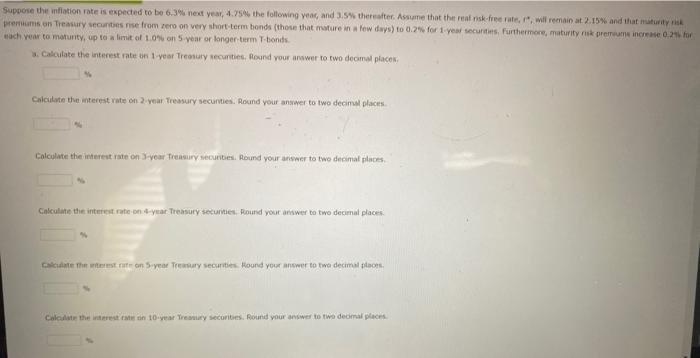

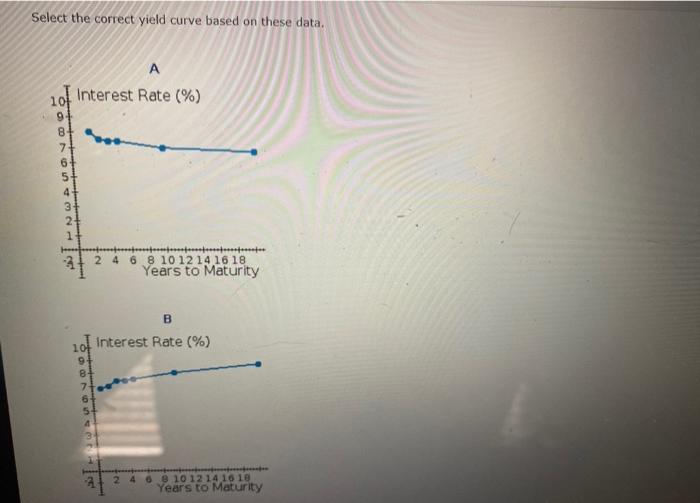

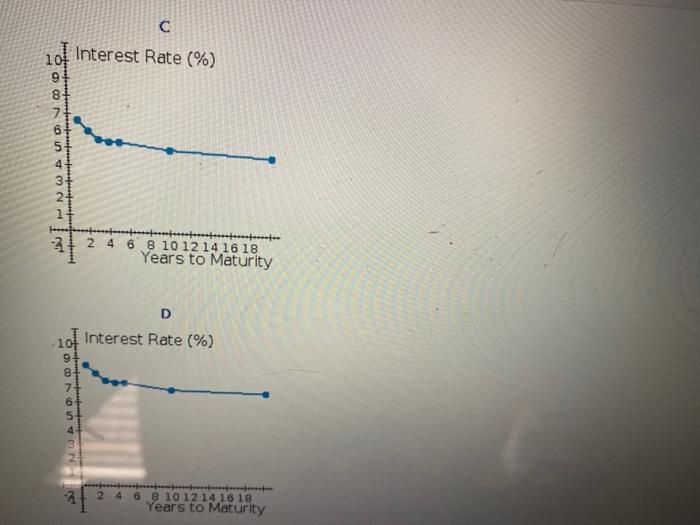

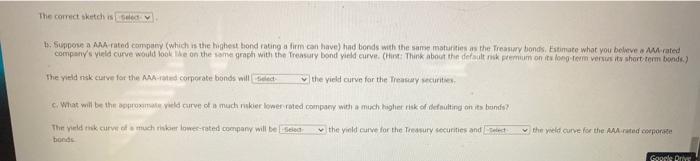

Suppose the inflation rate is expected to be 6.3 next year, 4.75 the following year, and 3.5% thereafter. Assume that the real risk free rate will remain at 2.15% and that maturity risk premiums on Treasury cuties rise from zero on very short-term bonds (those that mature in a few days) to 0.2% for 1 year securities. Furthermore, maturity risk prerum increto each year to mounty, up to limit of 10% on 5 year or longer term T-bonds 5. Calculate the interest rate on 1 year Treasury securities, Round your awwer to two deomal placer Calculate the interest rate on 2-year Treasury securities. Round your answer to two decimal places Calculate the interest rate on year sury securities. Round your answer to two decimal places Calculate the interest rate one-year Treasury securities. Round your answer to two decimal places Calculate the worst nutron Syee Tremur securities Hound your answer to two decimal loon Calculate the interest in 10 year Treaty Securities. Round your answer to two decimal places Calculate the interest rate on 20-year Treasury securities. Round your answer to two decimal places, % Select the correct yield curve based on these data. A A 10 Interest Rate (%) 94 B+ 7 6 5 4 3+ 2 1 2 4 6 8 10 12 14 16 18 Years to Maturity B 10 Interest Rate (%) 9+ B 7 6 5 4 3 2 4 6 8 10 12 14 16 18 Years to Maturity 101 Interest Rate (%) . 31 21 1+ 2 2 4 6 8 10 12 14 16 18 Years to Maturity D Interest Rate (%) Od 8 7 6 5 3 NG 3+2 4 6 8 10 12 14 16 18. Years to Maturity The correct sketch is see 1. Suppose a Amrated company (which is the highest bond rating a firm can have had bonds with the same maturities as the Treasury bonds. Estimate what you believe a Mrated company's yield curve would look like on the same graph with the Treasury bond yield curve (Hit Think about the default premium on its long-term versus it short term bonds) The yield risk curve for the corporate bonds will be the yield curve for the Treasury securities c. What will be the promul curve of much risker lower rated company with a much higher risk of defaulting on its bonde? The eldri curve of much risker lower-rated company will be boede the yield curve for the Treasury securities and the yeld curve for the Awed corporate Google Dri