Question

Suppose the Jacksonville State Bank paid a dividend this year of $3.00 per share. Dividends are expected to grow at a rate of 5

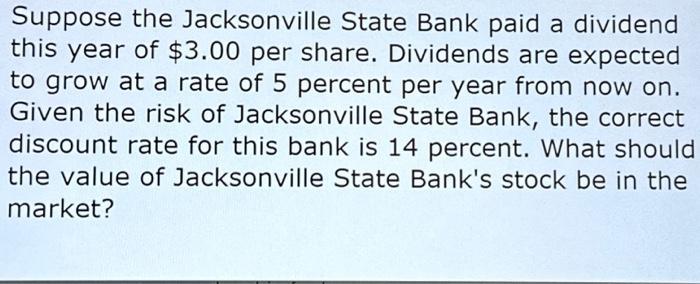

Suppose the Jacksonville State Bank paid a dividend this year of $3.00 per share. Dividends are expected to grow at a rate of 5 percent per year from now on. Given the risk of Jacksonville State Bank, the correct discount rate for this bank is 14 percent. What should the value of Jacksonville State Bank's stock be in the market?

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of Jacksonville State Banks stock we can use the dividend discount model DDM ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis and Valuation

Authors: Clyde P. Stickney

6th edition

324302959, 978-0324302967, 324302967, 978-0324302950

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App