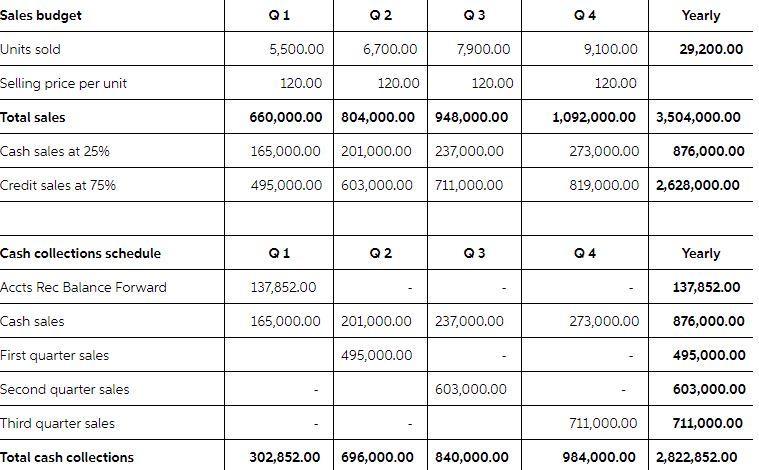

Suppose that you have decided that you want to manufacture 15% for future quarters stock in the preceding quarter and have it on the shelves

- Suppose that you have decided that you want to manufacture 15% for future quarter’s stock in the preceding quarter and have it on the shelves in advance. Draw up a Production budget using the following information for 2019: (5)

- Opening stock (15%)

- Closing stock (15%)

- Direct material costs are R12.25 per unit

- Direct material purchases are paid 50% cash in the quarter of purchase and 50% in the following quarter (30days).

- Creditors or accounts payable will be paid at the beginning of the year and will be paid on full in the first quarter.

- It takes one hour of labour per unit at an average wage of R18 per hour to make the mobile cover. Draw up a labour budget for 2019. (5)

- MAN206 (Pty) Ltd has collected the following information to do their cash flow budget for 2019: (10)

- The enterprise’s bank account shows a negative at the beginning of the year.

- An investment of R R15000.00 will be sold off in the third period of the year.

- Purchases of all current costs are spread evenly over the quarters.

- Direct labour costs are settled in the period in which they are incurred.

- Management wants to purchase a new vehicle for R235 000 in the third period.

- The enterprise pays the tax monthly in equal instalments.

- Loans are paid in the second period of R7500.

- A loan of R550 000 will be granted in the first period of the year.

- There’s share capital of R497 195 (opening)

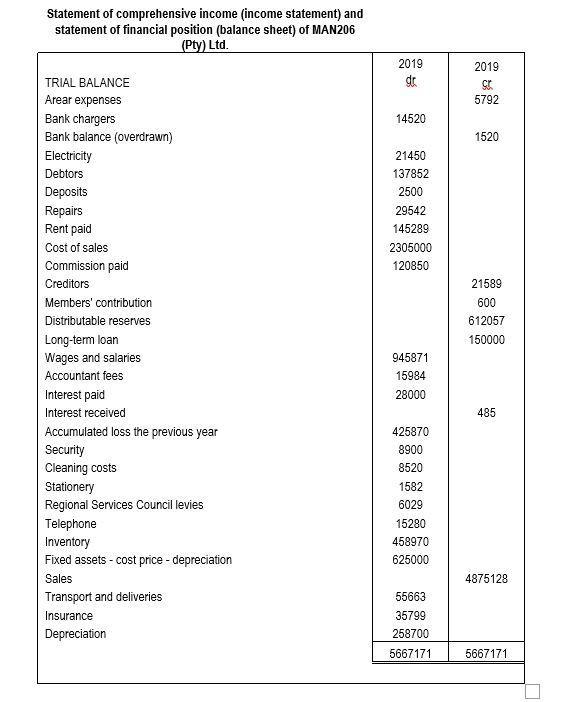

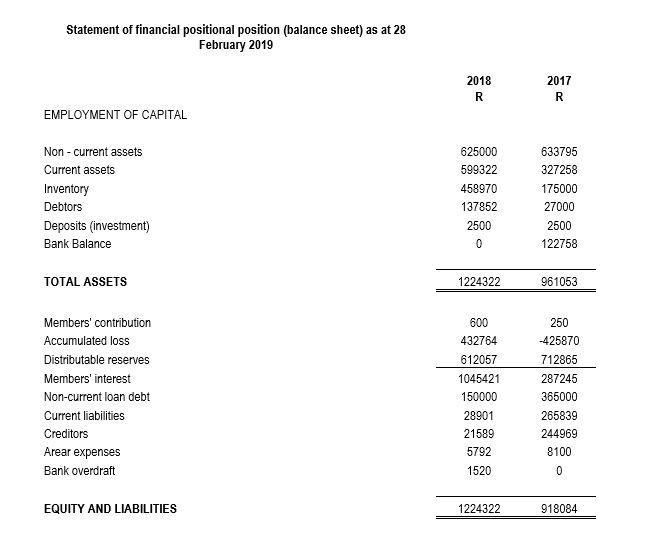

Statement of comprehensive income (income statement) and statement of financial position (balance sheet) of MAN206 (Pty) Ltd. TRIAL BALANCE Arear expenses Bank chargers Bank balance (overdrawn) Electricity Debtors Deposits Repairs Rent paid Cost of sales Commission paid Creditors Members' contribution Distributable reserves Long-term loan Wages and salaries Accountant fees Interest paid Interest received Accumulated loss the previous year Security Cleaning costs Stationery Regional Services Council levies Telephone Inventory Fixed assets - cost price - depreciation Sales Transport and deliveries Insurance Depreciation 2019 dr 14520 21450 137852 2500 29542 145289 2305000 120850 945871 15984 28000 425870 8900 8520 1582 6029 15280 458970 625000 55663 35799 258700 5667171 2019 St 5792 1520 21589 600 612057 150000 485 4875128 5667171

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To draw up the production budget and labor budget we need the following information 1 Sales budget B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started