Question

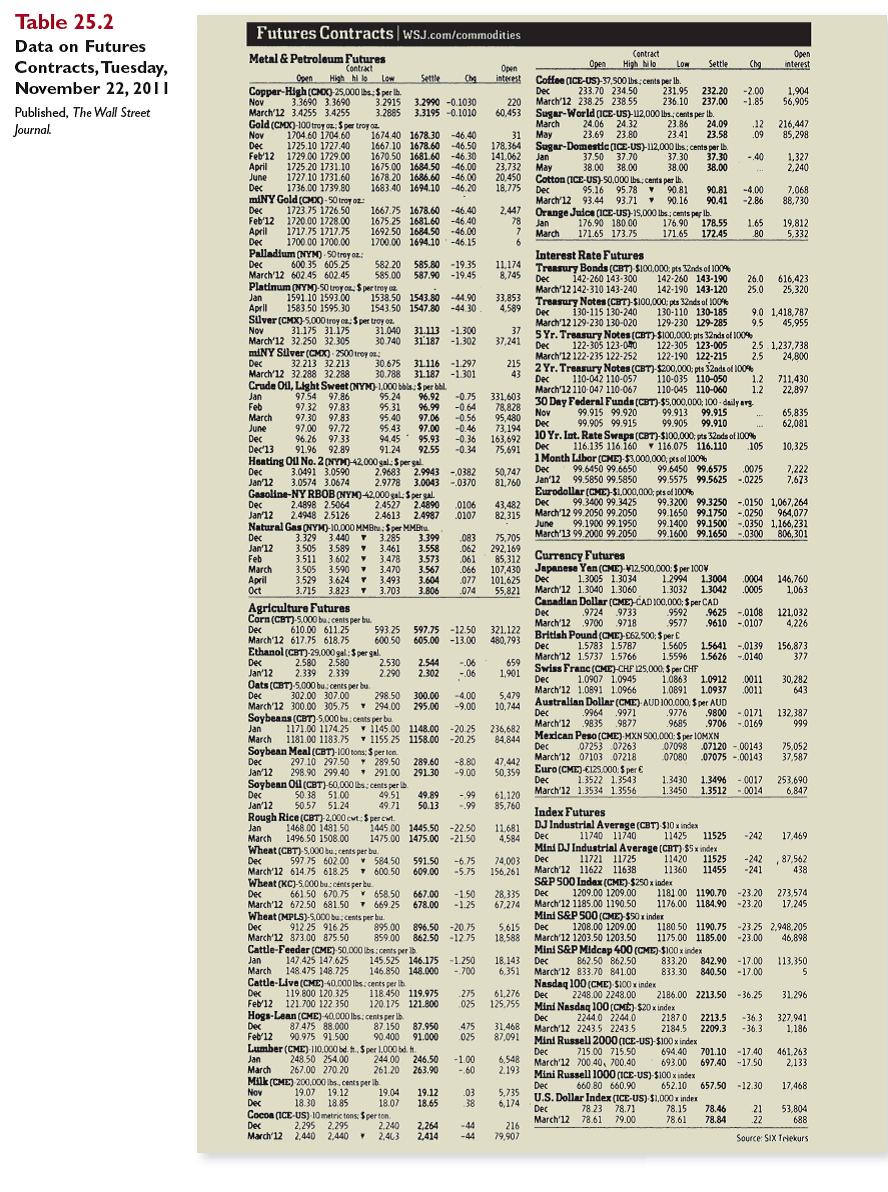

Refer to Table 25.2 in the text to answer this question. Suppose today is November 22, 2011, and your firm produces breakfast cereal and needs

Refer to Table 25.2 in the text to answer this question. Suppose today is November 22, 2011, and your firm produces breakfast cereal and needs 135,000 bushels of corn in March 2012 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and March.

a. How could you use corn futures contracts to hedge your risk exposure? What price would you effectively be locking in based on the closing price of the day?

b. Suppose corn prices are $6.13 per bushel in March. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the corn market.

