Question

Suppose that you offered labor the minimum 80% of the current wage, no benefits, no profit sharing, no wage escalator. After a three month strike

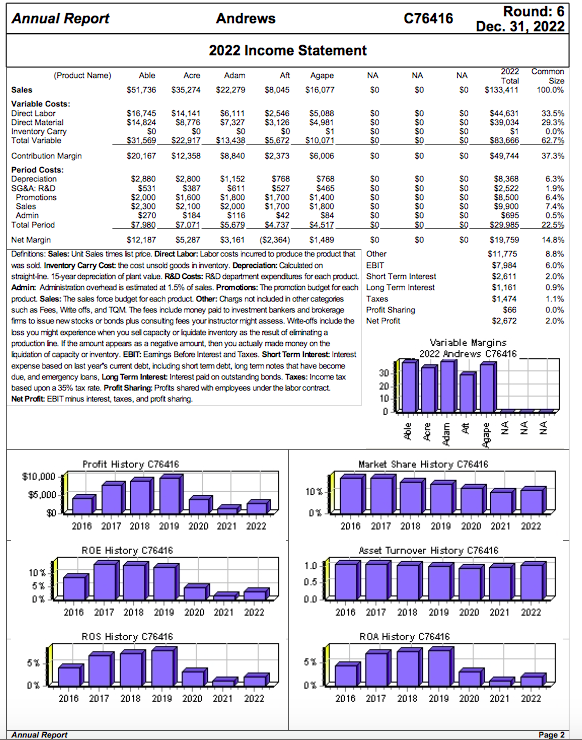

Suppose that you offered labor the minimum 80% of the current wage, no benefits, no profit sharing, no wage escalator. After a three month strike you could expect to settle half way between their demands and your offer, at least 10% below your competitors. How much money is that per year? (Tip take 10% of the total Labor Cost on the Annual Report Income Statement.)

How much would you save over the next five years?

Assume that a strike would hurt your productivity gains by cutting them half. If your productivity index is now 1.12, and it dropped to 1.06, you would have to hire additional workers. Estimate what this would cost you. (Tip. Look at last years total Labor Cost on the Annual Report Income Statement. This was your cost at your current productivity level. If productivity falls, you labor cost would go up. For example, if the productivity level fell by .06, you would need 1-1/(1.06) = 5.7% more workers. Your labor costs would increase by 5.7%.) Given these tradeoffs, what do you want your company to offer in the labor negotiation this round?

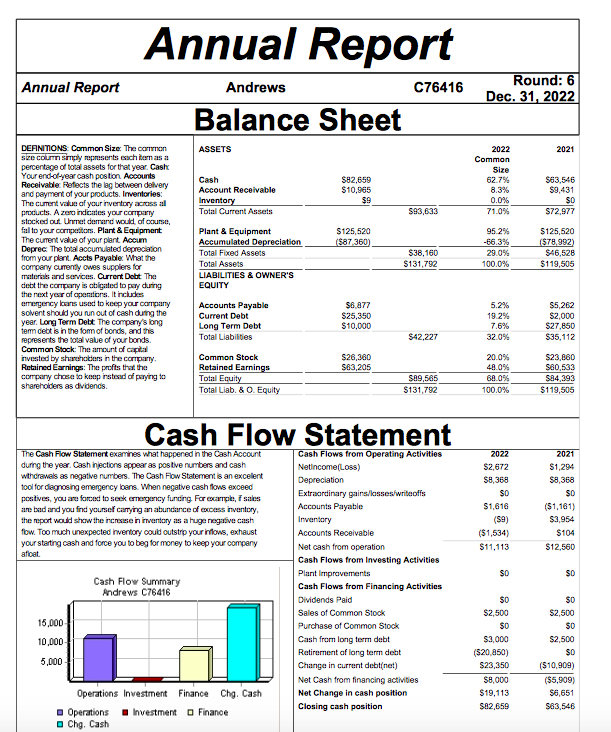

Annual Report Round: 6 Annual Report Andrews C76416 Balance Sheet DEANmNS Common Size The rmon ASSETS 2021 percentage of total assets for that year. Cash Your end-o-yearcash postion Accounts Receivable Refects the lag between daivery and payment of your products. Inventories: The cument value af your invertory across al products. A ze indcates your company stocked Umnet dem ind wold of course. fail to yur petos. Plant & Equipment The cument value of your plant Accun Deprec The total accumulated deprecaion from your plant. Accts Payable What he commpany cumeny owes suppliers for materiaks and sevices. Currert Debt T 62.7% S63,546 $82,659 $10,965 Account Receivable Total Current Assets Plant & Equipment $93,633 71.0% $72,977 $125,520 S46,528 29 0% 100.0% Total Fixed Assets Total Assets LIABILITIES& OWNER'S EQUITY debt the copary is abigated to pary duing the rext yeer of apeniions. It includes emergercy kar s used to keep yor mpany solvent shouid you run out of cash duing the year. Long Term Debt The compay's long emn cebt is in the om cf bonds, and this represents the total value of your bonds. Comman Stock: The amourt of capit nvested by shahaters in the comprry. Retained Earnings: The profts that the company chose to keop instead o parying to sharehoders as dvidencs. S6,877 $5,262 S2,000 $27,850 19.2% 32.0% 20.0% Current Debt g Term Debt Total Liabilies $26,380 63,205 23,860 60,533 Common Stock Retaincd Total Total Liab. &O. Equity $89,585 100.0% Cash Flow Statement examines what happened in the Operating Activities during the year. Cash injections appearas postve numbers and cash wthcrawals as negative numbers. The Cash Fow Statement s an excelent ool for dagnosing emegency lbens. When neatve cash lows exceed postives, you ae forcsd to seek emergency funding For eocampe, sales ane bad and you find yoursef carying an abuncance of excess inventory the neport woud show the incresse in irnventcry as a huge negive cash fow. Toomuch unexpected inventory coud outstrp your inows, exhaust your starting cash and force you to beg for money to keep your company afloat $2,672 $8,368 $1,294 S0 Accounts Payable S3,954 Accounts Receivable Net cash from operation Cash Flows from Investing Activities S0 Cash Flow Summary Andrews C76416 Cash Flows from Financing Activities Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long terrn debt Retirernernt af long term deht Change in current debtinet) Net Cash from financing actividies Net Change in cash position Closing cash position 2,500 S0 $2,500 15,000 10,000 $3,000 S0 $23,350 $5,909) $6,651 Operations Investment Finance Chg. Cash Operations -investment Finance 82,859 83,546

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started