Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the economy is in a recession. Policymakers estimate that aggregate demand is RM100 billion short of the amount necessary to generate the long-run

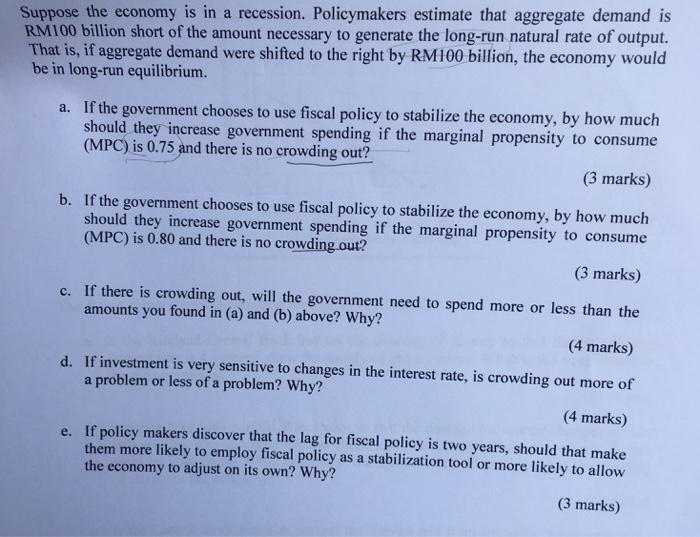

Suppose the economy is in a recession. Policymakers estimate that aggregate demand is RM100 billion short of the amount necessary to generate the long-run natural rate of output. That is, if aggregate demand were shifted to the right by RM100 billion, the economy would be in long-run equilibrium. a. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.75 and there is no crowding out? (3 marks) b. If the government chooses to use fiscal policy to stabilize the economy, by how much should they increase government spending if the marginal propensity to consume (MPC) is 0.80 and there is no crowding out? (3 marks) c. If there is crowding out, will the government need to spend more or less than the amounts you found in (a) and (b) above? Why? (4 marks) d. If investment is very sensitive to changes in the interest rate, is crowding out more of a problem or less of a problem? Why? (4 marks) e. If policy makers discover that the lag for fiscal policy is two years, should that make them more likely to employ fiscal policy as a stabilization tool or more likely to allow the economy to adjust on its own? Why? (3 marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To determine how much government spending should be increased to shift aggregate demand by RM100 billion we can use the spending multiplier formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started