Answered step by step

Verified Expert Solution

Question

1 Approved Answer

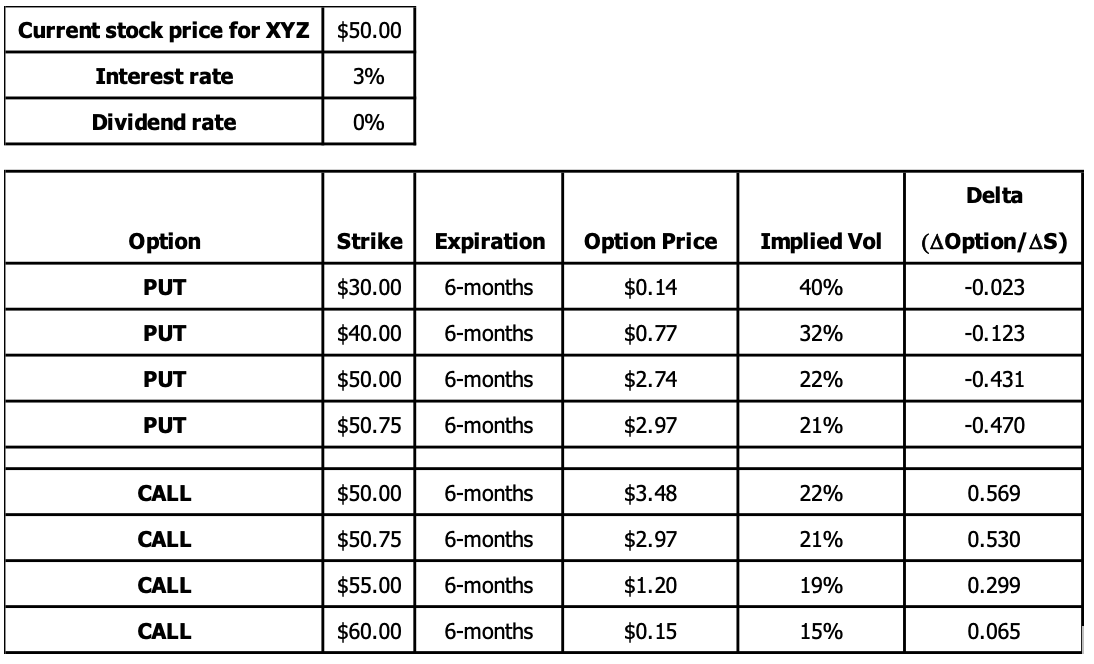

] Suppose today you bought the $40-strike put and the $60-strike call. This would cost you $0.77 + $0.15 = $0.92. Please draw a graph

] Suppose today you bought the $40-strike put and the $60-strike call. This would cost you

$0.77 + $0.15 = $0.92.

Please draw a graph that shows the value of this combined position at the expiration date. The x-axis will be S(T), the value of the stock at expiration; the y-axis will be the value of the position (put and call). Note that a graph of the profit/loss would be the same except that it would be shifted down by $0.92.

Current stock price for XYZ $50.00 Interest rate 3% Dividend rate 0% Delta Option Strike Expiration Option Price Implied Vol (4Option/AS) PUT $30.00 6-months $0.14 40% -0.023 PUT $40.00 6-months $0.77 32% -0.123 PUT $50.00 6-months $2.74 22% -0.431 PUT $50.75 6-months $2.97 21% -0.470 CALL $50.00 6-months $3.48 22% 0.569 CALL $50.75 6-months $2.97 21% 0.530 CALL $55.00 6-months $1.20 19% 0.299 CALL $60.00 6-months $0.15 15% 0.065Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started