Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the current price of a stock is $18. Consider a two state tree model defined such that after 3 months, the stock price

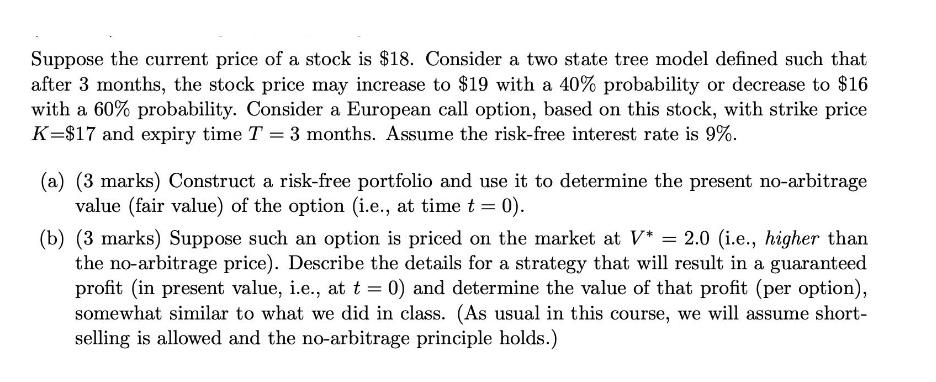

Suppose the current price of a stock is $18. Consider a two state tree model defined such that after 3 months, the stock price may increase to $19 with a 40% probability or decrease to $16 with a 60% probability. Consider a European call option, based on this stock, with strike price K=$17 and expiry time T = 3 months. Assume the risk-free interest rate is 9%. (a) (3 marks) Construct a risk-free portfolio and use it to determine the present no-arbitrage value (fair value) of the option (i.e., at time t = 0). (b) (3 marks) Suppose such an option is priced on the market at V* = 2.0 (i.e., higher than the no-arbitrage price). Describe the details for a strategy that will result in a guaranteed profit (in present value, i.e., at t = 0) and determine the value of that profit (per option), somewhat similar to what we did in class. (As usual in this course, we will assume short- selling is allowed and the no-arbitrage principle holds.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To construct a riskfree portfolio we need to determine the number of shares of the stock and the investment in the riskfree asset such as a bond Let...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started