Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there is a U.S.-based firm that will produce 100 widgets at T = 0.5 (6 months). They can either sell the widgets in

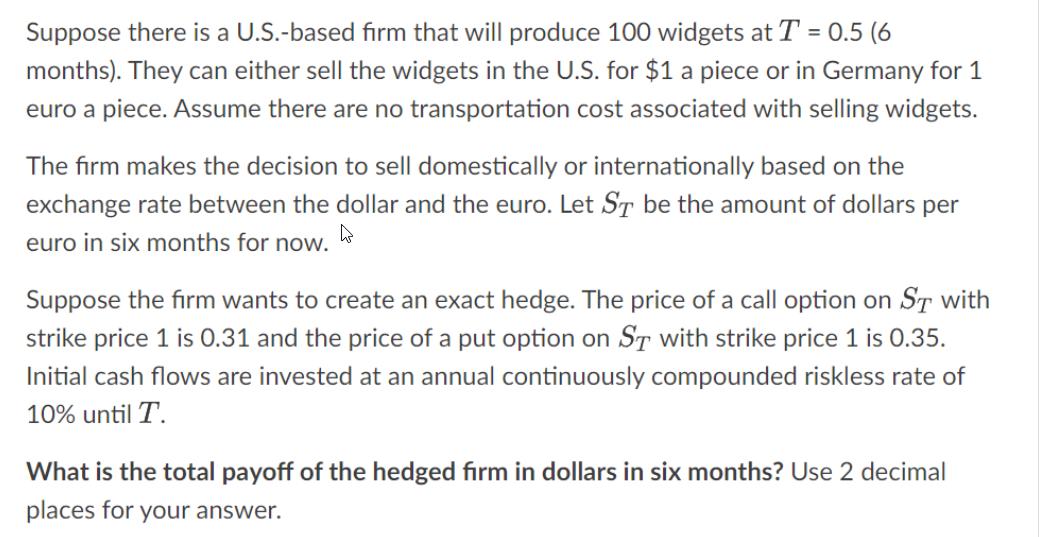

Suppose there is a U.S.-based firm that will produce 100 widgets at T = 0.5 (6 months). They can either sell the widgets in the U.S. for $1 a piece or in Germany for 1 euro a piece. Assume there are no transportation cost associated with selling widgets. The firm makes the decision to sell domestically or internationally based on the exchange rate between the dollar and the euro. Let ST be the amount of dollars per euro in six months for now. Suppose the firm wants to create an exact hedge. The price of a call option on ST with strike price 1 is 0.31 and the price of a put option on ST with strike price 1 is 0.35. Initial cash flows are invested at an annual continuously compounded riskless rate of 10% until T. What is the total payoff of the hedged firm in dollars in six months? Use 2 decimal places for your answer.

Step by Step Solution

★★★★★

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To create an exact hedge the firm will use a combination of call and put options on the exchange rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started