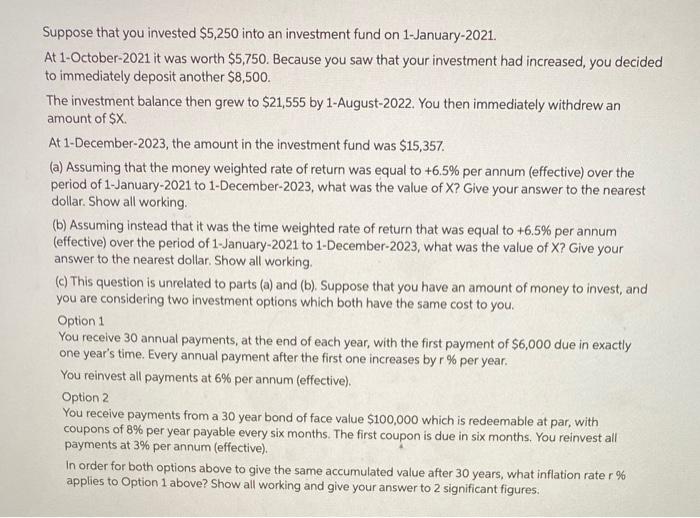

Suppose that you invested $5,250 into an investment fund on 1-January-2021. At 1-October-2021 it was worth $5,750. Because you saw that your investment had increased, you decided to immediately deposit another $8,500. The investment balance then grew to $21,555 by 1-August-2022. You then immediately withdrew an amount of $X. At 1-December-2023, the amount in the investment fund was $15,357 (a) Assuming that the money weighted rate of return was equal to +6,5% per annum (effective) over the period of 1-January-2021 to 1-December-2023, what was the value of X? Give your answer to the nearest dollar. Show all working. (b) Assuming instead that it was the time weighted rate of return that was equal to +6,5% per annum (effective) over the period of 1-January-2021 to 1-December-2023, what was the value of X? Give your answer to the nearest dollar. Show all working, (c) This question is unrelated to parts (a) and (b). Suppose that you have an amount of money to invest, and you are considering two investment options which both have the same cost to you. Option 1 You receive 30 annual payments, at the end of each year, with the first payment of $6,000 due in exactly one year's time. Every annual payment after the first one increases by r % per year. You reinvest all payments at 6% per annum (effective) Option 2 You receive payments from a 30 year bond of face value $100,000 which is redeemable at par, with coupons of 8% per year payable every six months. The first coupon is due in six months. You reinvest all payments at 3% per annum (effective) In order for both options above to give the same accumulated value after 30 years, what inflation rate r % applies to Option 1 above? Show all working and give your answer to 2 significant figures. Suppose that you invested $5,250 into an investment fund on 1-January-2021. At 1-October-2021 it was worth $5,750. Because you saw that your investment had increased, you decided to immediately deposit another $8,500. The investment balance then grew to $21,555 by 1-August-2022. You then immediately withdrew an amount of $X. At 1-December-2023, the amount in the investment fund was $15,357 (a) Assuming that the money weighted rate of return was equal to +6,5% per annum (effective) over the period of 1-January-2021 to 1-December-2023, what was the value of X? Give your answer to the nearest dollar. Show all working. (b) Assuming instead that it was the time weighted rate of return that was equal to +6,5% per annum (effective) over the period of 1-January-2021 to 1-December-2023, what was the value of X? Give your answer to the nearest dollar. Show all working, (c) This question is unrelated to parts (a) and (b). Suppose that you have an amount of money to invest, and you are considering two investment options which both have the same cost to you. Option 1 You receive 30 annual payments, at the end of each year, with the first payment of $6,000 due in exactly one year's time. Every annual payment after the first one increases by r % per year. You reinvest all payments at 6% per annum (effective) Option 2 You receive payments from a 30 year bond of face value $100,000 which is redeemable at par, with coupons of 8% per year payable every six months. The first coupon is due in six months. You reinvest all payments at 3% per annum (effective) In order for both options above to give the same accumulated value after 30 years, what inflation rate r % applies to Option 1 above? Show all working and give your answer to 2 significant figures