Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the following spot ( Table 1 . 1 ) and futures contract ( Table 1 . 2 ) interest rates on JIBAR are quoted

Suppose the following spot Table and futures contract Table interest rates on

JIBAR are quoted on August ie days before the September contract expires Note that the spot rates are quoted as nominal annual NAC rates, while the futures rates are quoted as annual effective rates AER

Table : JIBAR Spot rates NAC on August :

JIBAR day rate:

Bused to Pind

JIBAR day rate:

tre forward

JIBAR day rate:

JIBAR day rate:

JIBAR dav rate:

JIBAR day rate:

JIBAR day rate:

JIBAR day rate:

JIBAR day rate:

JIBAR day rate:

JIBAR day rate:

Table : JIBAR Futures contract prices IMM Index on August :

Actual

September expiration in days:

December expiration in days:

March expiration in days:

June expiration in days:

September expiration in days:

Notes: Initial Margin required per JIBAR contract is R

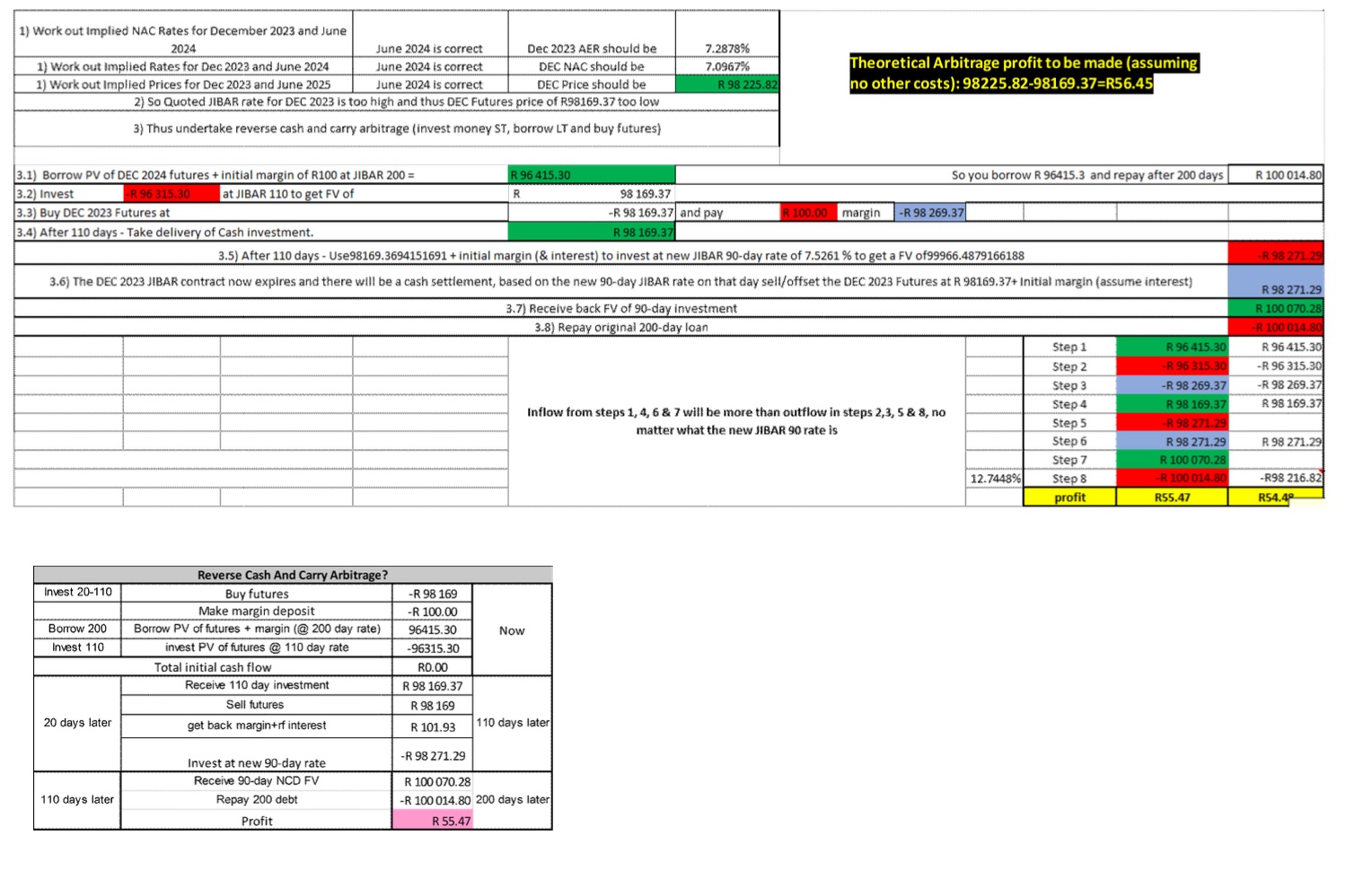

Calculate the yields ie AER for the Dec and June futures contracts.

Calculate the actual futures prices ie PV of R face value per JIBAR contract for both the Dec and June JIBAR futures contracts by discounting with the applicable NAC rates

As an arbitrage specialist, you suspect that the December andor June

JIBAR futures contracts might be incorrectly priced. Calculate if any mispricing is present in the two contracts. Note use daycount throughout.

Use the largest arbitrage opportunity in question above and explain in detail what transactions you will undertake to exploit the mispricing.How was calculated given the answers on the picture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started