Question

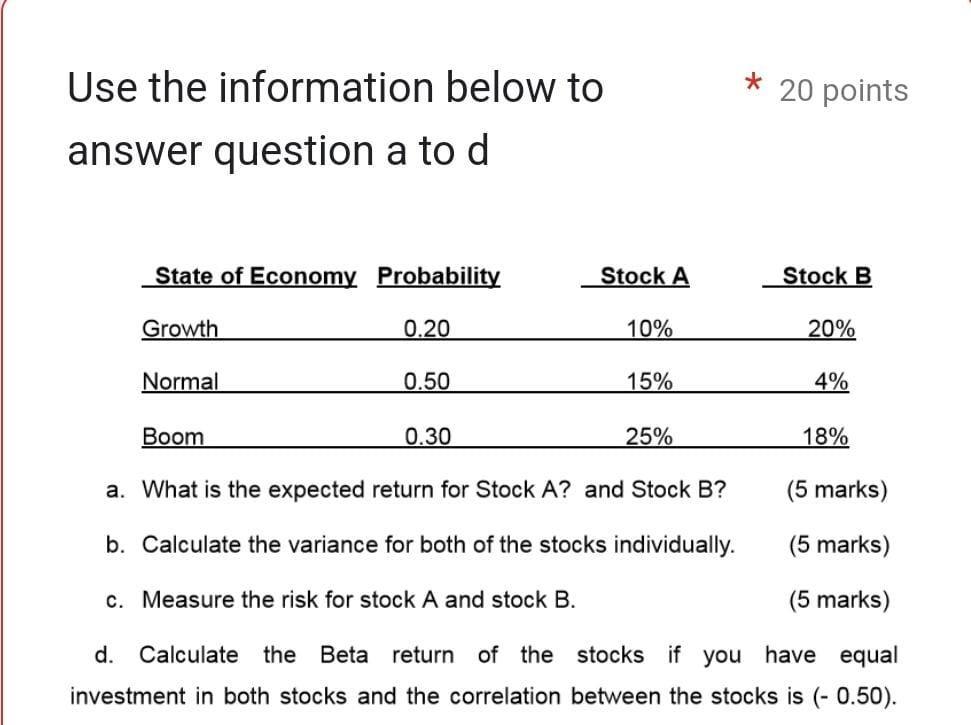

Use the information below to answer question a to d State of Economy Probability Growth 0.20 Normal 0.50 Boom 0.30 Stock A 10% 15%

Use the information below to answer question a to d State of Economy Probability Growth 0.20 Normal 0.50 Boom 0.30 Stock A 10% 15% 25% * a. What is the expected return for Stock A? and Stock B? b. Calculate the variance for both of the stocks individually. c. Measure the risk for stock A and stock B. 20 points Stock B 20% 4% 18% (5 marks) (5 marks) (5 marks) d. Calculate the Beta return of the stocks if you have equal investment in both stocks and the correlation between the stocks is (- 0.50).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a Expected return for Stock A The expected return for Stock A can be calculated using the probabilityweighted average of the possible returns ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J. Chris Leach, Ronald W. Melicher

6th edition

1305968352, 978-1337635653, 978-1305968356

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App