Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the following exchange rate quotes for the Turkish Lira (TRY) against the U.S. dollar (ignore bid/ask spreads here), and for the returns on

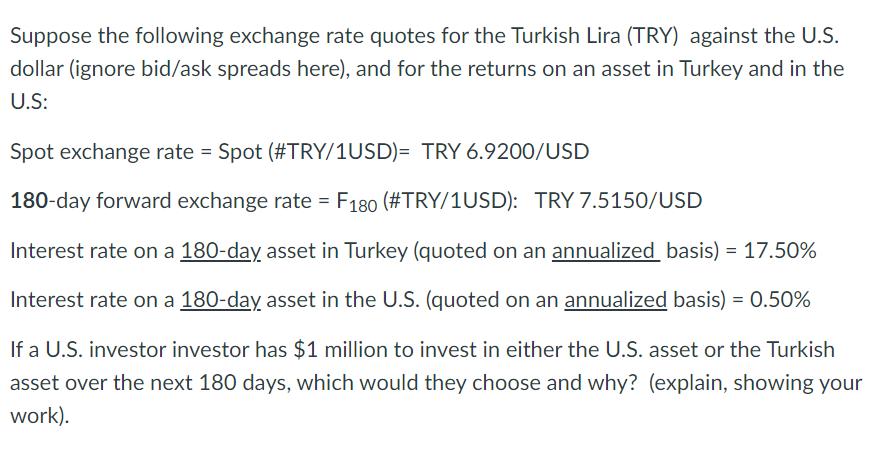

Suppose the following exchange rate quotes for the Turkish Lira (TRY) against the U.S. dollar (ignore bid/ask spreads here), and for the returns on an asset in Turkey and in the U.S: Spot exchange rate = Spot (#TRY/1USD)= TRY 6.9200/USD 180-day forward exchange rate = F180 (#TRY/1USD): TRY 7.5150/USD Interest rate on a 180-day asset in Turkey (quoted on an annualized basis) = 17.50% Interest rate on a 180-day asset in the U.S. (quoted on an annualized basis) = 0.50% If a U.S. investor investor has $1 million to invest in either the U.S. asset or the Turkish asset over the next 180 days, which would they choose and why? (explain, showing your work).

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine which asset to invest in we need to compare the returns on both assets adjusted f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started