Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose Wealthy Construction is considering another smaller scale project that has an initial cost of RM10,000. The project has a two-year life with cash inflows

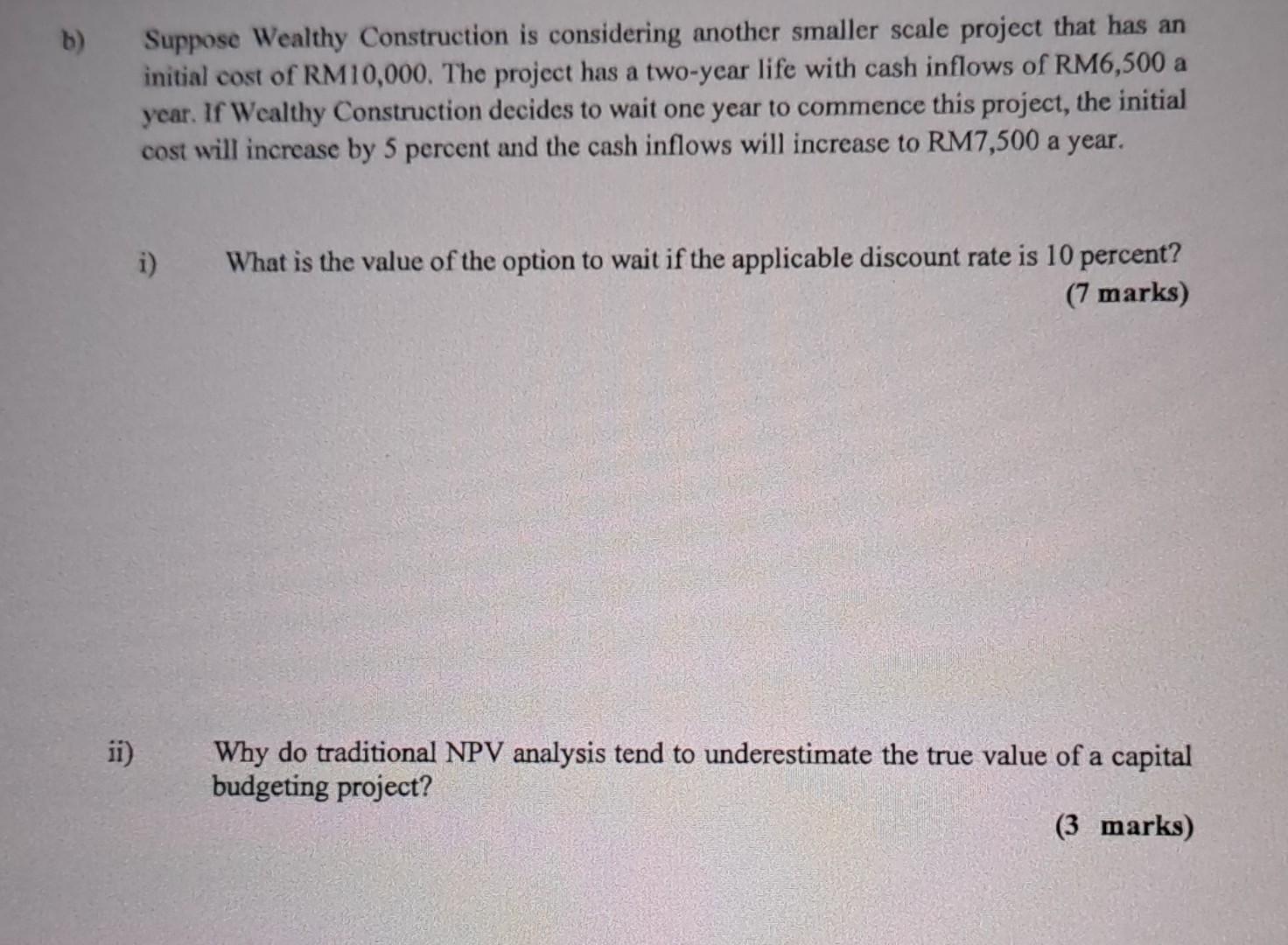

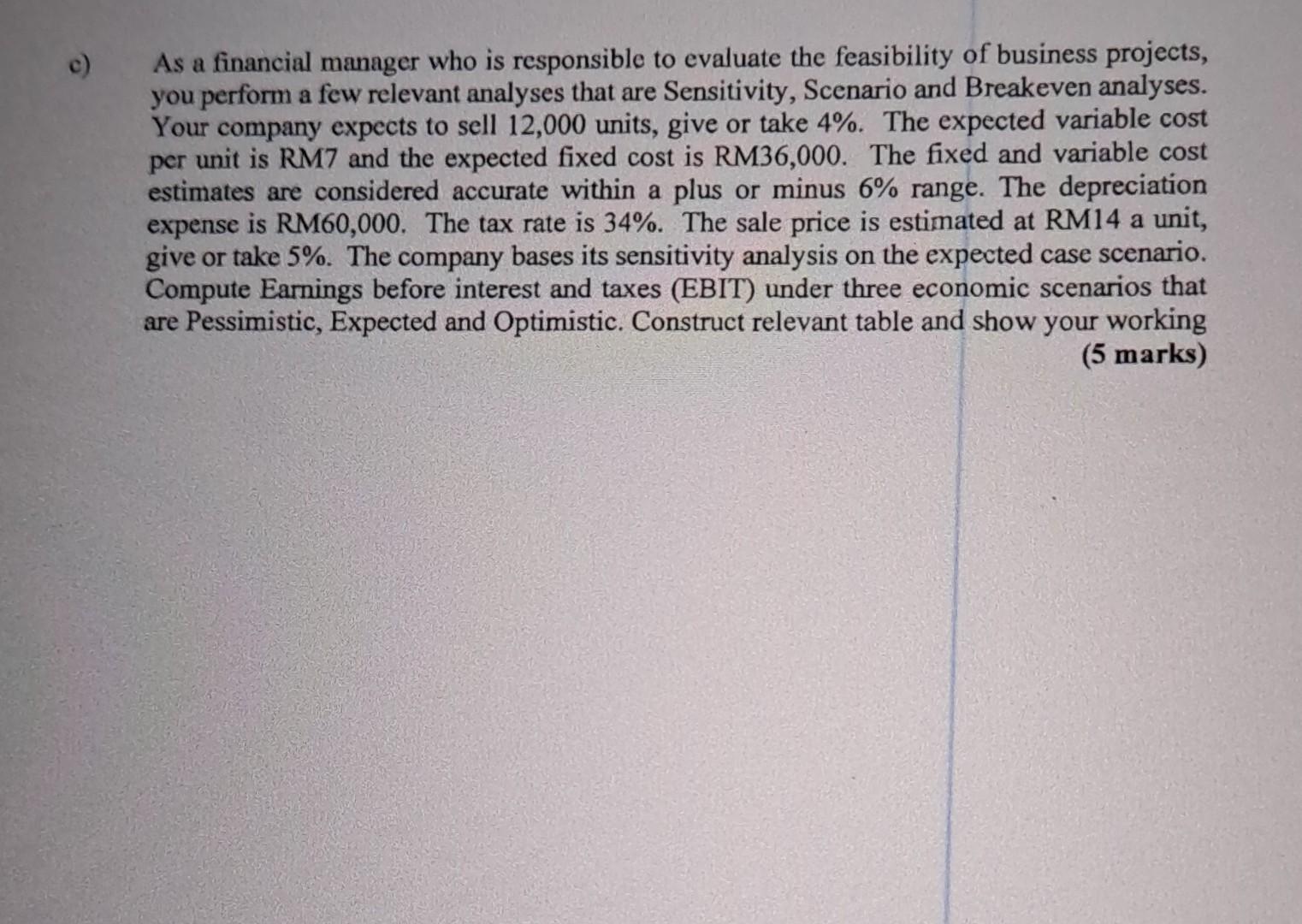

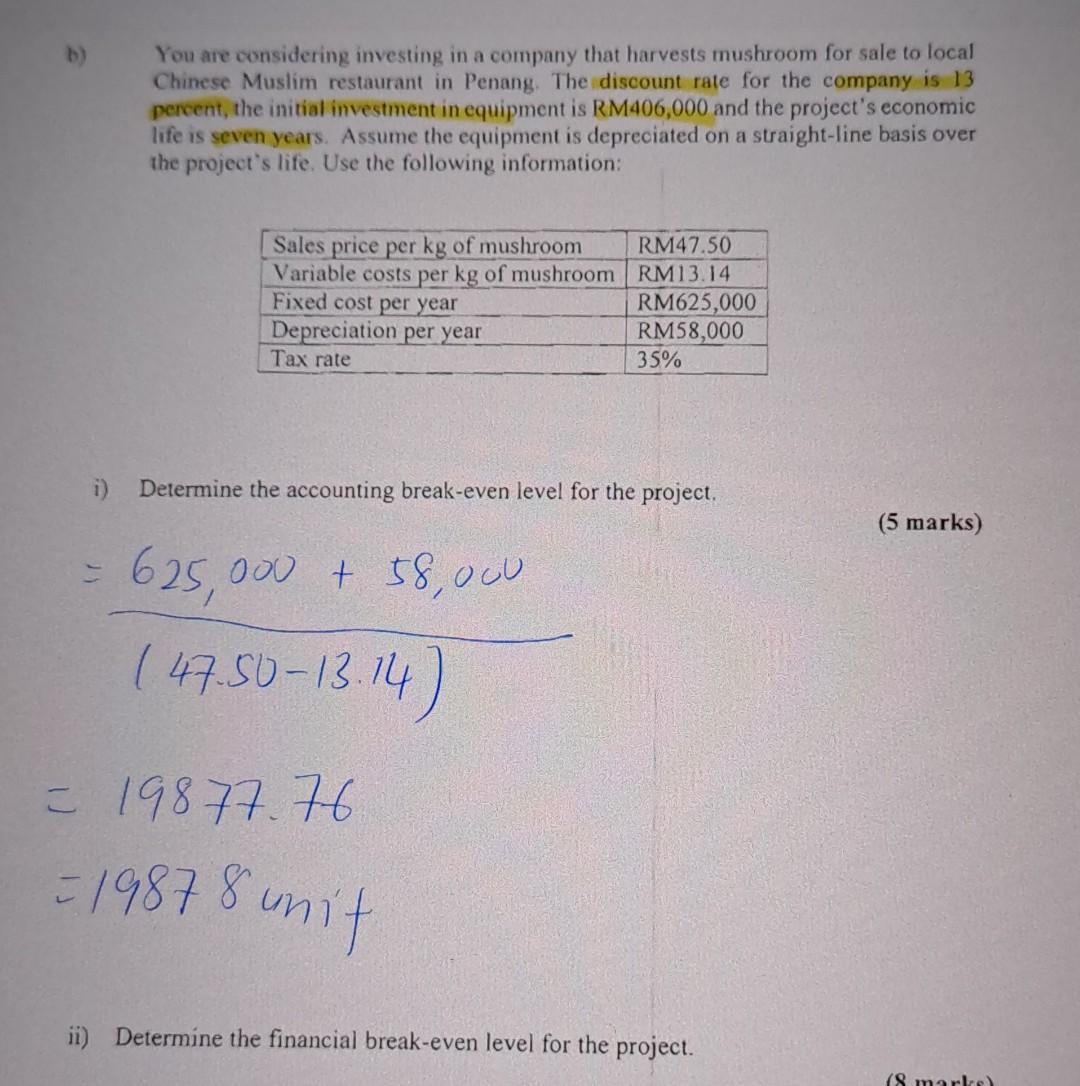

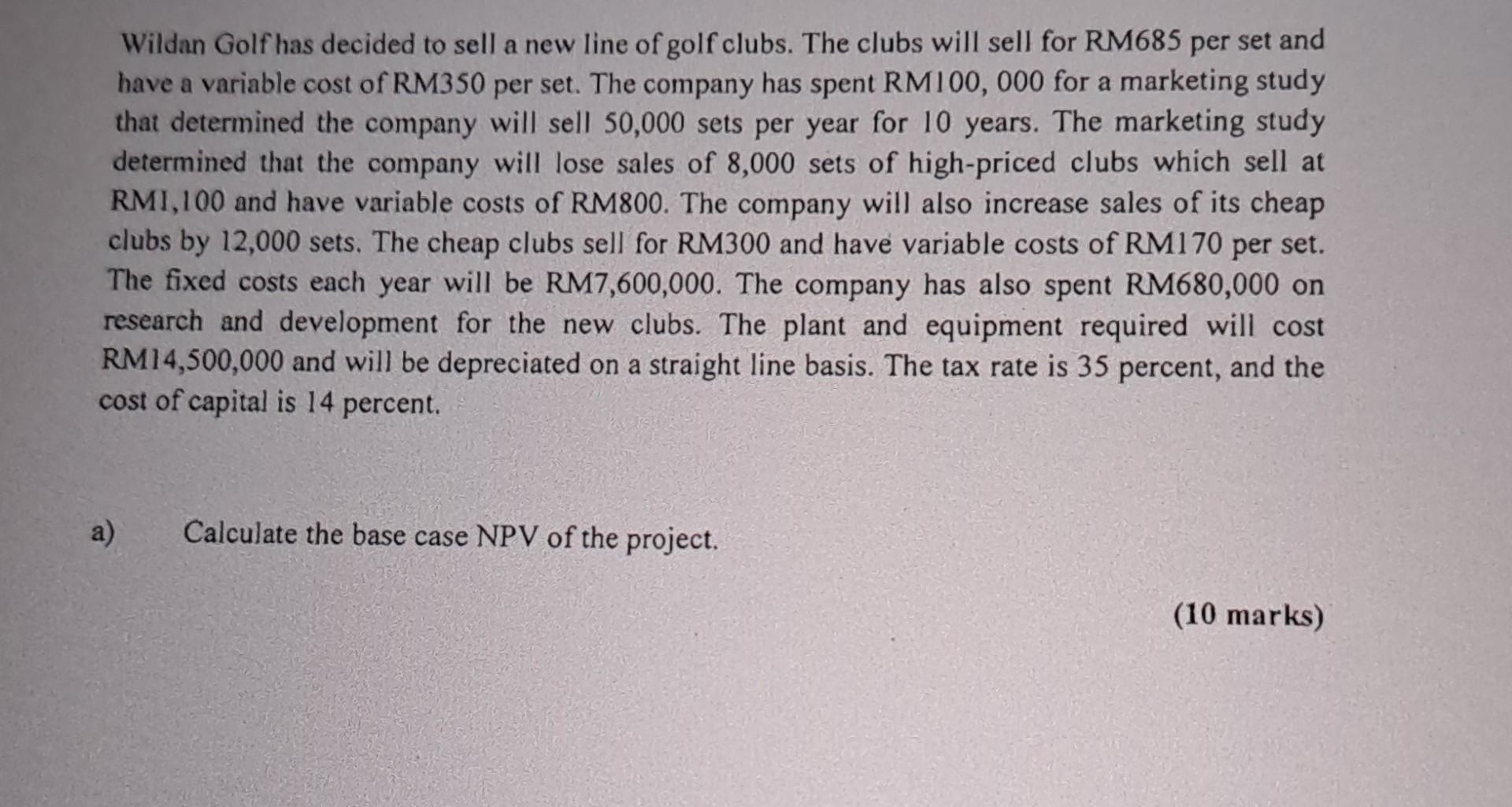

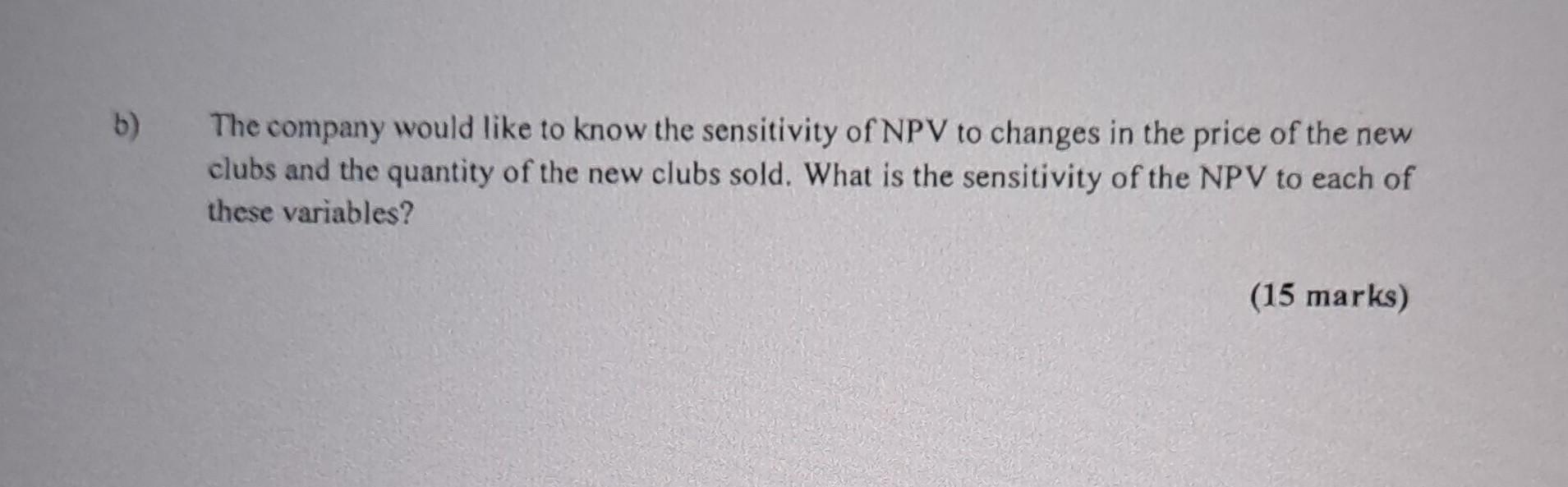

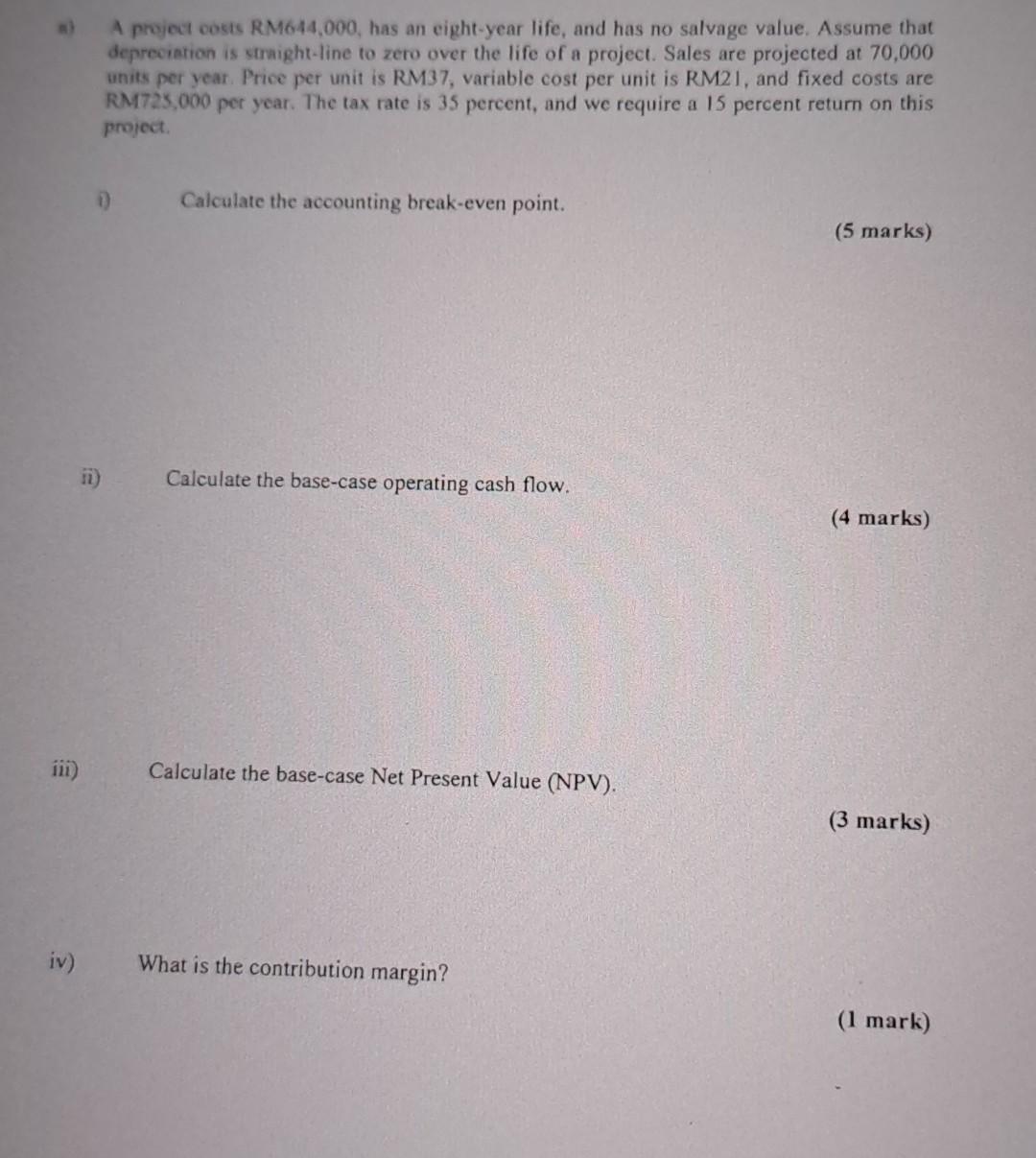

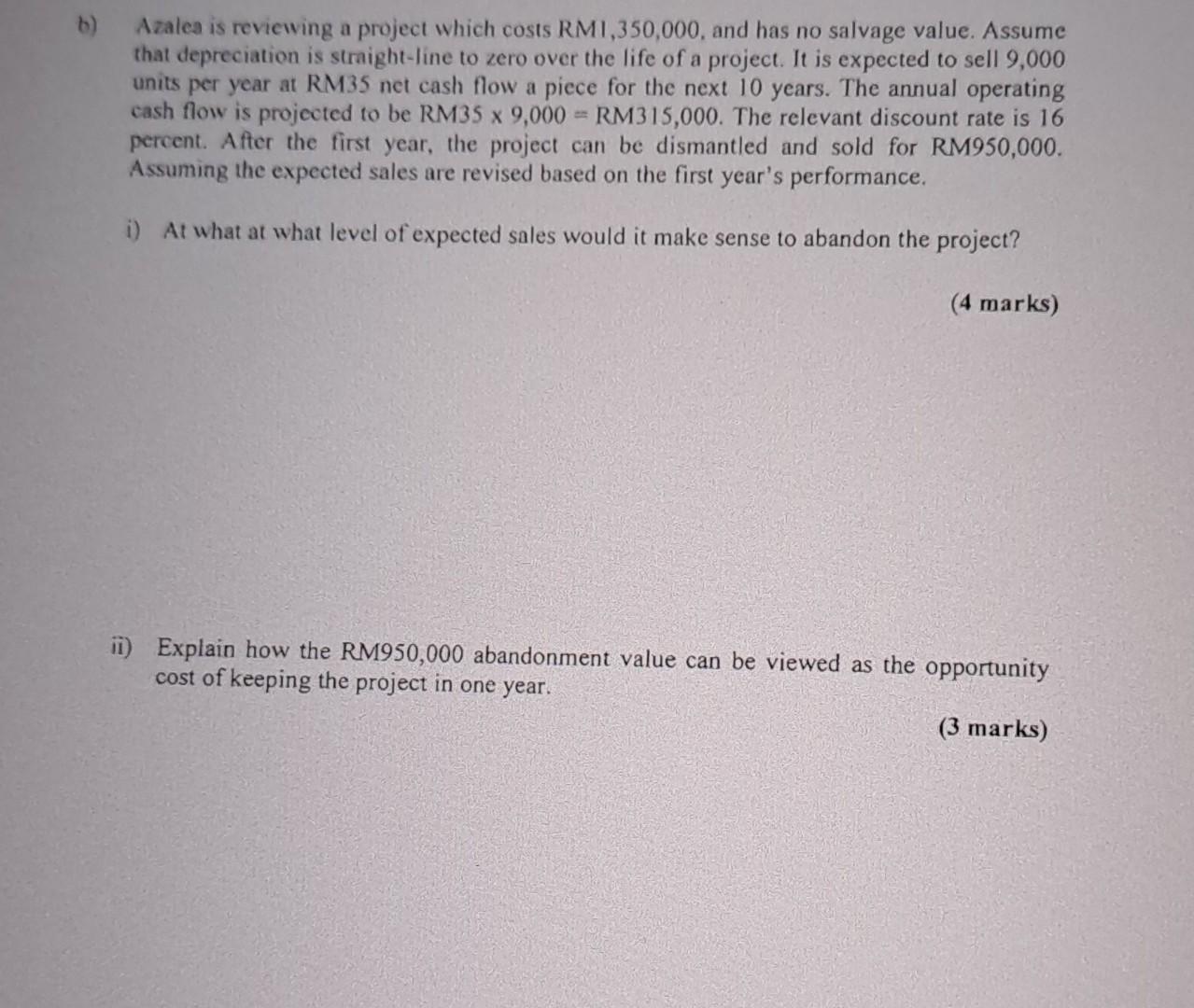

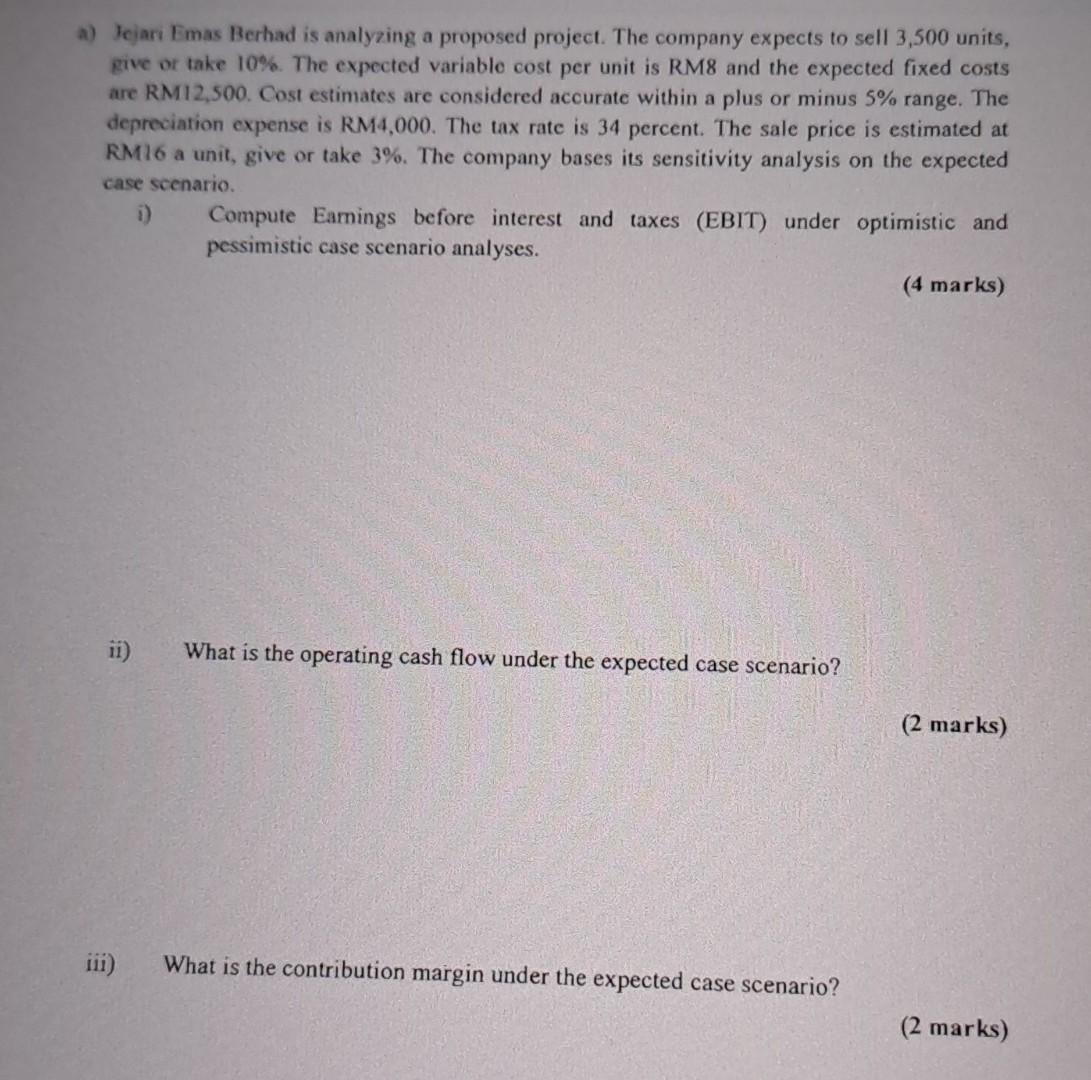

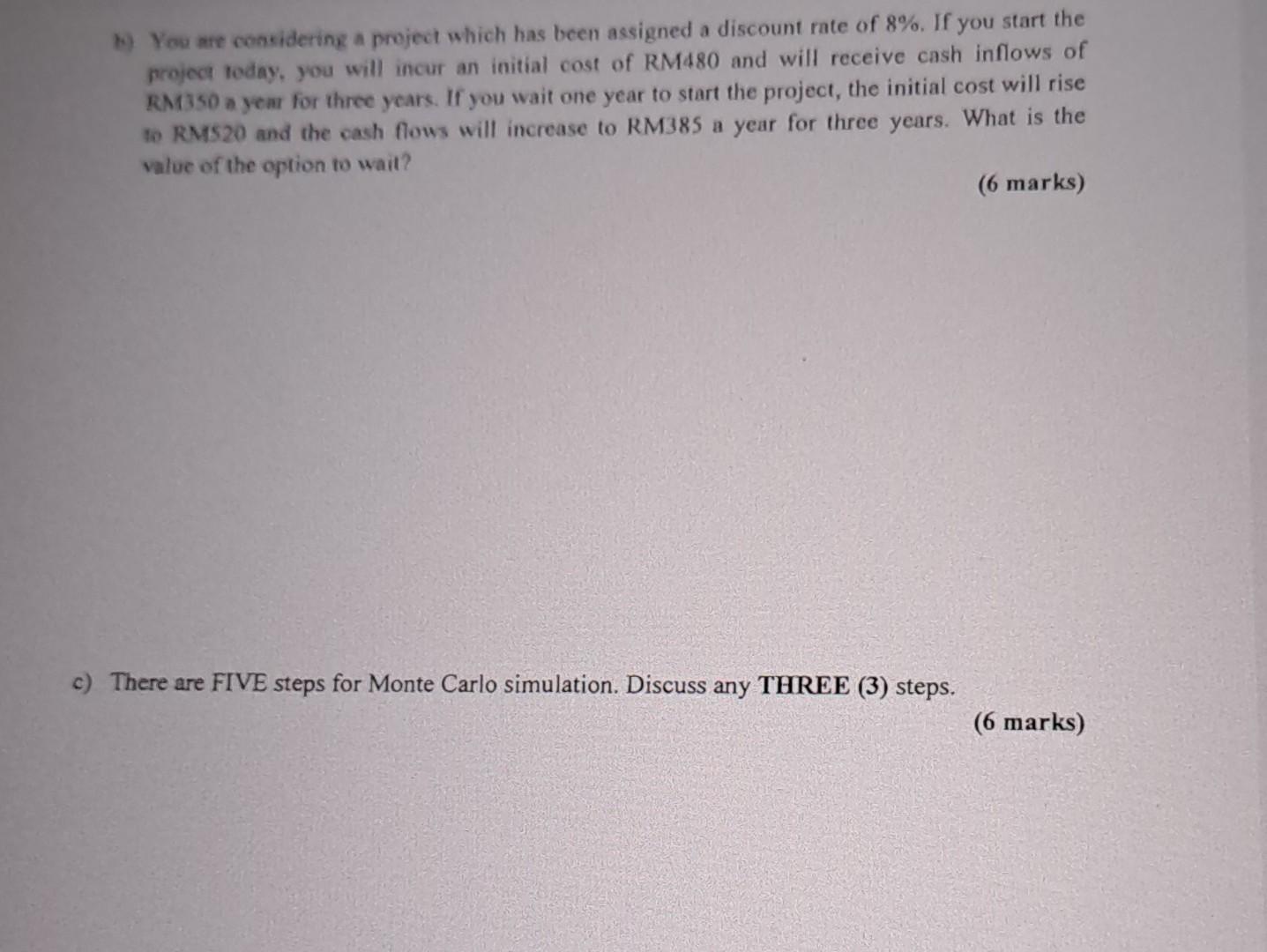

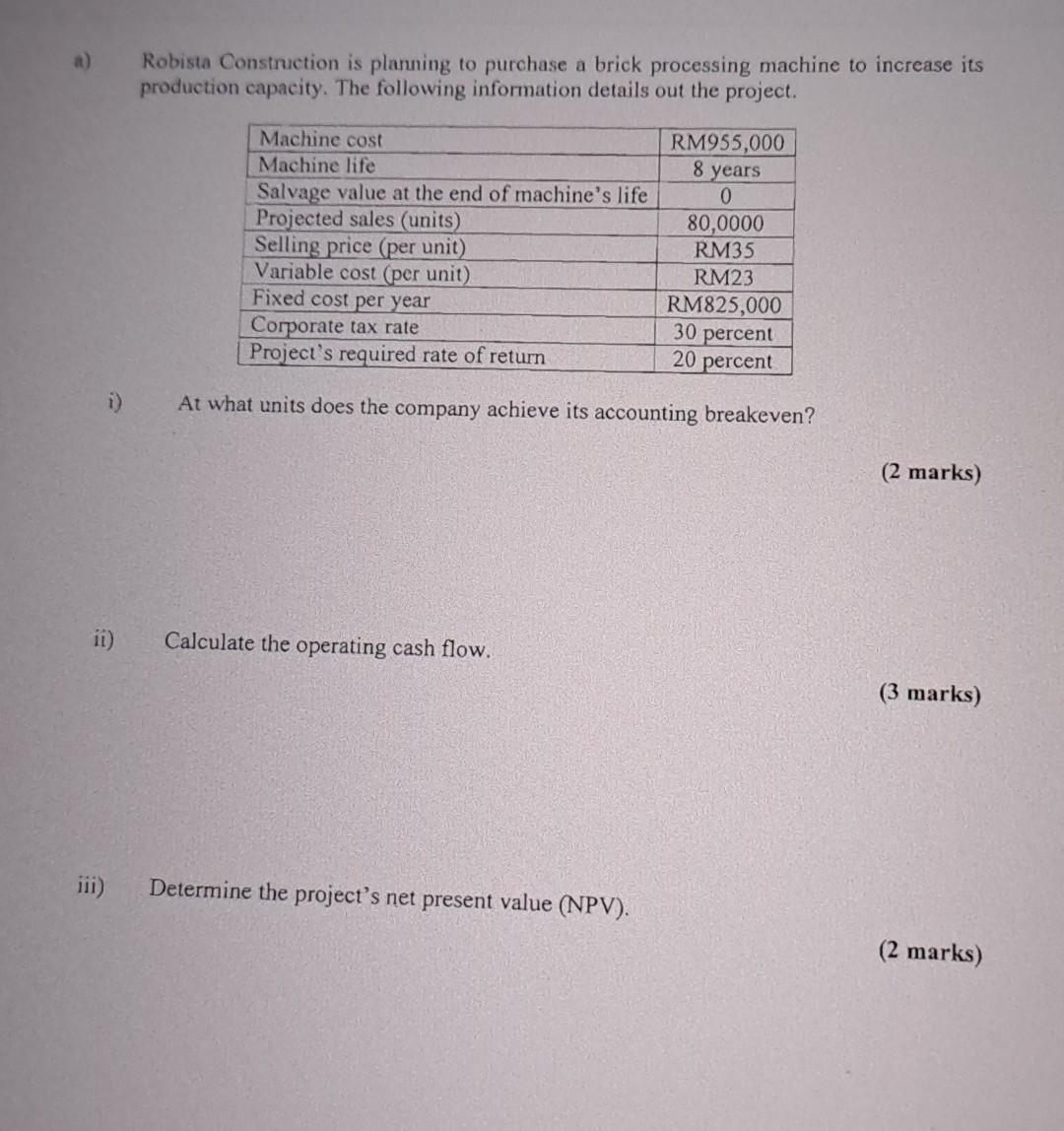

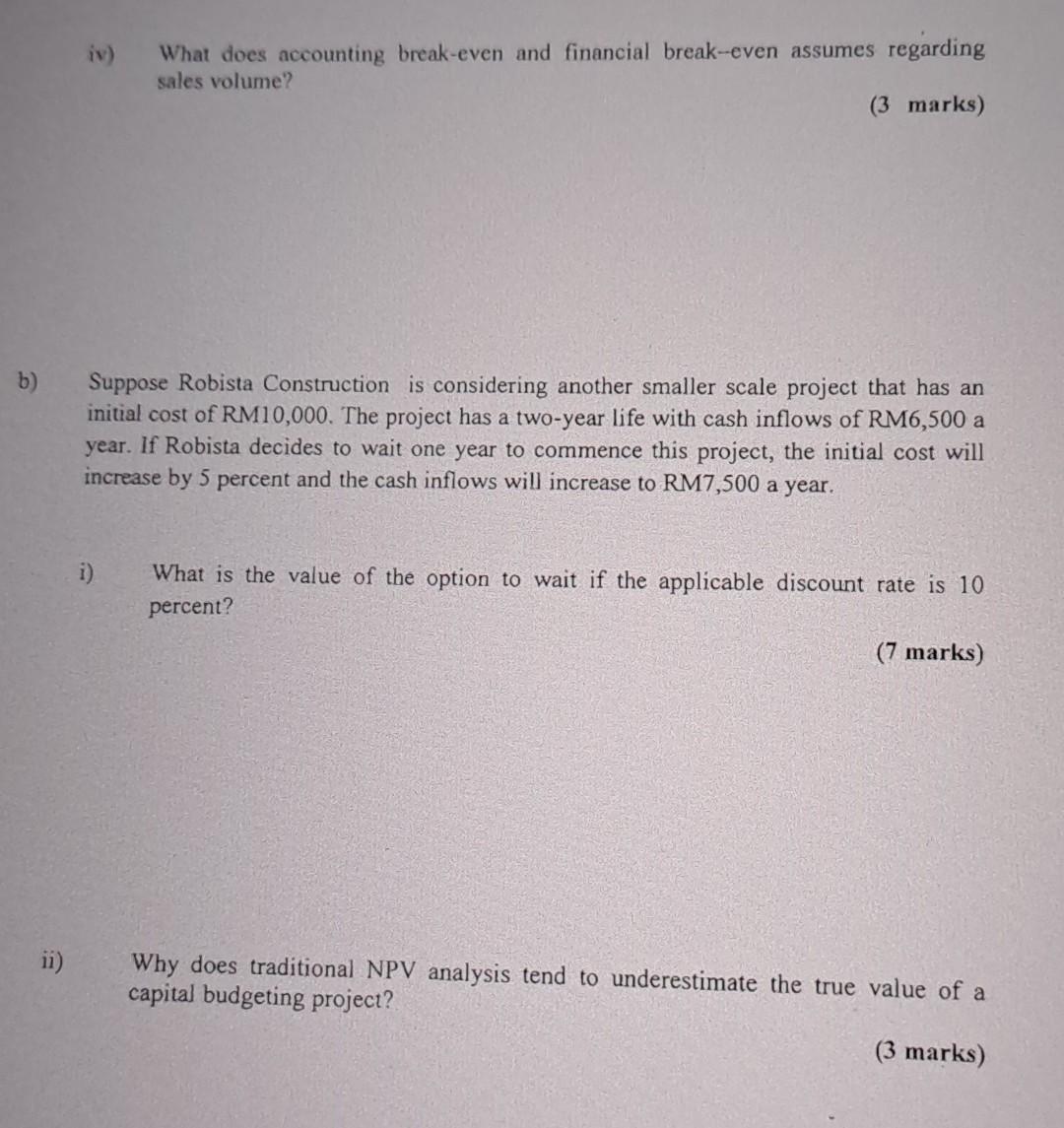

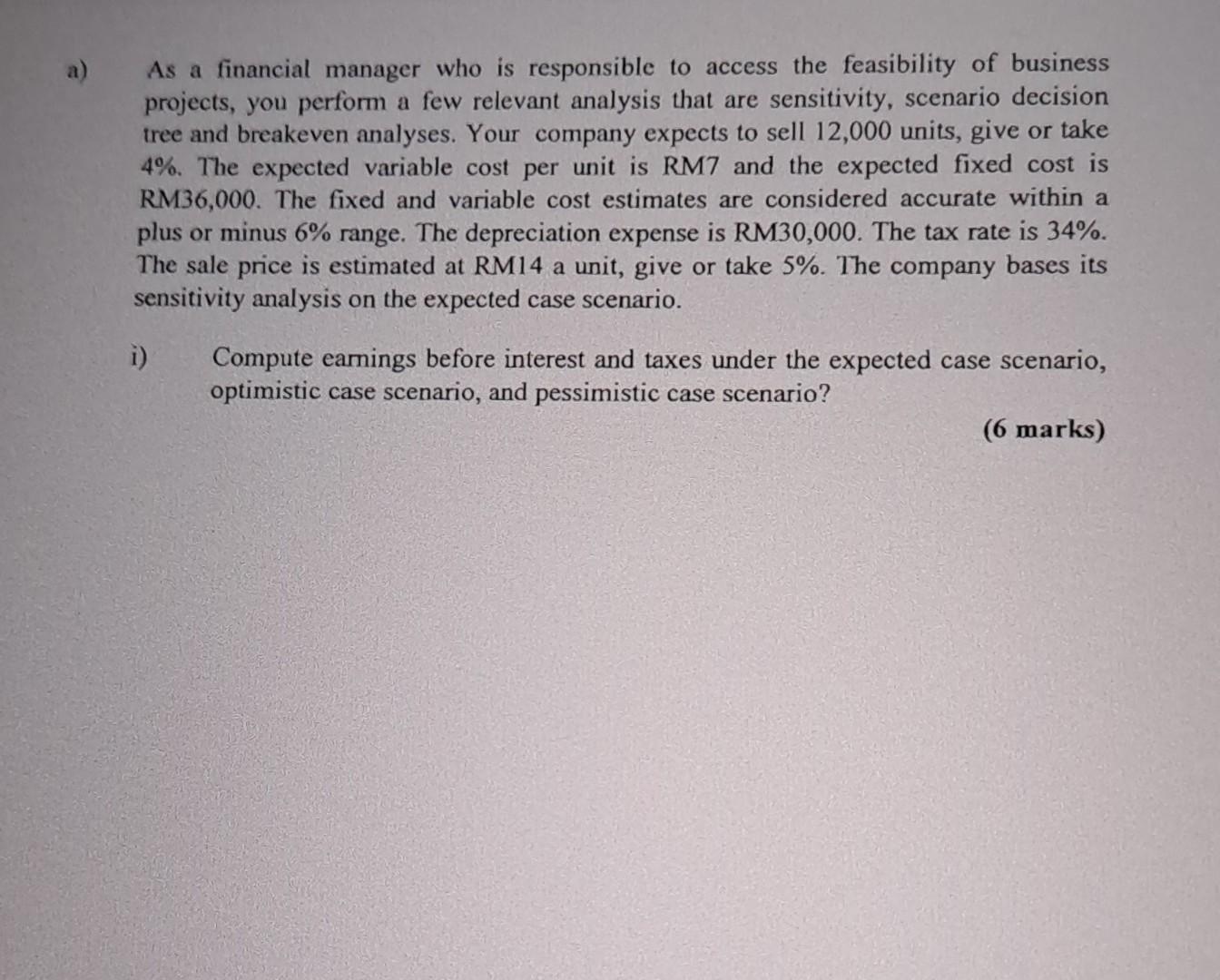

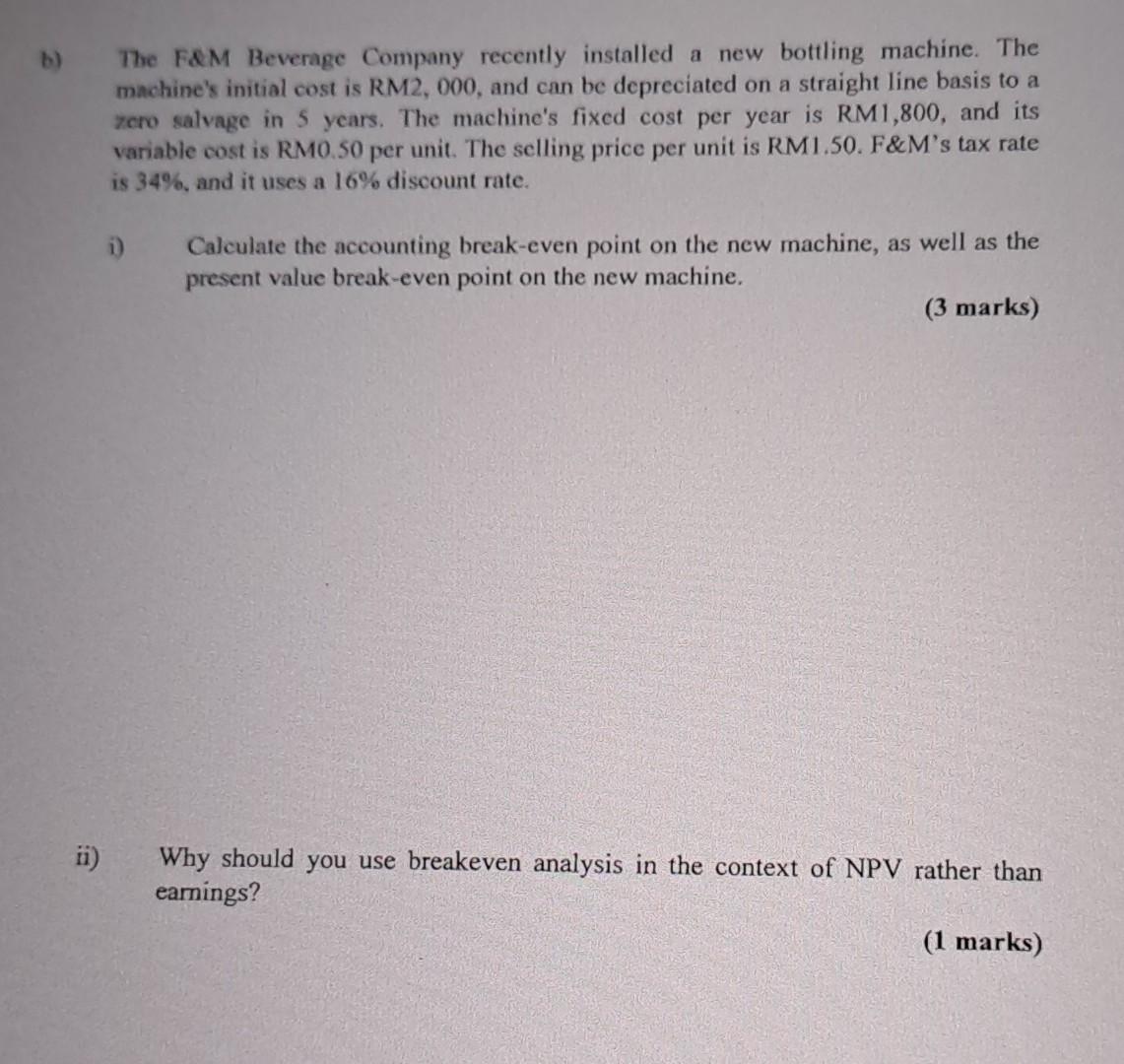

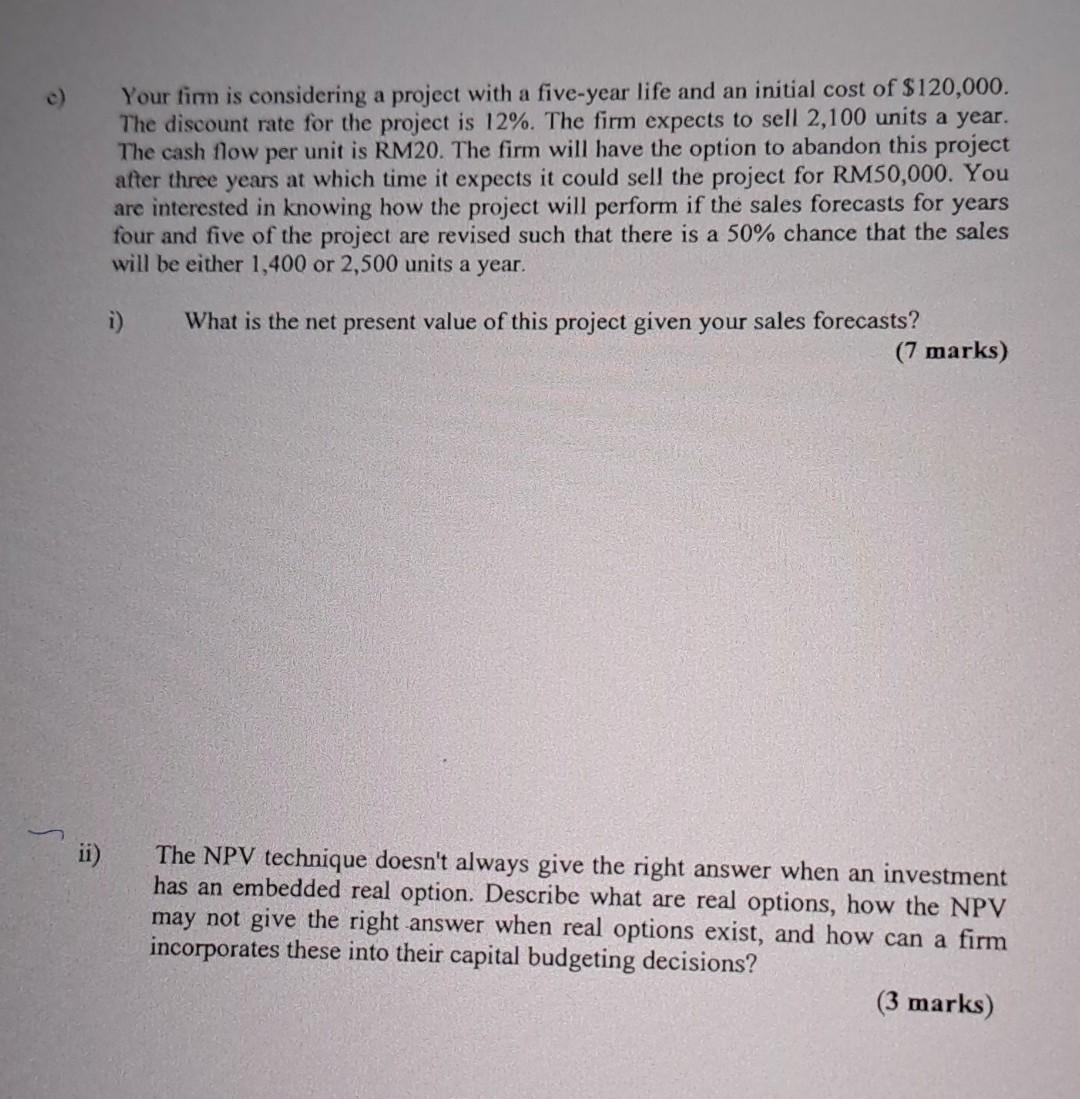

Suppose Wealthy Construction is considering another smaller scale project that has an initial cost of RM10,000. The project has a two-year life with cash inflows of RM6,500 a year. If Wealthy Construction decides to wait one year to commence this project, the initial cost will increase by 5 percent and the cash inflows will increase to RM7,500 a year. i) What is the value of the option to wait if the applicable discount