Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you open a long position in SPI 200 futures on 3rd June at 4540 points. Each contract is $25 times the index

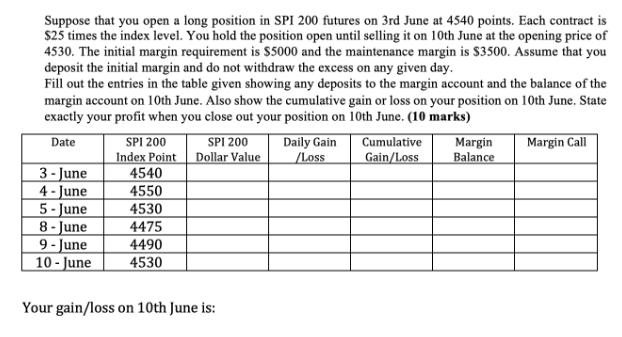

Suppose that you open a long position in SPI 200 futures on 3rd June at 4540 points. Each contract is $25 times the index level. You hold the position open until selling it on 10th June at the opening price of 4530. The initial margin requirement is $5000 and the maintenance margin is $3500. Assume that you deposit the initial margin and do not withdraw the excess on any given day. Fill out the entries in the table given showing any deposits to the margin account and the balance of the margin account on 10th June. Also show the cumulative gain or loss on your position on 10th June. State exactly your profit when you close out your position on 10th June. (10 marks) Date 3-June 4-June 5-June 8-June 9-June 10-June SPI 200 Index Point 4540 4550 4530 4475 4490 4530 SPI 200 Dollar Value Your gain/loss on 10th June is: Daily Gain /Loss Cumulative Gain/Loss Margin Balance Margin Call

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started