Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the annualized spot rates are as follows 6 months 3% 12 months 5% (a) Calculate the price of the 6-month Treasury bill with

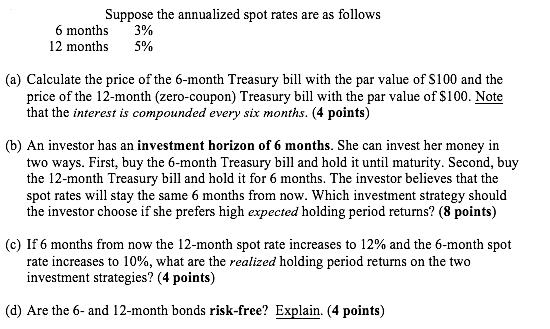

Suppose the annualized spot rates are as follows 6 months 3% 12 months 5% (a) Calculate the price of the 6-month Treasury bill with the par value of $100 and the price of the 12-month (zero-coupon) Treasury bill with the par value of $100. Note that the interest is compounded every six months. (4 points) (b) An investor has an investment horizon of 6 months. She can invest her money in two ways. First, buy the 6-month Treasury bill and hold it until maturity. Second, buy the 12-month Treasury bill and hold it for 6 months. The investor believes that the spot rates will stay the same 6 months from now. Which investment strategy should the investor choose if she prefers high expected holding period returns? (8 points) (c) If 6 months from now the 12-month spot rate increases to 12% and the 6-month spot rate increases to 10%, what are the realized holding period returns on the two investment strategies? (4 points) (d) Are the 6- and 12-month bonds risk-free? Explain. (4 points)

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The price of the 6month Treasury bill with the par value of 100 can be calculated as follows Price Par Value 1 Rate Time 100 1 003 05 9806 Similarly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started