Corn (CBT)-5.000 bu. cents per bu. Mini Nasdag l100 (CHE) $20 x 10 Table 25.2 Futures Contracts wsJ.com/commodities Data on Futures Metal & Petroleum Futures Contract Contract High Nlo Open interest Contracts, Tuesday, November 22, 2011 Open Low Settle Chg Open intecest Open High i lo Low Copper-High (CMOX)-25,000 bs:S per lb. 3.3690 33690 March'12 3.4255 3.4255 Gold (CMX)-100 troy on. S per troy oz 1704.60 i704.60 1725.10 1727.40 Feb'12 1729.00 1729.00 1725.20 1731.10 1727.10 1731.60 1736.00 1739.80 MINY Gold (CHO0-50 troy oz: 1723.75 1726.50 Feb'12 1720.00 1728.00 1717.75 1717.75 1700.00 1700.00 Palladlum OYM) - S0 trey oz.: Dec 600 35 605.25 March'12 602.45 602.45 Platinum (NYM)-50 troy on. S per trey a 1591.10 1593.00 1583.50 1595.30 Slver (CMX)-5.000 troy on. S per troy oz 31.175 31.175 March'12 32.250 32.305 miNY Slver (CX) 2500 troy on: 32.213 32.213 March'12 32.288 32.288 Crude Oil, Light Sweet (NYM) 1000 bals, S per bal. 9754 97.86 97.32 97.83 97.30 97.83 97.00 97.72 96.26 97.33 91.96 92.89 Heating Ol No. 2 (NYM)-42.000 sal. S per gal 3.0491 3.0590 3.0574 3.0674 Gasoline-NY RBOB NYM)-42.000 gal. S per gal. 2.4898 2.5064 2.4948 2.5126 Natural Gas (NYM)-10.000 MMBtu: Sper MMBtu Settle Chg Coffee (ICE-US)-37,500 lbs cents per Ib. 233.70 234.50 Dec Nov 3 2915 3.2990 -0.1030 3.2885 220 March'12 238.25 238.55 60,453 231.95 236.10 232.20 237.00 -2.00 -1.85 1,904 56,905 Published, The Wall Street 3.3195 -0.1010 Sugar-World (CE-US)-112,000 lbs., cents per lb. 24.06 24.32 23.69 23.80 Sugar-Domestic (ICE-US)-112,000 lbs; cents per lb. 37.50 37.70 38.00 38.00 Cotton (ICE-US) 50,000 lbs, centa per lh. 95.16 95.78 v 90.81 Journal. March May 23.86 24.09 .12 .09 216,447 85,298 1674.40 1678.30 -46.40 1667.10 1678.60 -46.50 1670.50 1681.60 -46.30 1675.00 1684.50 46.00 1678.20 1686.60 -46.00 1683.40 1694.10 -46.20 23.58 Nov Dec 31 178.364 141,062 23,732 20,450 18,775 23.41 1,327 2,240 - 40 Jan May 37.30 37.30 38.00 April June Dec 38.00 7,068 88,730 Dec 90.81 90.41 . 176.90 178.55 172.45 -4.00 -2.86 March'12 93.44 93.71 Orange Juice (ICE-US) 15,000 lbs; cents per lb. 176.90 180 00 171.65 173.75 90.16 Dec 1667.75 1678.60 -46.40 1675.25 1681.60 -46.40 1692.50 1684.50 -46.00 1700.00 1694.10 -46.15 2,447 78 Jan April Dec 1.65 80 19,812 5.332 7. March 171.65 Interest Rate Futures 582.20 585.80 -19.35 585.00 11,174 8,745 Treasury Bonds (CBT) $100.000; pts 32nds of 100 Dec 142-260 143-300 142-260 143-190 142-190 143-120 Treasury Notes (CBT)-SI00,000: pts 32nds ol 100% 130-110 130-185 129-230 129-285 SYr. Treasury Notes (CBT) SI00,000: pts 32nds of 100 122-305 123-005 122-190 122-215 2 Yr. Treasury Notes (CBT) $200,000; pts 32ods of 100% 110-035 110-050 110-045 110-060 30 Day Federal Funds (CBT) $5,000,000; 100 - daily avg 99.913 99.915 587.90 -19.45 26.0 616,423 25,320 March'12 142-310 143-240 25.0 Jan 1538.50 1543.80 -44.90 33,853 4.589 April 1543.50 1547.80 -44.30. Dec March'12 