Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reid Co has 5 million $0.25 ordinary shares and $20 million loan capital. The Board of Directors of Reid Co has decided to reduce

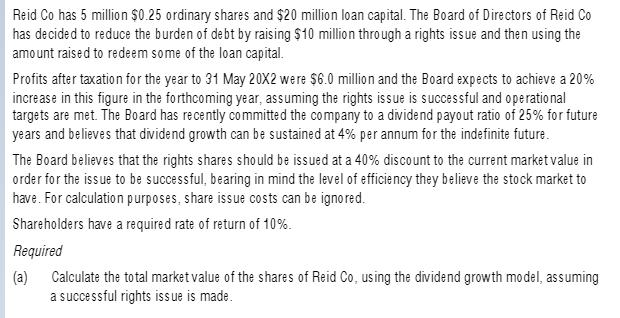

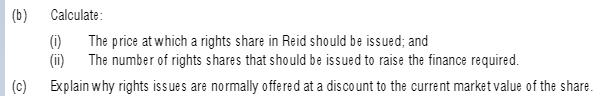

Reid Co has 5 million $0.25 ordinary shares and $20 million loan capital. The Board of Directors of Reid Co has decided to reduce the burden of debt by raising $10 million through a rights issue and then using the amount raised to redeem some of the loan capital. Profits after taxation for the year to 31 May 20X2 were $6.0 million and the Board expects to achieve a 20% increase in this figure in the forthcoming year, assuming the rights issue is successful and operational targets are met. The Board has recently committed the company to a dividend payout ratio of 25% for future years and believes that dividend growth can be sustained at 4% per annum for the indefinite future. The Board believes that the rights shares should be issued at a 40% discount to the current market value in order for the issue to be successful, bearing in mind the level of efficiency they believe the stock market to have. For calculation purposes, share issue costs can be ignored. Shareholders have a required rate of return of 10%. Required (a) Calculate the total market value of the shares of Reid Co, using the dividend growth model, assuming a successful rights issue is made. (b) (c) Calculate: The price at which a rights share in Reid should be issued; and The number of rights shares that should be issued to raise the finance required. Explain why rights issues are normally offered at a discount to the current market value of the share. (0) (ii)

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a P0 D1rg D1 0256 r 10 g 4 P0 22501004 P0 225006 P0 375 3755 1875m bi PV of rights share 10 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d6f7388b67_175590.pdf

180 KBs PDF File

635d6f7388b67_175590.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started