Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the 0.5-year zero rate is 6% and the 1-year zero rate is 8%. Consider a 1-year, semi-annual pay, fixed-for-floating interest rate swap between

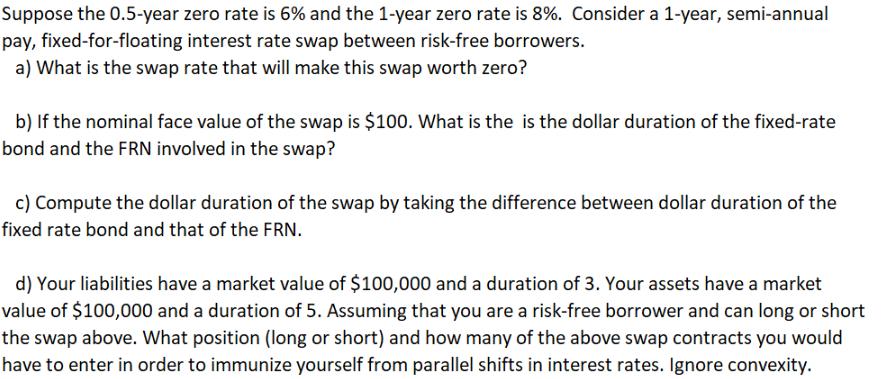

Suppose the 0.5-year zero rate is 6% and the 1-year zero rate is 8%. Consider a 1-year, semi-annual pay, fixed-for-floating interest rate swap between risk-free borrowers. a) What is the swap rate that will make this swap worth zero? b) If the nominal face value of the swap is $100. What is the is the dollar duration of the fixed-rate bond and the FRN involved in the swap? c) Compute the dollar duration of the swap by taking the difference between dollar duration of the fixed rate bond and that of the FRN. d) Your liabilities have a market value of $100,000 and a duration of 3. Your assets have a market value of $100,000 and a duration of 5. Assuming that you are a risk-free borrower and can long or short the swap above. What position (long or short) and how many of the above swap contracts you would have to enter in order to immunize yourself from parallel shifts in interest rates. Ignore convexity.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a The swap rate that will make this swap worth zero can be calculated using the formula Swap Rate 1 Present Value of Fixed Payments Present Value of Floating Payments The fixed payments are semiannual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started