Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there is a monopoly firm operating in the Home market in the no-trade situation. When Home opens up to trade, many foreign firms

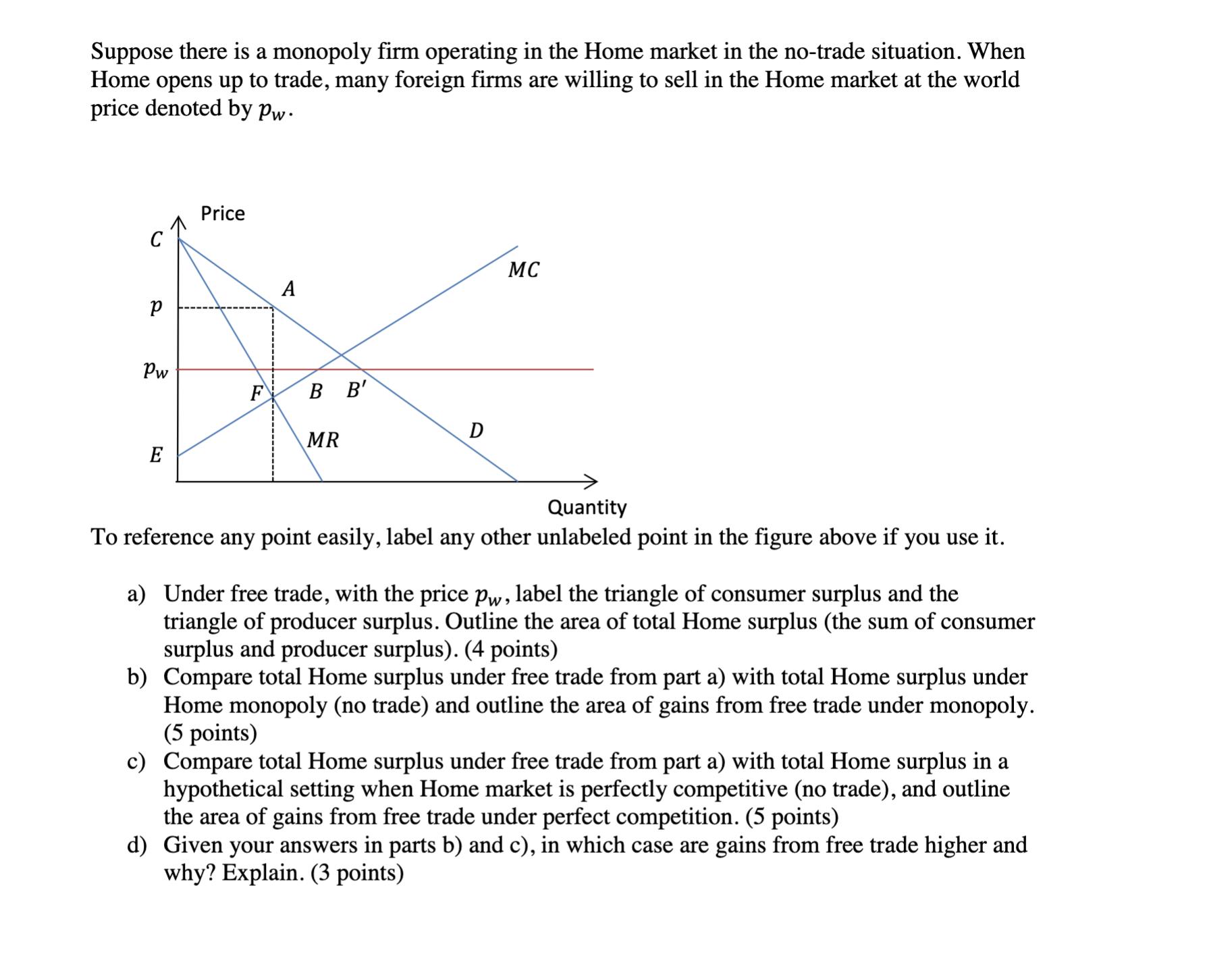

Suppose there is a monopoly firm operating in the Home market in the no-trade situation. When Home opens up to trade, many foreign firms are willing to sell in the Home market at the world price denoted by pw. Price MC A P Pw F B B' D MR E Quantity To reference any point easily, label any other unlabeled point in the figure above if you use it. a) Under free trade, with the price pw, label the triangle of consumer surplus and the triangle of producer surplus. Outline the area of total Home surplus (the sum of consumer surplus and producer surplus). (4 points) b) Compare total Home surplus under free trade from part a) with total Home surplus under Home monopoly (no trade) and outline the area of gains from free trade under monopoly. (5 points) c) Compare total Home surplus under free trade from part a) with total Home surplus in a hypothetical setting when Home market is perfectly competitive (no trade), and outline the area of gains from free trade under perfect competition. (5 points) d) Given your answers in parts b) and c), in which case are gains from free trade higher and why? Explain. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started