Question

Suppose the spread of a particular bond, S , based on the past 200 trading days is distributed normally with a mean of 0.02% and

Suppose the spread of a particular bond, S, based on the past 200 trading days is distributed normally with a mean of 0.02% and a standard deviation of 0.02%. We define the spread of a bond on a particular day to be S = M T where M is the yield to maturity used by the market on that day and T is the yield to maturity we believe should be used to price the bond

What is the significance of S having a positive mean?

(b) How do you interpret the standard deviation of S?

(c) What is the significance of 2 appearing in the denominator of U?

(d) Suppose today the bonds spread is 0.07%. Is the bond considered cheap or expensive? Suppose tomorrow the spread is -0.01%. Is the bond considered cheap or expensive?

(e) What risks are there in implementing rich-cheap analysis? How are these

overcome in practice in the implementation of the strategy?

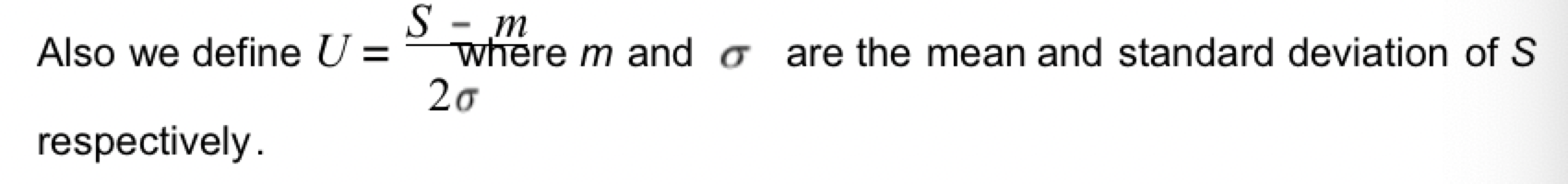

Also we define U = respectively. S m where m and o are the mean and standard deviation of S 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started