rate is 10 percent? (7 marks) ii) Why do traditional NPV analysis tend to underestimate the true value of a capital budgeting project? (3 marks) Wildan Golf has decided to sell a new line of golf clubs. The clubs will sell for RM685 per set and have a variable cost of RM350 per set. The company has spent RMI00, 000 for a marketing study that determined the company will sell 50,000 sets per year for 10 years. The marketing study determined that the company will lose sales of 8,000 sets of high-priced clubs which sell at RMI, 100 and have variable costs of RM800. The company will also increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for RM300 and have variable costs of RM170 per set. The fixed costs each year will be RM7,600,000. The company has also spent RM680,000 on research and development for the new clubs. The plant and equipment required will cost RM14,500,000 and will be depreciated on a straight line basis. The tax rate is 35 percent, and the cost of capital is 14 percent. a) Calculate the base case NPV of the project. (10 marks) The company would like to know the sensitivity of NPV to changes in the price of the new clubs and the quantity of the new clubs sold. What is the sensitivity of the NPV to each of these variables? s) A project costs RM644,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of a project. Sales are projected at 70,000 units per year. Price per unit is RM37, variable cost per unit is RM21, and fixed costs are RM725, 000 per year. The tax rate is 35 percent, and we require a 15 percent return on this project. 1) Calculate the accounting break-even point. (5 marks) ii) Calculate the base-case operating cash flow. (4 marks) iii) Calculate the base-case Net Present Value (NPV). (3 marks) iv) What is the contribution margin? (1 mark) b) You are considering investing in a company that harvests mushroom for sale to local Chinese Muslim restaurant in Penang. The discount rate for the company is 13 percent, the initial investment in equipment is RM406,000 and the project's economic life is seven years. Assume the equipment is depreciated on a straight-line basis over the project's life. Use the following information: i) Determine the accounting break-even level for the project. (5 marks) =(47.5013.14)625,000+58,000=19877.76=19878unit ii) Determine the financial break-even level for the project. a) Robista Construction is planuing to purchase a brick processing machine