Answered step by step

Verified Expert Solution

Question

1 Approved Answer

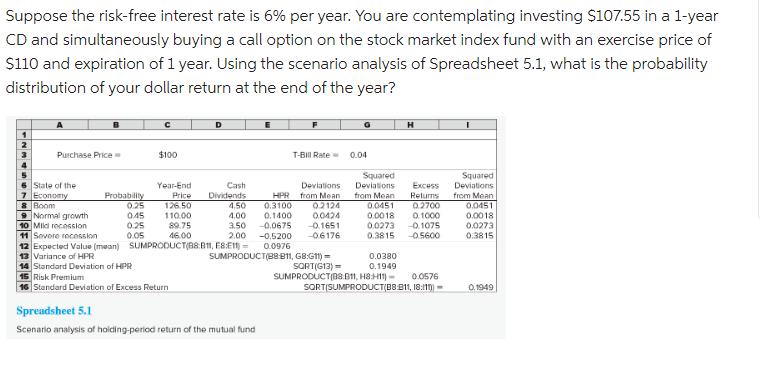

Suppose the risk-free interest rate is 6% per year. You are contemplating investing $107.55 in a 1-year CD and simultaneously buying a call option

Suppose the risk-free interest rate is 6% per year. You are contemplating investing $107.55 in a 1-year CD and simultaneously buying a call option on the stock market index fund with an exercise price of $110 and expiration of 1 year. Using the scenario analysis of Spreadsheet 5.1, what is the probability distribution of your dollar return at the end of the year? Purchase Price => State of the 7 Economy & Boom Probability 0.25 0.45 0.25 0.05 Normal growth 10 Mild recession 11 Sovore recession 12 Expected Value (mean) 13 Variance of HPR 14 Standard Deviation of HPR $100 Year-End Price 126.50 110.00 89.75 46.00 D Risk Premium Standard Deviation of Excess Return SUMPRODUCT(88:811, E8:E11) = 0.0976 Deviations HPR from Mean 0.3100 02124 Cash Dividends 4.50 4.00 3.50 -0.0675 -0.1651 2.00 -0.5200 -06176 0.1400 0.0424 T-Bill Rate Spreadsheet 5.1 Scenario analysis of holding-period return of the mutual fund 0.04 SUMPRODUCT(B8B11, G8:GH)= 0.0380 SORT(G13) = 0.1949 SUMPRODUCTIB8 D1, H&H) - H Squared Deviations from Mean Excess Returns 0.2700 0.0451 0.0018 0.1000 0.0273 -0.1075 0.3815 -0.5600 0.0576 SORT(SUMPRODUCT|B8E11, 18:11)) = Squared Deviations from Mean 0.0451 0.0018 0.0273 0.3815 0.1949

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started