Answered step by step

Verified Expert Solution

Question

1 Approved Answer

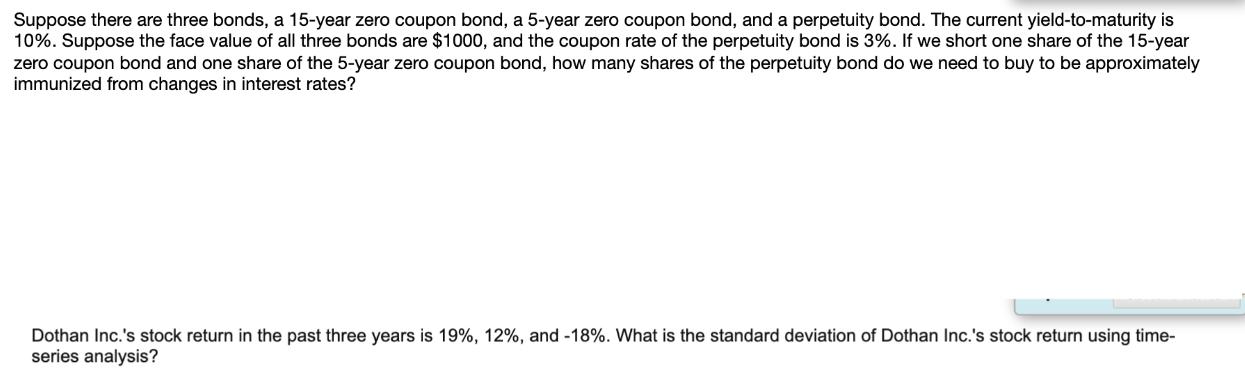

Suppose there are three bonds, a 15-year zero coupon bond, a 5-year zero coupon bond, and a perpetuity bond. The current yield-to-maturity is 10%.

Suppose there are three bonds, a 15-year zero coupon bond, a 5-year zero coupon bond, and a perpetuity bond. The current yield-to-maturity is 10%. Suppose the face value of all three bonds are $1000, and the coupon rate of the perpetuity bond is 3%. If we short one share of the 15-year zero coupon bond and one share of the 5-year zero coupon bond, how many shares of the perpetuity bond do we need to buy to be approximately immunized from changes in interest rates? Dothan Inc.'s stock return in the past three years is 19%, 12%, and -18%. What is the standard deviation of Dothan Inc.'s stock return using time- series analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Immunization in the Zero Coupon Bond Portfolio To achieve immunization in this scenario we need the duration of our short position 15year and 5year zerocoupon bonds to equal the duration of our long p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started