Answered step by step

Verified Expert Solution

Question

1 Approved Answer

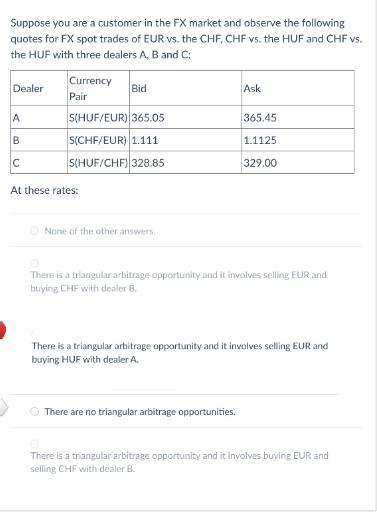

Suppose you are a customer in the FX market and observe the following quotes for FX spot trades of EUR vs. the CHF, CHF

Suppose you are a customer in the FX market and observe the following quotes for FX spot trades of EUR vs. the CHF, CHF vs. the HUF and CHF vs. the HUF with three dealers A, B and C: Dealer A B C Currency Pair Bid S(HUF/EUR) 365.05 S(CHF/EUR) 1.111 S(HUF/CHF) 328.85 At these rates: None of the other answers. Ask 365.45 1.1125 329.00 0 There is a triangular arbitrage opportunity and it involves selling EUR and buying CHF with dealer B. There are no triangular arbitrage opportunities. There is a triangular arbitrage opportunity and it involves selling EUR and buying HUF with dealer A. There is a triangular arbitrage opportunity and it involves buying EUR and selling CHF with dealer B.

Step by Step Solution

★★★★★

3.35 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

To determine if there is a triangular arbitrage opportunity we need to check if the cross exchang...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started