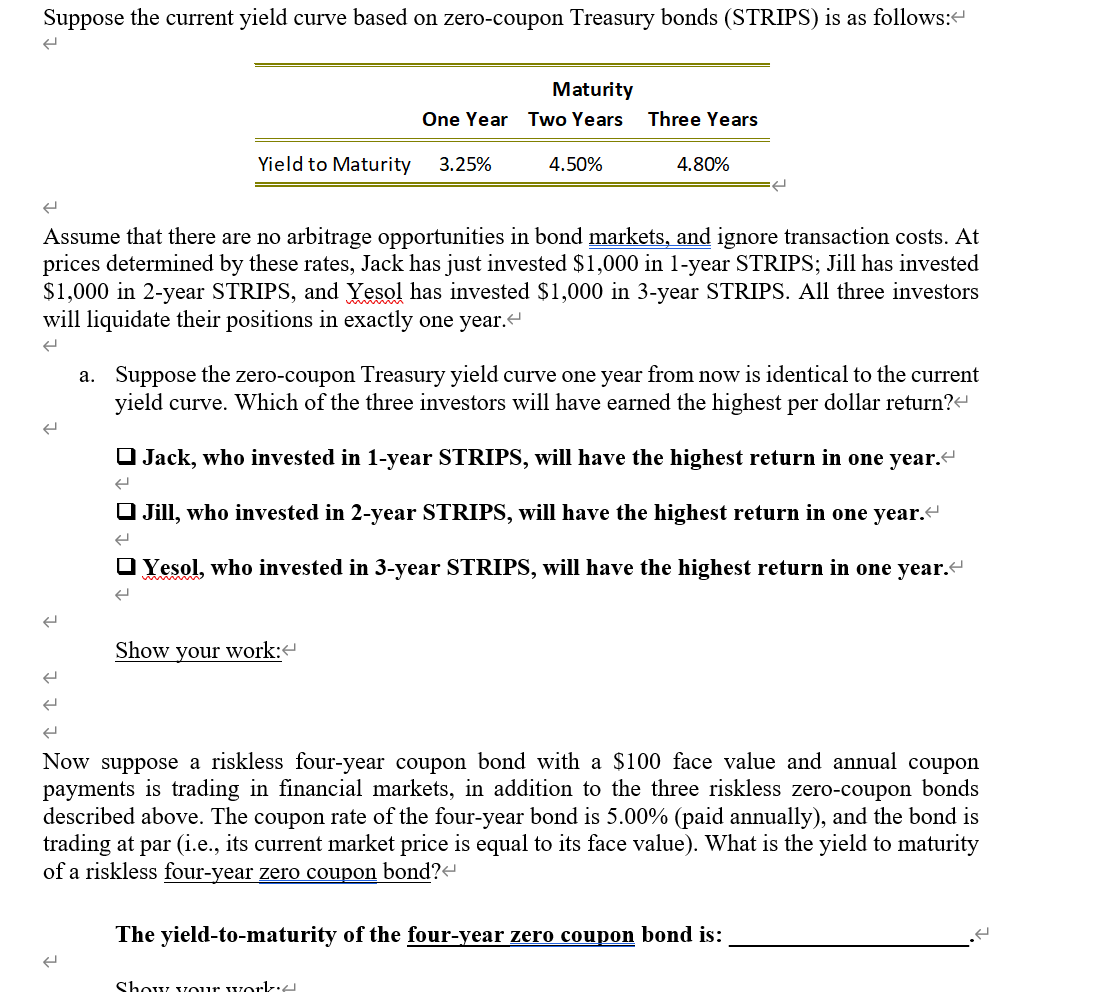

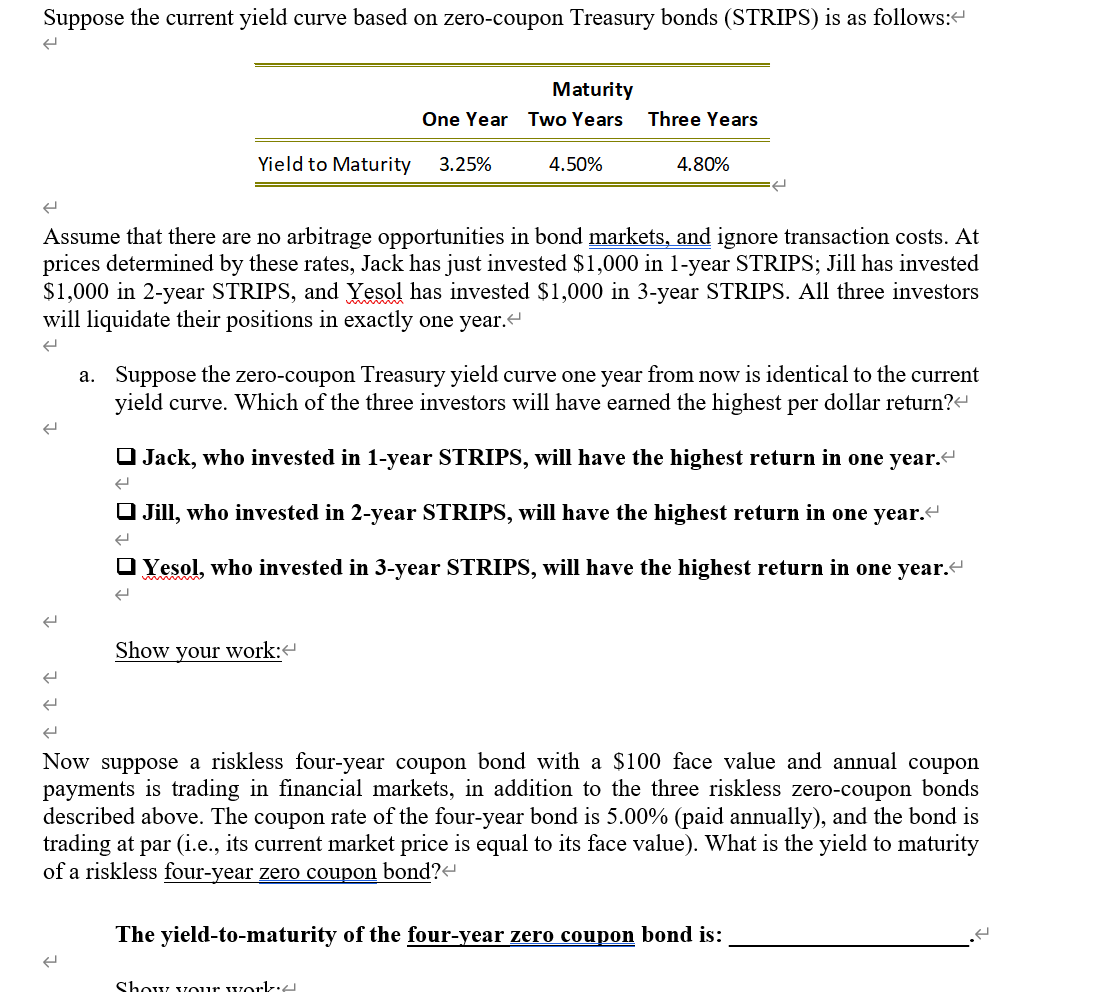

Suppose the current yield curve based on zero-coupon Treasury bonds (STRIPS) is as follows: Assume that there are no arbitrage opportunities in bond markets, and ignore transaction costs. At prices determined by these rates, Jack has just invested $1,000 in 1-year STRIPS; Jill has invested $1,000 in 2-year STRIPS, and Yesol has invested \$1,000 in 3-year STRIPS. All three investors will liquidate their positions in exactly one year. a. Suppose the zero-coupon Treasury yield curve one year from now is identical to the current yield curve. Which of the three investors will have earned the highest per dollar return? Jack, who invested in 1-year STRIPS, will have the highest return in one year. Jill, who invested in 2-year STRIPS, will have the highest return in one year. Yesol, who invested in 3-year STRIPS, will have the highest return in one year. Show your work: Now suppose a riskless four-year coupon bond with a $100 face value and annual coupon payments is trading in financial markets, in addition to the three riskless zero-coupon bonds described above. The coupon rate of the four-year bond is 5.00% (paid annually), and the bond is trading at par (i.e., its current market price is equal to its face value). What is the yield to maturity of a riskless four-year zero coupon bond? The yield-to-maturity of the four-year zero coupon bond is: Suppose the current yield curve based on zero-coupon Treasury bonds (STRIPS) is as follows: Assume that there are no arbitrage opportunities in bond markets, and ignore transaction costs. At prices determined by these rates, Jack has just invested $1,000 in 1-year STRIPS; Jill has invested $1,000 in 2-year STRIPS, and Yesol has invested \$1,000 in 3-year STRIPS. All three investors will liquidate their positions in exactly one year. a. Suppose the zero-coupon Treasury yield curve one year from now is identical to the current yield curve. Which of the three investors will have earned the highest per dollar return? Jack, who invested in 1-year STRIPS, will have the highest return in one year. Jill, who invested in 2-year STRIPS, will have the highest return in one year. Yesol, who invested in 3-year STRIPS, will have the highest return in one year. Show your work: Now suppose a riskless four-year coupon bond with a $100 face value and annual coupon payments is trading in financial markets, in addition to the three riskless zero-coupon bonds described above. The coupon rate of the four-year bond is 5.00% (paid annually), and the bond is trading at par (i.e., its current market price is equal to its face value). What is the yield to maturity of a riskless four-year zero coupon bond? The yield-to-maturity of the four-year zero coupon bond is