to increase its production capacity. The following information details out the project. i) At what units does the company achieve its accounting breakeven? (2 marks) ii) Calculate the operating cash flow. (3 marks) iii) Determine the project's net present value (NPV). (2 marks) b) Azalea is reviewing a project which costs RMI,350,000, and has no salvage value. Assume that depreciation is straight-line to zero over the life of a project. It is expected to sell 9,000 units per year at RM35 net cash flow a piece for the next 10 years. The annual operating cash flow is projected to be RM35 9,000=RM315,000. The relevant discount rate is 16 percent. After the first year, the project can be dismantled and sold for RM950,000. Assuming the expected sales are revised based on the first year's performance. i) At what at what level of expected sales would it make sense to abandon the project? (4 marks) ii) Explain how the RM950,000 abandonment value can be viewed as the opportunity cost of keeping the project in one year. (3 marks) As a financial manager who is responsible to evaluate the feasibility of business projects, you perform a few relevant analyses that are Sensitivity, Scenario and Breakeven analyses. Your company expects to sell 12,000 units, give or take 4%. The expected variable cost per unit is RM7 and the expected fixed cost is RM36,000. The fixed and variable cost estimates are considered accurate within a plus or minus 6% range. The depreciation expense is RM60,000. The tax rate is 34%. The sale price is estimated at RM14 a unit, give or take 5%. The company bases its sensitivity analysis on the expected case scenario. Compute Earnings before interest and taxes (EBIT) under three economic scenarios that are Pessimistic, Expected and Optimistic. Construct relevant table and show your working (5 marks) The F\&M Beverage Company recently installed a new bottling machine. The machine's initial cost is RM2,000, and can be depreciated on a straight line basis to a zero salvage in 5 years. The machine's fixed cost per year is RM1,800, and its variable cost is RM0.50 per unit. The selling price per unit is RM1.50. F\&M's tax rate is 34%, and it uses a 16% discount rate. i) Calculate the accounting break-even point on the new machine, as well as the present value break-even point on the new machine. (3 marks) ii) Why should you use breakeven analysis in the context of NPV rather than earnings? a) Jejari