Answered step by step

Verified Expert Solution

Question

1 Approved Answer

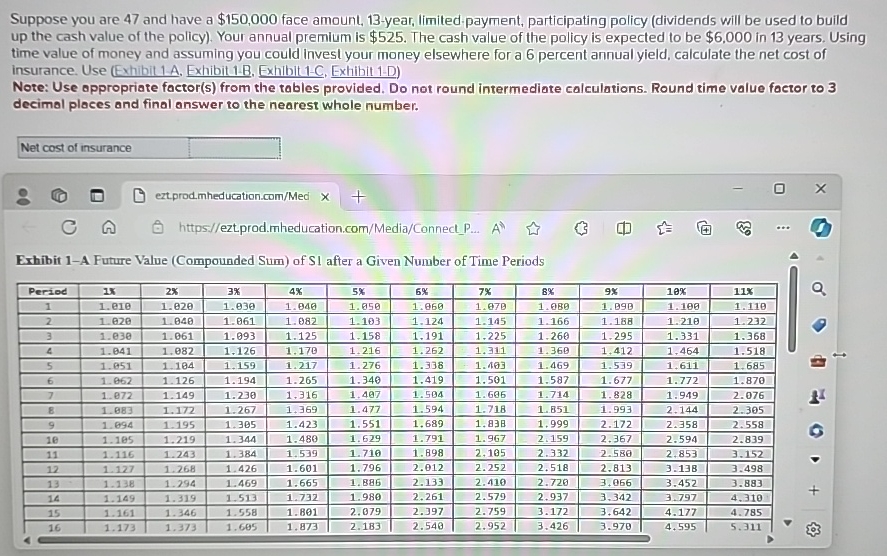

Suppose you are 4 7 and have a $ 1 5 0 , 0 0 0 face amount, 1 3 - year, limited payment, participating

Suppose you are and have a $ face amount, year, limited payment, participating policy dividends will be used to build up the cash value of the policy Your annual premium is $ The cash value of the policy is expected to be $ in years. Using time value of money and assuming you could invest your money elsewhere for a percent annual yield, calculate the net cost of insurance. Use Exhibit A Exhibit B Exhibit C Exhibit D

Note: Use appropriate factors from the tables provided. Do not round intermediate calculations. Round time value foctor to decimal places and final answer to the nearest whole number.

Net cost of insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started