Question

Suppose the Modigliani-Miller assumptions hold, and we have no taxes. Cantrasus Inc. currently has no debt. The market value of its equity is $10,000,000.

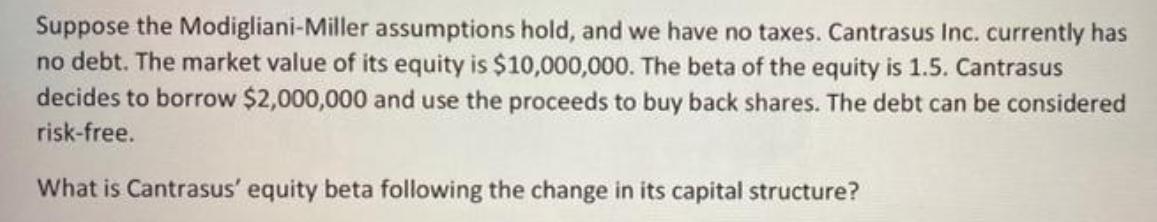

Suppose the Modigliani-Miller assumptions hold, and we have no taxes. Cantrasus Inc. currently has no debt. The market value of its equity is $10,000,000. The beta of the equity is 1.5. Cantrasus decides to borrow $2,000,000 and use the proceeds to buy back shares. The debt can be considered risk-free. What is Cantrasus' equity beta following the change in its capital structure?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cantrasus Equity Beta after Capital Structure Change 1 Introduction The ModiglianiMiller MM Proposit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App