Question

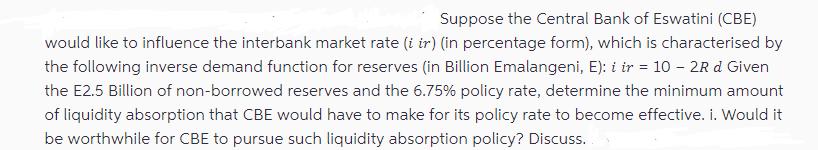

Suppose the Central Bank of Eswatini (CBE) would like to influence the interbank market rate (i ir) (in percentage form), which is characterised by

Suppose the Central Bank of Eswatini (CBE) would like to influence the interbank market rate (i ir) (in percentage form), which is characterised by the following inverse demand function for reserves (in Billion Emalangeni, E): i ir = 10 - 2R d Given the E2.5 Billion of non-borrowed reserves and the 6.75% policy rate, determine the minimum amount of liquidity absorption that CBE would have to make for its policy rate to become effective. i. Would it be worthwhile for CBE to pursue such liquidity absorption policy? Discuss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Stability in the economy The primary goal of the Central Bank of Eswatini BE is to maintain stabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Economics Theory and Policy

Authors: Paul R. Krugman, Maurice Obstfeld, Marc J. Melitz

9th Edition

978-0132146654, 0132146657, 9780273754091, 978-0273754206

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App