129-230 130-020 130-115 130-240 9.0 1,418,787 9.5 45,955 Nov 31.040 30 740 31.113 -1.300 31.187 -1.302 37 37,241 Dec March'12 122-235 122-252 122-305 123-040 2.5 1,237,738 2.5 24,800 30.675 30.788 31.187 -1301 Dec 31116 -1297 215 43 Dec 110-042 110-057 1.2 1.2 711,430 22,897 March'12 110-047 110-067 95.24 95.31 95.40 331,603 78,828 95,480 73,194 163,692 75,691 Jan 96.92 96.99 97.06 97.00 94.45 95.93 92.55 -0.75 -0.64 -0.56 Feb March June Dec Dec'13 Nov Dec 99.915 99.920 99.905 99.915 65,835 62,081 99.905 99.910 95.43 -0.46 -0.36 -0.34 10 Yr. Int. Rate Swaps (CBT)-$I00,000; pts 32ods of 100% 105 116.135 116.160 v 116.075 i16.110 1 Month Libor (CHE) $3,000,000, prs of 100% 99.6450 99.6575 91.24 Dec 10,325 Dec Jan'12 99.5850 99.5850 Eurodollar (CME)-S1.000,000; pes of 100 Dec March'12 99.2050 99.2050 June March'13 99.2000 99.2050 99.6450 99.6650 Dec Jan'12 2.9683 2.9943 -0382 2.9778 50,747 81,760 0075 99.5575 99.5625 -.0225 7,222 7,673 3.0043 -0370 99.3200 99.3250 -.0150 1,067,264 99.1650 99.1750 -0250 964,077 99.1400 99.1500 -.0350 1,166,231 99.1600 99.1650 -.0300 99.3400 99.3425 Dec Jan'12 2.4527 2.4890 2.4613 2.4987 0107 0106 43,482 82,315 99.1900 99.1950 806, 301 Dec Jan'12 Feb March April Oct 3.329 3.440 3.285 3.461 3.511 3602 v 3.478 3.505 3.590 3.470 3.529 3.624 3.493 3.703 3.399 3.558 3.573 3.567 083 062 061 066 75,705 292,169 85,312 Currency Futures 107,430 101.625 55,821 3.505 3.589 Japanese Yen (CME) VIZ500.000: $ per 10ov Dec 1.3005 1.3034 March'12 1.3040 1.3060 Canadlan Dollar (CME) CAD 100,000; S per CAD Dec March'12 9700 9718 British Pound (CME)-E62,500; $ per E 3.604 3.806 077 074 1.2994 1.3004 1.3032 1.3042 .0004 .0005 146,760 1,063 3.715 3.823 Agriculture Futures Corn (CBT)-5.000 bu.cents per bu. 9592 9577 .9724 9733 .9625 -.0108 .9610 -0107 121,032 4,226 321.122 480, 793 Dec 593.25 600.50 597.75 -12.50 605.00 -13.00 March'12 617.75 618.75 Ethanol (CBT)-29.000 gal: S per gal. 2.580 2.580 2.339 2.339 Oats (CBT)-5.000 bu: cents per bu Dec 302.00 307.00 March'12 300.00 305.75 * 294.00 295.00 Soybeans (CBT)5000 bu: cents per bu Jan 1171.00 1174.25 Dec 1.5783 1.5787 1.560S 1.5596 1.5626 -.0140 1.5641 -.0139 156,873 377 March'12 1.5737 1.5766 659 Swiss Franc (CME)-CHF 125,000, $ per CHF Dec Dec 2.530 2.290 2.544 2.302 -.06 -06 Jan'12 1,901 1.0907 1.0945 1.0863 1.0912 .0011 .0011 30,282 643 March'12 1.0891 1.0966 1.0891 1.0937 298.50 300.00 -4.00 -9.00 5,479 10,744 Australian Dollar (CME) AUD100.000, $ per AUD Dec 9964 9971 March'12 .9776 9685 9800 - 0171 .9706 -.0169 132,387 999 .9835 9877 * 1145.00 1148.00 -20.25 1181.00 1183.75 1155.25 1158.00 -20.25 236,682 84,844 Mexican Peso (CME) MXN S00.000: $ per 1OMXN Dec March 07098 07120 - 00143 07080 07253 07263 Soybean Meal (CBT)-I00 tons: S per len. 75,052 37,587 March'12 07103 07218 07075 -00143 Dec Jan'12 297.10 297.50 289.50 289.60 298.90 299.40 291.00 291.30 -8.80 -9.00 47,442 50,359 Euro (CME) 