Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the billing cycle for your credit card is from the first day of each month to the last day of each month. And

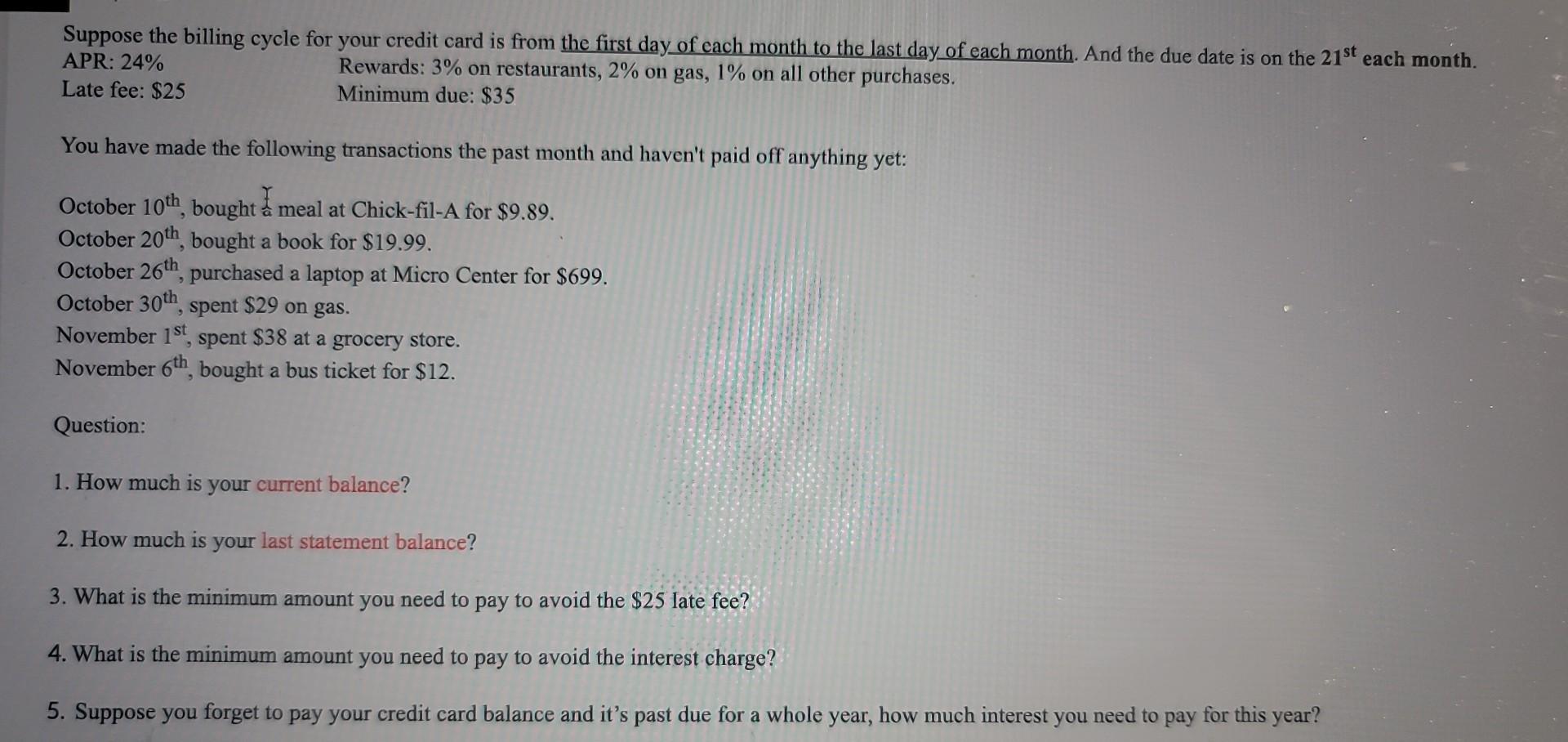

Suppose the billing cycle for your credit card is from the first day of each month to the last day of each month. And the due date is on the 21st each month. APR: 24% Rewards: 3% on restaurants, 2% on gas, 1% on all other purchases. Minimum due: $35 Late fee: $25 You have made the following transactions the past month and haven't paid off anything yet: October 10th, bought a meal at Chick-fil-A for $9.89. October 20th, bought a book for $19.99. October 26th, purchased a laptop at Micro Center for $699. October 30th, spent $29 on gas. November 1st, spent $38 at a grocery store. November 6th, bought a bus ticket for $12. Question: 1. How much is your current balance? 2. How much is your last statement balance? 3. What is the minimum amount you need to pay to avoid the $25 late fee? 4. What is the minimum amount you need to pay to avoid the interest charge? 5. Suppose you forget to pay your credit card balance and it's past due for a whole year, how much interest you need to pay for this year?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Your current balance is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started