Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the government wants to reduce carbon emissions and therefore increases the tax on gasoline. (Let's assume that there is no tax on gasoline

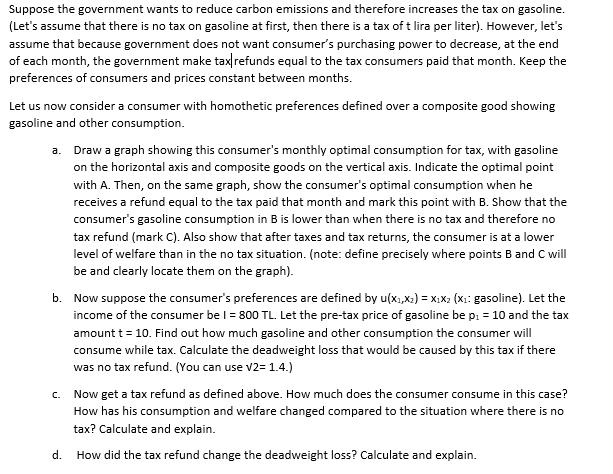

Suppose the government wants to reduce carbon emissions and therefore increases the tax on gasoline. (Let's assume that there is no tax on gasoline at first, then there is a tax of t lira per liter). However, let's assume that because government does not want consumer's purchasing power to decrease, at the end of each month, the government make tax refunds equal to the tax consumers paid that month. Keep the preferences of consumers and prices constant between months. Let us now consider a consumer with homothetic preferences defined over a composite good showing gasoline and other consumption. a. Draw a graph showing this consumer's monthly optimal consumption for tax, with gasoline on the horizontal axis and composite goods on the vertical axis. Indicate the optimal point with A. Then, on the same graph, show the consumer's optimal consumption when he receives a refund equal to the tax paid that month and mark this point with B. Show that the consumer's gasoline consumption in B is lower than when there is no tax and therefore no tax refund (mark C). Also show that after taxes and tax returns, the consumer is at a lower level of welfare than in the no tax situation. (note: define precisely where points B and C will be and clearly locate them on the graph). b. Now suppose the consumer's preferences are defined by u(x,x) = X1X2 (X: gasoline). Let the income of the consumer be I = 800 TL. Let the pre-tax price of gasoline be p = 10 and the tax amount t = 10. Find out how much gasoline and other consumption the consumer will consume while tax. Calculate the deadweight loss that would be caused by this tax if there was no tax refund. (You can use V2= 1.4.) c. Now get a tax refund as defined above. How much does the consumer consume in this case? How has his consumption and welfare changed compared to the situation where there is no tax? Calculate and explain. d. How did the tax refund change the deadweight loss? Calculate and explain.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started