Question

Suppose the dividends for the Seger Corporation over the past six years were $1.49, $1.57, $1.66, $1.74, $1.84, and $1.89, respectively. Assume that the

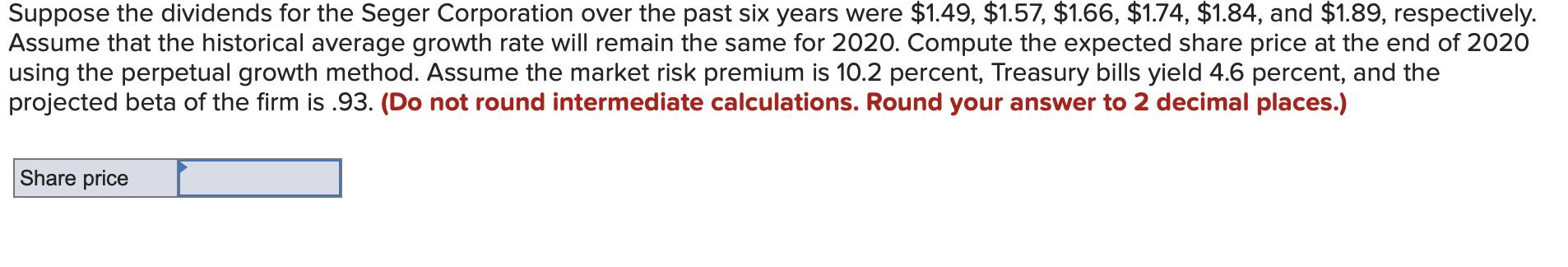

Suppose the dividends for the Seger Corporation over the past six years were $1.49, $1.57, $1.66, $1.74, $1.84, and $1.89, respectively. Assume that the historical average growth rate will remain the same for 2020. Compute the expected share price at the end of 2020 using the perpetual growth method. Assume the market risk premium is 10.2 percent, Treasury bills yield 4.6 percent, and the projected beta of the firm is .93. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Share price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected share price at the end of 2020 using the perpetual growth method Gordon Gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Analysis With Microsoft Excel

Authors: Timothy R. Mayes

9th Edition

0357442059, 9780357442050

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App