Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there are three possible states of the economy and estimates of the rates of return for Stocks A and B in each state are

Suppose there are three possible states of the economy and estimates of the rates of return for Stocks A and B in each state are given in the table below.

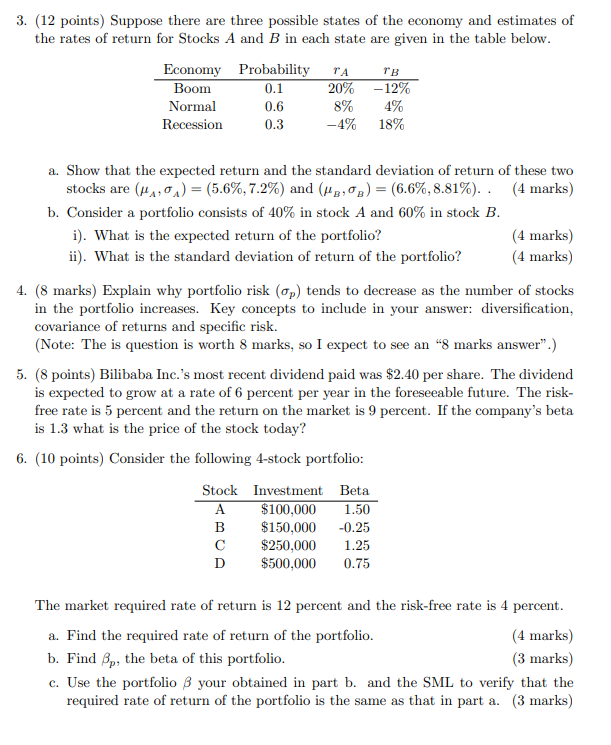

3. (12 points) Suppose there are three possible states of the economy and estimates of the rates of return for Stocks A and B in each state are given in the table below. Economy Boom Normal Recession Probability 0.1 0.6 0.3 TA 20% 8% -4% a. Show that the expected return and the standard deviation of return of these two stocks are (, ) = (5.6%, 7.2%) and (BB) = (6.6%, 8.81%).. (4 marks) b. Consider a portfolio consists of 40% in stock A and 60% in stock B. TB -12% 4% 18% i). What is the expected return of the portfolio? ii). What is the standard deviation of return of the portfolio? D 4. (8 marks) Explain why portfolio risk (op) tends to decrease as the number of stocks in the portfolio increases. Key concepts to include in your answer: diversification, covariance of returns and specific risk. (Note: The is question is worth 8 marks, so I expect to see an "8 marks answer".) Stock Investment Beta A $100,000 1.50 B $150,000 -0.25 $250,000 1.25 $500,000 0.75 (4 marks) (4 marks) 5. (8 points) Bilibaba Inc.'s most recent dividend paid was $2.40 per share. The dividend is expected to grow at a rate of 6 percent per year in the foreseeable future. The risk- free rate is 5 percent and the return on the market is 9 percent. If the company's beta is 1.3 what is the price of the stock today? 6. (10 points) Consider the following 4-stock portfolio: The market required rate of return is 12 percent and the risk-free rate is 4 percent. a. Find the required rate of return of the portfolio. b. Find 3p, the beta of this portfolio. c. Use the portfolio 3 your obtained in part b. and the SML to verify that the required rate of return of the portfolio is the same as that in part a. (3 marks) (4 marks) (3 marks)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

3 12 points a Calculating the expected return and standard deviation of returns for Stocks A and B Stock A Expected return A 01 20 06 8 03 4 56 Standard deviation A 01 20 562 06 8 562 03 4 562 72 Stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started