125.000. S per Dec Soybean Oil (CBT)-60,000 bs; cents per ib. 50 38 51.00 1.3522 1.3543 1.3430 1.3450 1.3496 - 0017 1.3512 - 0014 253,690 6,847 March'12 1.3534 1.3556 Dec Jan'12 49.51 49.71 49.89 50.13 - 99 -99 61.120 35,760 50.57 51.24 Index Futures DJ Industrial Average (CBT) $10 x index Dec Mini DJ Industrial Average (CBT) $5x index Dec March'12 11622 11638 S&P 500 Indax (CME)-$250 x index Rough Rice (CBT) 2,000 cvt: S per cwt. 1468.00 1431 50 1445 00 1445.50 -22.50 1475.00 1475.00 -21.50 Jan 11.681 4.584 11740 11740 11425 11525 -242 17,469 March 1496.50 1508.00 Wheat (CBT) S.000 ba, cents per bu Dec 597 75 602.00 584.50 March'12 614.75 618.25 600.50 609.00 Wheat (KC)-S.000 bu: cents per bu 661 50 670.75 658.50 March'12 672.50 681.50 669.25 Wheat (MPLS)-S000 bu: cents per bu 912 25 916 25 March'12 873.00 875.50 Cattle-Feeder (CME) 50.000 bs:cents per 147.425 147,625 148.475 148.725 Cattle-Live (CME)-40.000 lbs.certs per ib 119 800 i20.325 Feb'12 121.700 122 350 Hogs-Lean (CME) 40.000 lbs: cents per ib 87 475 88.000 90.975 91.500 Lumber (CME) 110,000 bd . Sper LO00 bd. . 248.50 254.00 267.00 270.20 Milk (CME) 200.000 lbs. cents per ib 19.07 19.12 18.30 11721 11725 11420 11525 -242 -241 87,562 438 591.50 -6.75 74,003 156.261 -5.75 11360 11455 1209.00 1209.00 -23.20 273,574 17.245 Dec 1181.00 1190.70 1176.00 1184.90 -23.20 Dec 667.00 678.00 -150 -1.25 28,335 67,274 March'12 1185.00 1190.50 Mini S&P S00 (CME) $50 x inder 1208.00 1209.00 March'12 1203.50 1203.50 896.50 -20.75 862.50 -12.75 Dec 895.00 859.00 5.615 Dec 18.588 18,588 1180.50 1190.75 -23.25 2,948,205 1175.00 1185.00 -23.00 46,898 Mini S&P Midcap 400 (CME) $100x index b 145.525 146.175 -1.250 146.850 148.000 862.50 862.50 Jan March 18.143 833.20 842.90 - 17.00 833.30 840.50 -17.00 Dec 113,350 - 700 6,351 March'12 833.70 841.00 Nasdag 100 (CME) SI00 x index 2248.00 2248.00 Mini Nasdaq 100 (CME) $20 x index 2244.0 2244.0 March'12 2243.5 2243.5 87,091 Mini Russell 2000 (ICE-US) S100 x index 118.450 119.975 120.175 121.800 Dec 275 025 61,276 125.755 31.296 Dec 2186.00 2213.50 -36.25 -36.3 -36.3 Dec 2187 0 2213.5 Dec 87.150 87.950 90 400 91.000 475 025 327,941 1,186 31,468 2184.5 2209.3 Feb'12 Dec 715.00 715.50 694.40 701.10 -17.40 Jan March 244.00 246.50 261.20 263.90 -100 - 60 461.263 2,133 6,548 2.193 March'12 700 40, 700.40 693.00 697.40 -17 50 Mini Russell 1000 (ICE-US)-$100 x index 660 80 660.90 U.S. Dollar Index (ICE-US) $1.000 x index 78.23 78.71 Dec 652.10 657.50 -12.30 17,468 Nov Dec 19.04 18.07 19.12 18.65 5,735 6,174 .03 18.85 Cocoa (ICE-US) 10 metric tons Sperton. 2,295 2.295 March'12 2,440 2,440 38 78.15 78.61 78.46 78.84 Dec 21 22 53,804 688 March'12 78.61 79.00 Dec 2.240 2,264 2,414 -44 -44 216 79,907 2,403 Source: SIX Teiekurs

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Hedging with futures Hedging is an investment strateg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started