Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the September Eurodollar futures contract has a price of 96.4. You plan to borrow $50m for 3 months in September at LIBOR Thanks! Suppose

Suppose the September Eurodollar futures contract has a price of 96.4. You plan to borrow $50m for 3 months in September at LIBOR

Thanks!

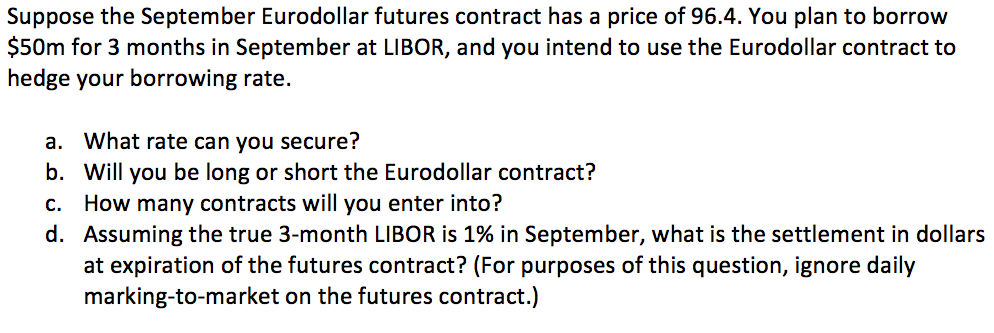

Suppose the September Eurodollar futures contract has a price of 96.4. You plan to borrow $50m for 3 months in September at LIBOR, and you intend to use the Eurodollar contract to hedge your borrowing rate. a. b. c. d. What rate can you secure? Will you be long or short the Eurodollar contract? How many contracts will you enter into? Assuming the true 3-month LIBOR is 1% in September, what is the settlement in dollars at expiration of the futures contract? (For purposes of this question, ignore daily marking-to-market on the futures contract.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started