Answered step by step

Verified Expert Solution

Question

1 Approved Answer

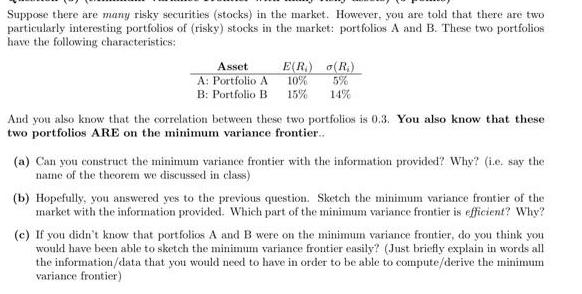

Suppose there are many risky securities (stocks) in the market. However, you are told that there are two particularly interesting portfolios of (risky) stocks

Suppose there are many risky securities (stocks) in the market. However, you are told that there are two particularly interesting portfolios of (risky) stocks in the market: portfolios A and B. These two portfolios have the following characteristics: E(R) (R) 10% 5% Asset A: Portfolio A B: Portfolio B 15% 14% And you also know that the correlation between these two portfolios is 0.3. You also know that these two portfolios ARE on the minimum variance frontier.. (a) Can you construct the minimum variance frontier with the information provided? Why? (i.e. say the name of the theorem we discussed in class) (b) Hopefully, you answered yes to the previous question. Sketch the minimum variance frontier of the market with the information provided. Which part of the minimum variance frontier is efficient? Why? (c) If you didn't know that portfolios A and B were on the minimum variance frontier, do you think you would have been able to sketch the minimum variance frontier easily? (Just briefly explain in words all the information/data that you would need to have in order to be able to compute/derive the minimum variance frontier)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started