Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the federal government imposes a tariff of $1 on each million bagels imported. Re-draw the demand and supply curves, along with the world

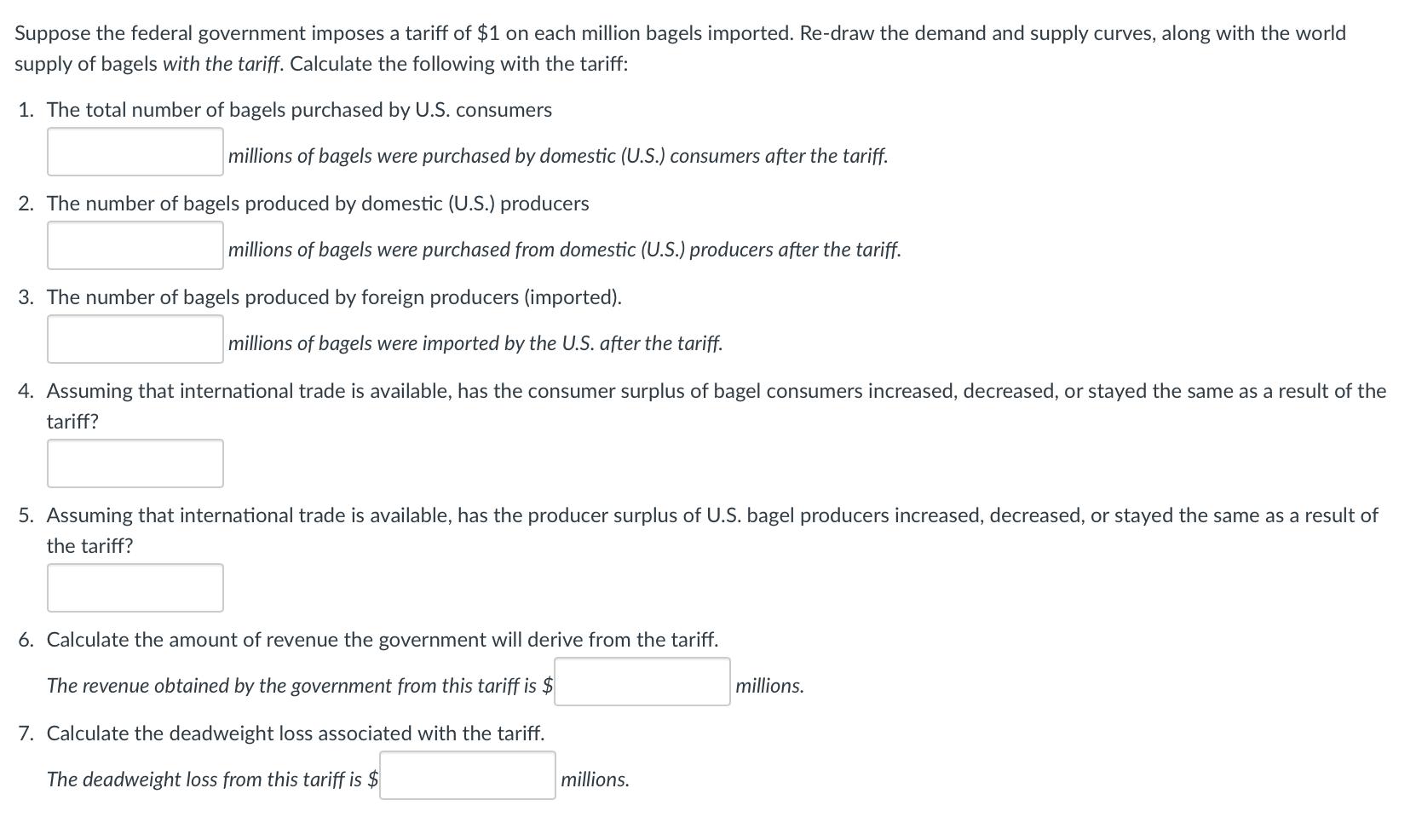

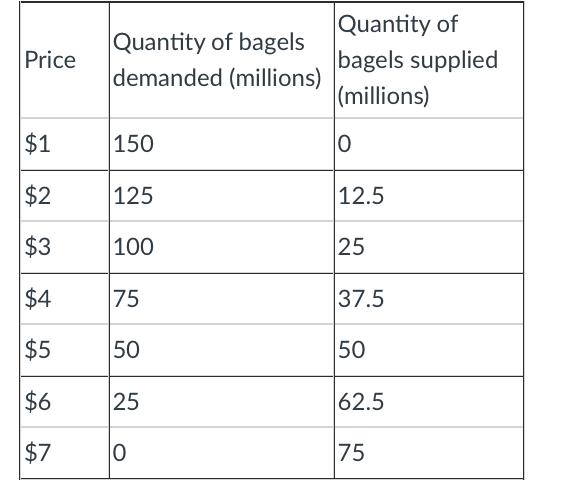

Suppose the federal government imposes a tariff of $1 on each million bagels imported. Re-draw the demand and supply curves, along with the world supply of bagels with the tariff. Calculate the following with the tariff: 1. The total number of bagels purchased by U.S. consumers millions of bagels were purchased by domestic (U.S.) consumers after the tariff. 2. The number of bagels produced by domestic (U.S.) producers millions of bagels were purchased from domestic (U.S.) producers after the tariff. 3. The number of bagels produced by foreign producers (imported). millions of bagels were imported by the U.S. after the tariff. 4. Assuming that international trade is available, has the consumer surplus of bagel consumers increased, decreased, or stayed the same as a result of the tariff? 5. Assuming that international trade is available, has the producer surplus of U.S. bagel producers increased, decreased, or stayed the same as a result of the tariff? 6. Calculate the amount of revenue the government will derive from the tariff. The revenue obtained by the government from this tariff is $ 7. Calculate the deadweight loss associated with the tariff. The deadweight loss from this tariff is $ millions. millions. Price $1 $2 $3 $4 $5 $6 $7 Quantity of bagels demanded (millions) 150 125 100 75 50 25 0 Quantity of bagels supplied (millions) 0 12.5 25 37.5 50 62.5 75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the effects of the tariff on the bagel market we need to consider the demand and supply curves and their intersection Lets redraw the deman...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started