Question

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The

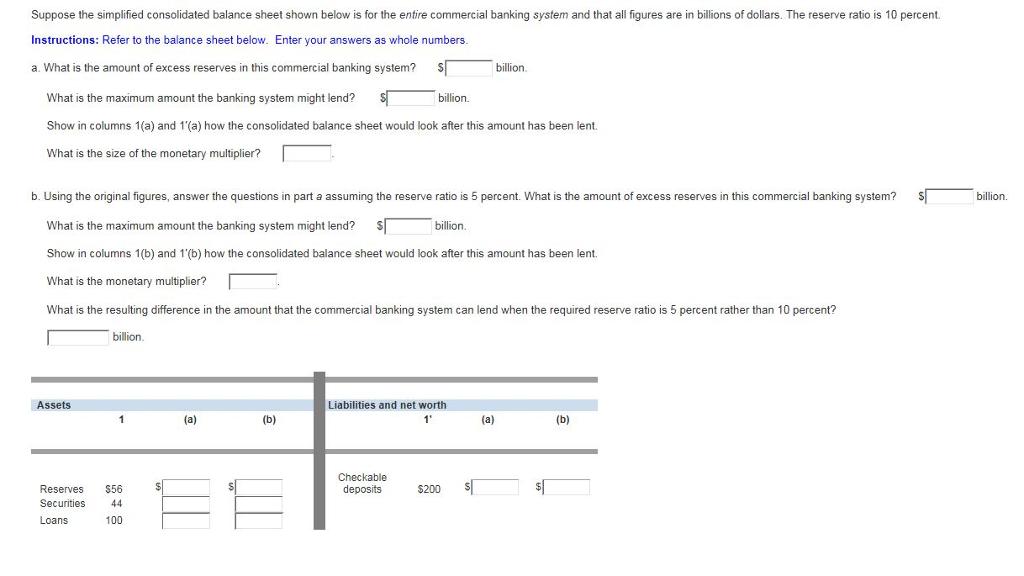

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 10 percent.

Instructions: Refer to the balance sheet below. Enter your answers as whole numbers.

a. What is the amount of excess reserves in this commercial banking system? $ billion.

What is the maximum amount the banking system might lend? $ billion.

Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent.

What is the size of the monetary multiplier? .

b. Using the original figures, answer the questions in part a assuming the reserve ratio is 5 percent. What is the amount of excess reserves in this commercial banking system? $ billion.

What is the maximum amount the banking system might lend? $ billion.

Show in columns 1(b) and 1'(b) how the consolidated balance sheet would look after this amount has been lent.

What is the monetary multiplier? .

What is the resulting difference in the amount that the commercial banking system can lend when the required reserve ratio is 5 percent rather than 10 percent?

billion.

| Assets | Liabilities and net worth | |||||||

| 1 | (a) | (b) | 1' | (a) | (b) | |||

| Reserves | $56 | $ | $ | Checkable deposits | $200 | $ | $ | |

| Securities | 44 | |||||||

| Loans | 100 | |||||||

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 10 percent. Instructions: Refer to the balance sheet below. Enter your answers as whole numbers. a. What is the amount of excess reserves in this commercial banking system? S What is the maximum amount the banking system might lend? Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent. What is the size of the monetary multiplier? Assets b. Using the original figures, answer the questions in part a assuming the reserve ratio is 5 percent. What is the amount f excess reserves in this commercial banking system? S What is the maximum amount the banking system might lend? S billion. Show in columns 1(b) and 1'(b) how the consolidated balance sheet would look after this amount has been lent. What is the monetary multiplier? What is the resulting difference in the amount that the commercial banking system can lend when the required reserve ratio is 5 percent rather than 10 percent? billion. Reserves $56 Securities 44 Loans 100 $ (a) (b) billion. Liabilities and net worth 15 Checkable deposits billion. $200 S (a) (b) billion.

Step by Step Solution

3.62 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a The reserve ratio is given at 25 percent Then the amount of excess reserves is calculated as foll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started