Question

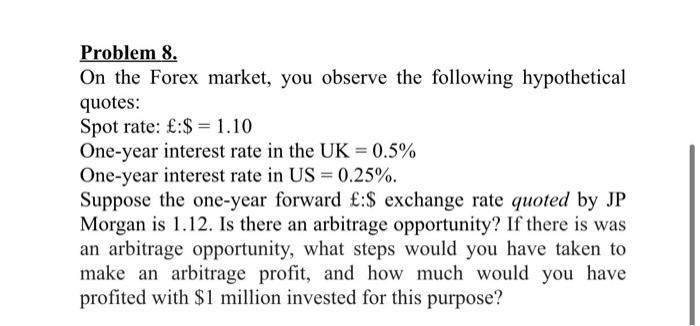

Problem 8. On the Forex market, you observe the following hypothetical quotes: Spot rate: :$= 1.10 One-year interest rate in the UK = 0.5%

Problem 8. On the Forex market, you observe the following hypothetical quotes: Spot rate: :$= 1.10 One-year interest rate in the UK = 0.5% One-year interest rate in US = 0.25%. Suppose the one-year forward :$ exchange rate quoted by JP Morgan is 1.12. Is there an arbitrage opportunity? If there is was an arbitrage opportunity, what steps would you have taken to make an arbitrage profit, and how much would you have profited with $1 million invested for this purpose?

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

one year future rate should be 110 100251005 10972 borrow 1 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting An Introduction to Concepts Methods and Uses

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil

10th Edition

1111822239, 324639767, 9781111822231, 978-0324639766

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App