Question

Suppose you are a financial planner and your client has asked you to use CAPM to select between Stock Hazelnut and Stock Walnut. The

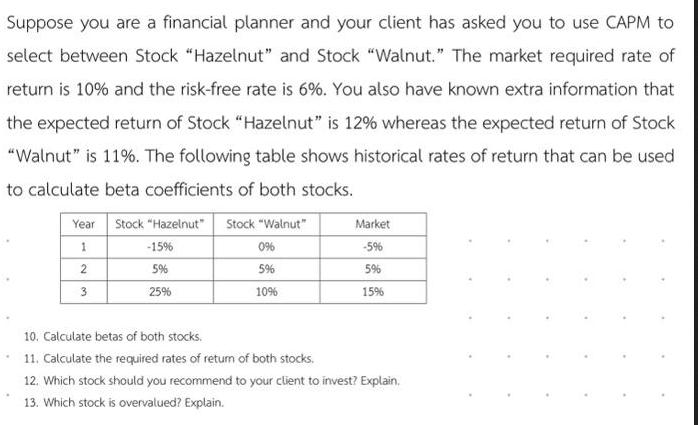

Suppose you are a financial planner and your client has asked you to use CAPM to select between Stock "Hazelnut" and Stock "Walnut." The market required rate of return is 10% and the risk-free rate is 6%. You also have known extra information that the expected return of Stock "Hazelnut" is 12% whereas the expected return of Stock "Walnut" is 11%. The following table shows historical rates of return that can be used to calculate beta coefficients of both stocks. Year Stock "Hazelnut" Stock "Walnut" 1 -15% 2 5% 3 25% Market 0% -596 5% 5% 10% 1596 10. Calculate betas of both stocks. 11. Calculate the required rates of return of both stocks. 12. Which stock should you recommend to your client to invest? Explain. 13. Which stock is overvalued? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

6th edition

1305637100, 978-1305637108

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App