Emas Berhad is analyzing a proposed project. The company expects to sell 3,500 units, give or take 10%. The expected variable cost per unit is RM8 and the expected fixed costs are RM12,500. Cost estimates are considered accurate within a plus or minus 5% range. The depreciation expense is RM4,000. The tax rate is 34 percent. The sale price is estimated at RM16 a unit, give or take 3%. The company bases its sensitivity analysis on the expected case scenario. i) Compute Earnings before interest and taxes (EBIT) under optimistic and pessimistic case scenario analyses. (4 marks) ii) What is the operating cash flow under the expected case scenario? (2 marks) iii) What is the contribution margin under the expected case scenario? b. You are considering a project which has been assigned a discount rate of 8%. If you start the project today, you will incur an initial cost of RM480 and will receive cash inflows of RMI350 a year for three years. If you wait one year to start the project, the initial cost will rise to RMS20 and the cash flows will increase to RM385 a year for three years. What is the value of the option to wait? (6 marks) c) There are FIVE steps for Monte Carlo simulation. Discuss any THREE (3) steps. (6 marks) As a financial manager who is responsible to access the feasibility of business projects, you perform a few relevant analysis that are sensitivity, scenario decision tree and breakeven analyses. Your company expects to sell 12,000 units, give or take 4%. The expected variable cost per unit is RM7 and the expected fixed cost is RM36,000. The fixed and variable cost estimates are considered accurate within a plus or minus 6% range. The depreciation expense is RM 30,000 . The tax rate is 34%. The sale price is estimated at RM14 a unit, give or take 5%. The company bases its sensitivity analysis on the expected case scenario. i) Compute earnings before interest and taxes under the expected case scenario, optimistic case scenario, and pessimistic case scenario? (6 marks) Your firm is considering a project with a five-year life and an initial cost of $120,000. The discount rate for the project is 12%. The firm expects to sell 2,100 units a year. The cash flow per unit is RM20. The firm will have the option to abandon this project after three years at which time it expects it could sell the project for RM50,000. You are interested in knowing how the project will perform if the sales forecasts for years four and five of the project are revised such that there is a 50% chance that the sales will be either 1,400 or 2,500 units a year. i) What is the net present value of this project given your sales forecasts? (7 marks) ii) The NPV technique doesn't always give the right answer when an investment has an embedded real option. Describe what are real options, how the NPV may not give the right answer when real options exist, and how can a firm incorporates these into their capital budgeting decisions? iv) What does accounting break-even and financial break-even assumes regarding sales volume? (3 marks) Suppose Robista Construction is considering another smaller scale project that has an initial cost of RM10,000. The project has a two-year life with cash inflows of RM6,500 a year. If Robista decides to wait one year to commence this project, the initial cost will increase by 5 percent and the cash inflows will increase to RM7,500 a year. i) What is the value of the option to wait if the applicable discount rate is 10 percent? (7 marks) ii) Why does traditional NPV analysis tend to underestimate the true value of a capital budgeting project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started