Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose Westwardly Airlines issued $120,000 of 11%, five-year bonds when the market interest rate is 14%. The market price of the bonds drops, and

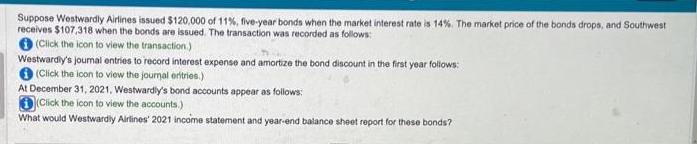

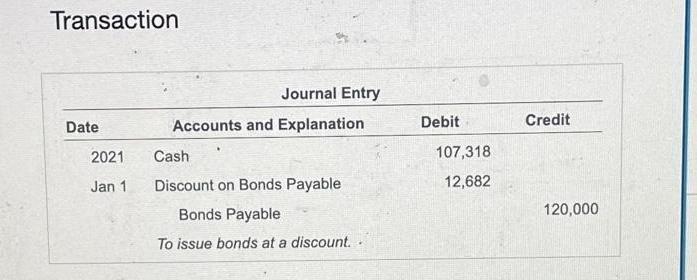

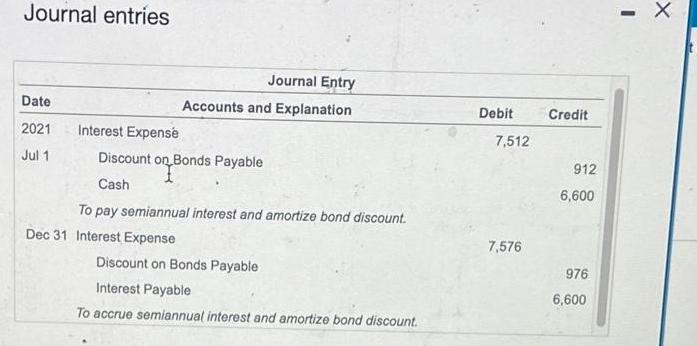

Suppose Westwardly Airlines issued $120,000 of 11%, five-year bonds when the market interest rate is 14%. The market price of the bonds drops, and Southwest receives $107,318 when the bonds are issued. The transaction was recorded as follows: (Click the icon to view the transaction.) Westwardly's journal entries to record interest expense and amortize the bond discount in the first year follows: (Click the icon to view the journal eritries.) At December 31, 2021, Westwardly's bond accounts appear as follows: (Click the icon to view the accounts.) What would Westwardly Airlines' 2021 income statement and year-end balance sheet report for these bonds? Transaction Date 2021 Jan 1 Journal Entry Accounts and Explanation Cash Discount on Bonds Payable Bonds Payable To issue bonds at a discount. Debit 107,318 12,682 Credit 120,000 Journal entries Date 2021 Jul 1 Interest Expense Journal Entry Accounts and Explanation Discount on Bonds Payable Cash To pay semiannual interest and amortize bond discount. Dec 31 Interest Expense Discount on Bonds Payable Interest Payable To accrue semiannual interest and amortize bond discount. Debit 7,512 7,576 Credit 912 6,600 976 6,600 - X Accounts Bonds Payable 120,000 Bal Discount on Bonds Payable 12,682 10,794 Bond carrying amount, $109,206 = $120,000 - $10,794. 912 976 X

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate Westwardly Airlines 2021 income statement and yearend balance sheet for the bonds iss...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started