Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the SPY index will either go up 10% or down 10% by the end of next week. In addition, you know that the probability

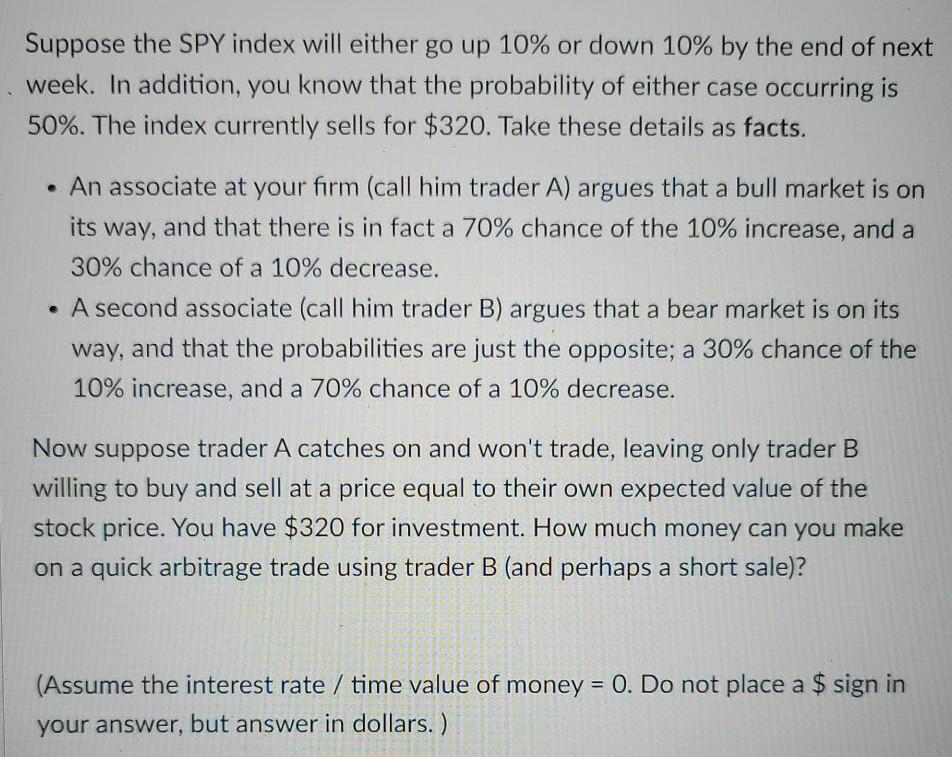

Suppose the SPY index will either go up 10% or down 10% by the end of next week. In addition, you know that the probability of either case occurring is 50%. The index currently sells for $320. Take these details as facts. An associate at your firm (call him trader A) argues that a bull market is on its way, and that there is in fact a 70% chance of the 10% increase, and a 30% chance of a 10% decrease. A second associate (call him trader B) argues that a bear market is on its way, and that the probabilities are just the opposite; a 30% chance of the 10% increase, and a 70% chance of a 10% decrease. Now suppose trader A catches on and won't trade, leaving only trader B willing to buy and sell at a price equal to their own expected value of the stock price. You have $320 for investment. How much money can you make on a quick arbitrage trade using trader B (and perhaps a short sale)? (Assume the interest rate / time value of money = 0. Do not place a $ sign in your answer, but answer in dollars.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started