Question

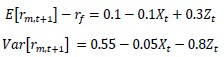

Suppose the market risk premium and variance are time-varying and depends on the two predictor variables and that are available at time as follows: Assume

Suppose the market risk premium and variance are time-varying and depends on the two predictor variables and that are available at time as follows:

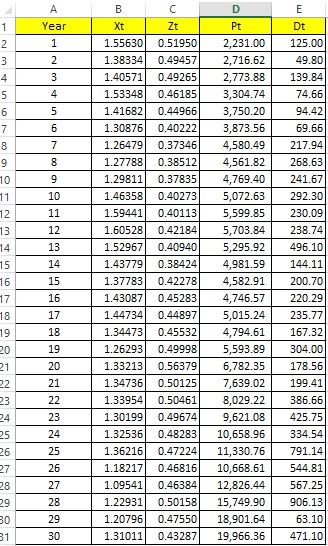

Assume your price of risk is A=4. The riskfree rate is 2% per year. Then you can compute the optimal asset allocation weights on the stock market and the riskfree asset using the formula you learned. If the predictor variables and and the dividend , and the price of the market portfolio change over time as in the table (table below), what would be your portfolio net return for the whole 30 years when you dynamically choose the optimal portfolio weight and rebalance the portfolio accordingly once a year? Express your answer as a decimal after rounding it to the nearest thousandth. Assume the divided paid is reinvested immediately.

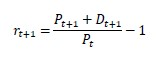

When you compute the net return, use the following definition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started