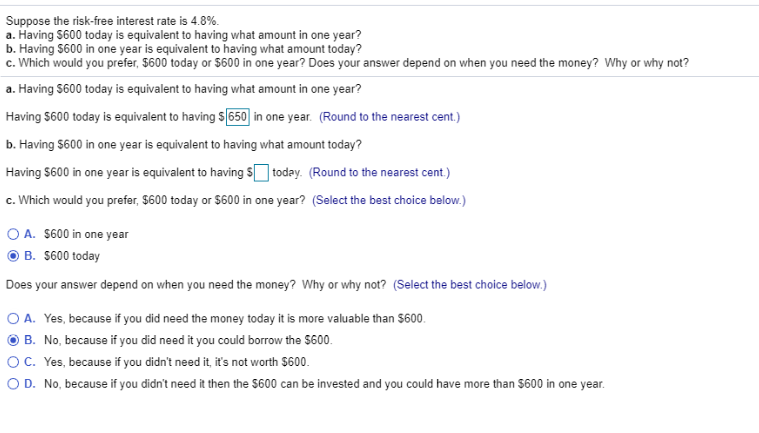

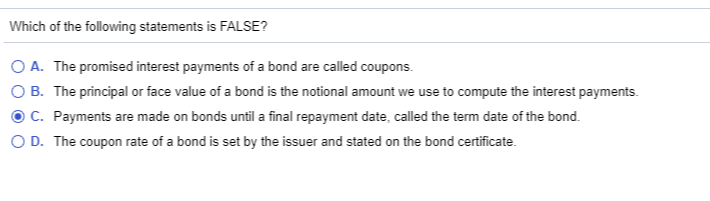

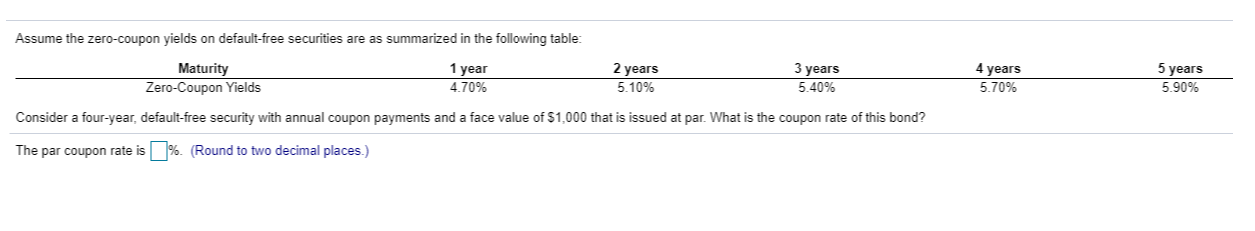

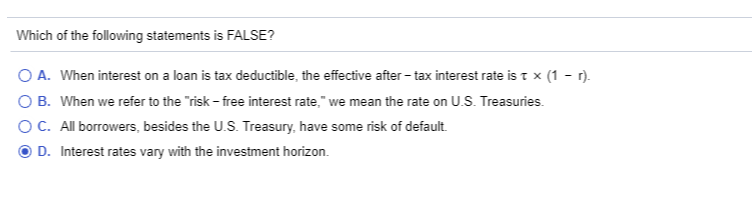

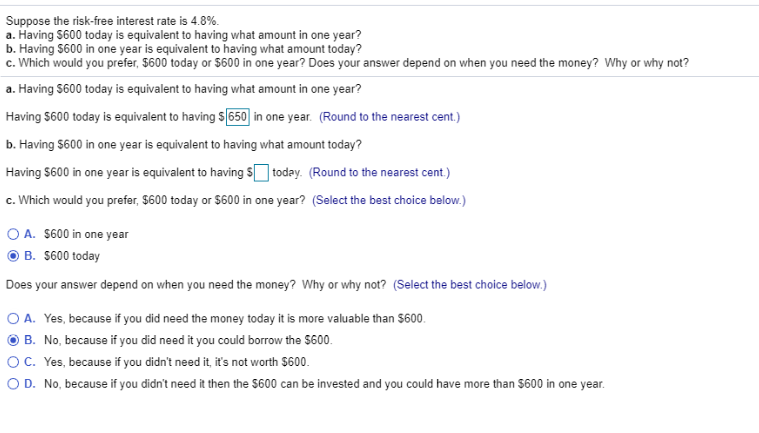

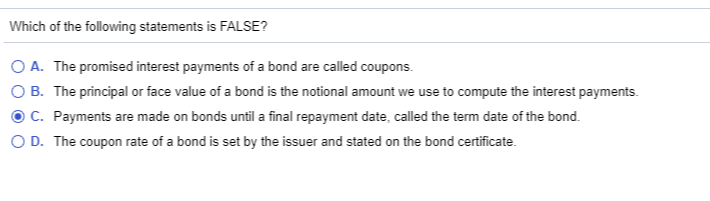

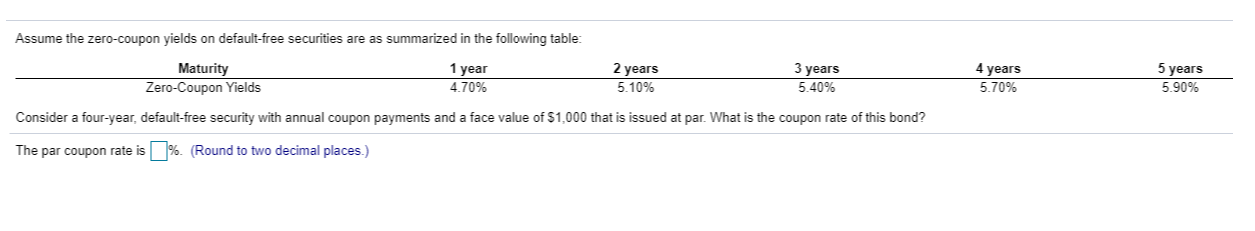

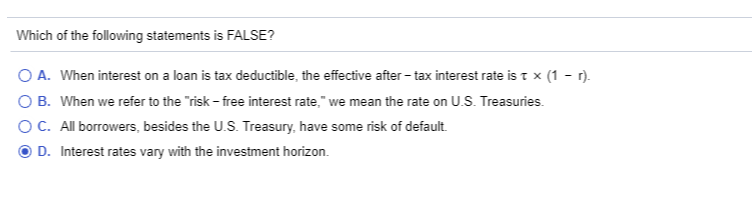

Suppose the risk-free interest rate is 4.8% a. Having 5600 today is equivalent to having what amount in one year? b. Having 5600 in one year is equivalent to having what amount today? c. Which would you prefer, $600 today or $600 in one year? Does your answer depend on when you need the money? Why or why not? a. Having 5600 today is equivalent to having what amount in one year? Having 5600 today is equivalent to having $ 650 in one year. (Round to the nearest cent.) b. Having 5600 in one year is equivalent to having what amount today? Having 5600 in one year is equivalent to having today. (Round to the nearest cent.) c. Which would you prefer, $600 today or $600 in one year? (Select the best choice below.) A. $600 in one year B. $600 today Does your answer depend on when you need the money? Why or why not? (Select the best choice below.) A. Yes, because if you did need the money today it is more valuable than $600. B. No, because if you did need it you could borrow the $600. C. Yes, because if you didn't need it, it's not worth $600. OD. No, because if you didn't need it then the 5600 can be invested and you could have more than $600 in one year. Which of the following statements is FALSE? O A. The promised interest payments of a bond are called coupons. OB. The principal or face value of a bond is the notional amount we use to compute the interest payments. C. Payments are made on bonds until a final repayment date, called the term date of the bond. OD. The coupon rate of a bond is set by the issuer and stated on the bond certificate. Assume the zero-coupon yields on default-free securities are as summarized in the following table: Maturity 1 year 2 years Zero-Coupon Yields 4.70% 5.10% 5.40% Consider a four-year, default-free security with annual coupon payments and a face value of $1,000 that is issued at par. What is the coupon rate of this bond? 3 years 4 years 5 years 5.90% 5.70% The par coupon rate is %. (Round to two decimal places.) Which of the following statements is FALSE? O A. When interest on a loan is tax deductible, the effective after-tax interest rate is t x (1 - 1). O B. When we refer to the risk-free interest rate," we mean the rate on U.S. Treasuries. O C. All borrowers, besides the U.S. Treasury, have some risk of default. OD. Interest rates vary with the investment horizon