Question

Suppose two investments yield the same fixed return as measured in dollars, say, $100. But the dollar return to one security has certainty (such as

Suppose two investments yield the same fixed return as measured in dollars, say, $100. But the dollar return to one security has certainty (such as a US Treasury obligation) and the return to the other is uncertain (such as a junk bond which may default). And further suppose that, for the moment, the price of each security is $1,000 and the percentage annual return of each is therefore 10%. This situation cannot persist as investors buy and sell these bonds in response to the perceived risk differences between the two investments. What would be a possible equilibrium price and return for each security? Note that you don't need to make any calculations to solve this. It is a conceptual problem - in which direction should the price and yield move for each security given their differences in risk? In other words, which of the answers below are a possible equilibrium outcome for this situation - remembering our discussion on the relationship between Bond prices and yield?

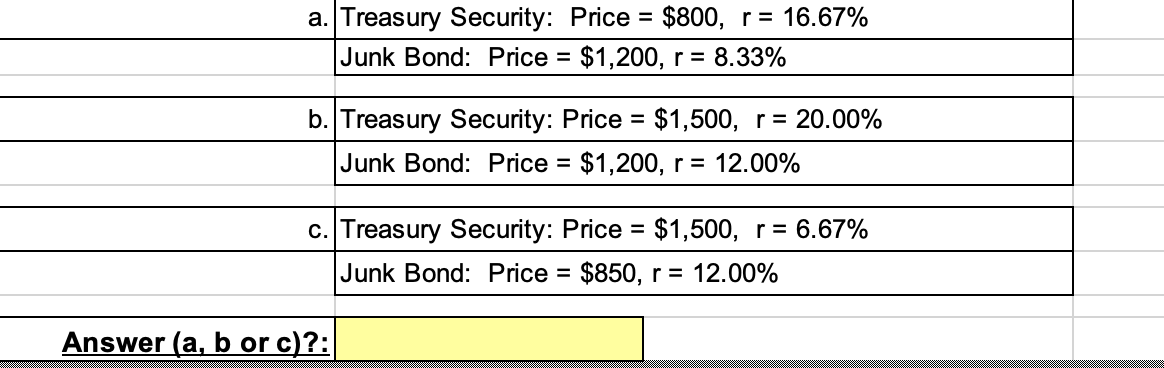

a. Treasury Security: Price =$800,r=16.67% Junk Bond: Price =$1,200,r=8.33% b. Treasury Security: Price =$1,500,r=20.00% Junk Bond: Price =$1,200,r=12.00% c. Treasury Security: Price =$1,500,r=6.67% Junk Bond: Price =$850,r=12.00% Answer ( a,b or c)

a. Treasury Security: Price =$800,r=16.67% Junk Bond: Price =$1,200,r=8.33% b. Treasury Security: Price =$1,500,r=20.00% Junk Bond: Price =$1,200,r=12.00% c. Treasury Security: Price =$1,500,r=6.67% Junk Bond: Price =$850,r=12.00% Answer ( a,b or c) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started