Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there are two firms, Walmart and Tesla. Both firms have the same cash flows in year 1: $300M if the economy is strong, and

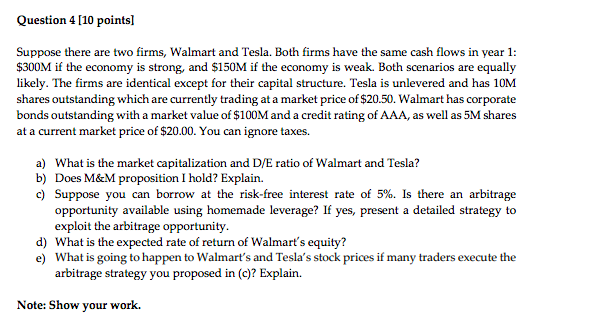

Suppose there are two firms, Walmart and Tesla. Both firms have the same cash flows in year 1: $300M if the economy is strong, and $150M if the economy is weak. Both scenarios are equally likely. The firms are identical except for their capital structure. Tesla is unlevered and has 10M shares outstanding which are currently trading at a market price of $20.50. Walmart has corporate bonds outstanding with a market value of $100M and a credit rating of AAA, as well as 5M shares at a current market price of $20.00. You can ignore taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started