Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you took out a college loan totalling $40,000 with interest of 7.5% that kicks in once you start work. At that point

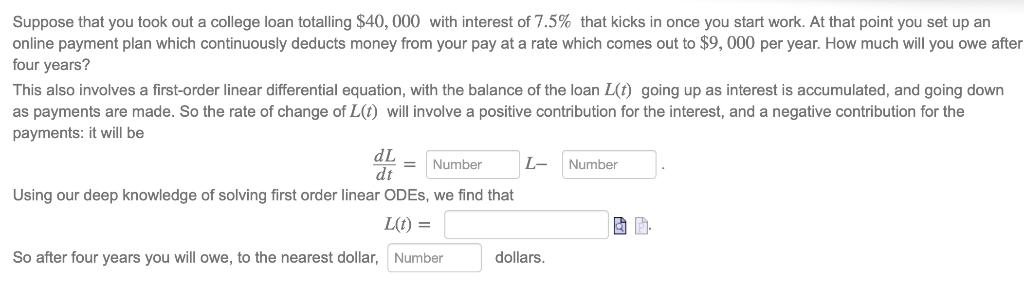

Suppose that you took out a college loan totalling $40,000 with interest of 7.5% that kicks in once you start work. At that point you set up an online payment plan which continuously deducts money from your pay at a rate which comes out to $9,000 per year. How much will you owe after four years? This also involves a first-order linear differential equation, with the balance of the loan L(t) going up as interest is accumulated, and going down as payments are made. So the rate of change of L(t) will involve a positive contribution for the interest, and a negative contribution for the payments: it will be dL dt Number Using our deep knowledge of solving first order linear ODEs, we find that L- Number L(t) = So after four years you will owe, to the nearest dollar, Number dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started